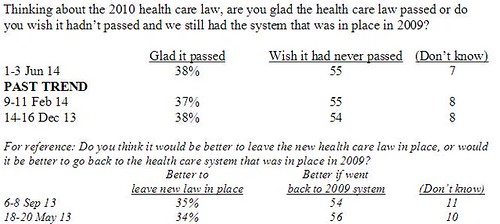

This latest polling nugget from Fox News isn't unusual. In fact, it's the stability of the question's trajectory that's so remarkable. Public disenchantment with Obamacare has calcified, and no amount of self-serving spin, racial demagoguery, ginned-up "winning streaks," or hollow triumphalism from the Left has moved the needle, dating back more than a year:

"Glad it passed" has been hovering in the mid-to-high 30's, with "turn back the clock" edging into the mid-50's in every survey. A Reason/Rupe poll asked a nearly identical question back in December, and produced nearly identical results. The law has been underwater by double digits in virtually all polling since its failed roll-out, with undecided (but likely) 2014 voters overwhelmingly opposed. In the new Fox survey, just 29 percent of respondents said Obamacare has made the country "better off." Obama administration officials privately conceded that the numbers aren't likely to change anytime soon, which no doubt contributed to this sort of urgent advice from Democratic pollsters and consultants:

In briefing for reporters earlier today, SAOs said there's nothing the WH can do to change opinions of the law while Obama is in office.

— Zeke Miller (@ZekeJMiller) April 1, 2014

One Democratic incumbent who's vowing to eschew Obamacare advice from her party's messaging men is Sen. Jeanne Shaheen of New Hampshire. "Absolutely:"

Whether she actually follows through is a separate question, of course, and Scott Brown's camp is praying that she will. The law is highly unpopular in New Hampshire, where cancellations (breaking a familiar Shaheen promise), sticker shock, and especially access shock have hit consumers hard. As projected premium increases continue to pour in from across the country, the nonpartisan Congressional Budget Office has thrown in the towel on tracking the law's overall fiscal impact, thanks to the administration's flurry of unilateral delays, exemptions and changes -- which are impacting Obamacare's pay-for's in disruptive and unpredictable ways. News also recently broke that more than two million of Obamacare's "eight million" sign-ups (a large majority of whom previously had insurance) are facing Healthcare.gov/bureaucracy-caused data discrepancies that could threaten coverage or result in higher costs. By the way, while the CBO has given up on keeping the big-picture score on Obamacare, they're still churning out related projections:

Recommended

Four million United States taxpayers will be forced to pay USD4bn in Affordable Care Act (ACA) individual mandate non-compliance penalties to the Internal Revenue Service in 2016, increasing to USD5bn annually in 2017-24, according to a new report from the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT). Within the provisions of the ACA, most Americans will be required to maintain "minimum essential" health insurance coverage, and employers will be encouraged to offer that health coverage. Those individuals and employers who do not comply with these mandates – the individual "employee mandate" and "employer mandate" – are to make "shared responsibility" payments, or tax penalties, to the IRS.

According to Americans for Tax Reform, the "overwhelming majority" of those liable for the tax earn less than $250,000 per year, another direct violation of Barack Obama's "firm" tax pledge of 2008. Four million is a much lower number of people subjected to the tax than previously expected, thanks in large part to the aforementioned waivers and exemptions. Parting thought: Why would anyone pay this tax when there are generous, verification-free "hardship exemptions" to be claimed? Going that route is certainly easier than trying to navigate this Kafkaesque maze. Click through, and locate the "honor system" graphic. There's your golden ticket, would-be individual mandate taxpayers. Sure, it'll further undermine the financial architecture of the law, but at this point, who's counting?

Join the conversation as a VIP Member