Markets were off to another lackluster start on Monday as investors dumped contracts on industrial commodities and overseas equity trading was mostly down.

Gold was trading weakly higher Monday morning, up $2.70 to $1,697.90 and silver is up $0.03 to $32.32 for a silver/gold ratio of 52.5.

The dollar is up against the euro but with commodity prices so disconnected from market fundamentals even that is no longer a reliable indicator of market direction. While gold, silver and crude oil are higher, platinum, palladium and copper are trading lower. Mainly markets are flat to slightly down, with prices shifting between small gains and small losses every few minutes.

I get nervous when I start reading predictions of gold reaching new highs so it comes as somewhat of a relief to read that mainstream analysts are heralding a looming gold bust and the impending sale of gold by central banks. The best time to buy gold and silver is when the voices sounding the alarm of gold’s pending demise are the loudest.

Recommended

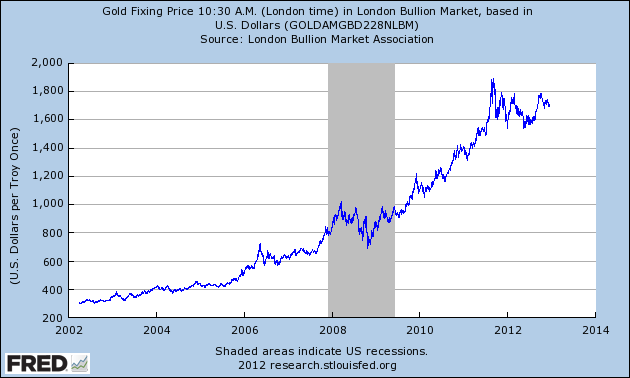

Popular financial media analysts are pointing to gold’s flat performance over the last year as evidence that the gold market is disconnected from fundamentals and the end is nigh. But if you look at a graph of gold prices since 2002, you’ll see this isn’t the first time gold has traded flat for a sustained period of time.

Notice the similar flat spot in 2008 where we heard the very same type of gloom and doom pronouncements about gold that we’re hearing today. I didn’t buy it then and I’m not buying it now.

Chris Poindexter, Senior Writer, National Gold Group, Inc

Join the conversation as a VIP Member