Wow. What a session on Wednesday. It was the kind of test I always appreciate because it’s a real test of the market and a gauge of investor resolve.

Boeing (BA) shares climbed off the canvas twice, finishing the session in the plus column. The initial pullback came after Canada announced it was banning the planes from even entering its airspace, reversing its stance after receiving more information. The stock swooned and then recovered.

Two hours later, President Trump grounded the 737 Max 8 and 9 planes. He stated the decision came about through fact-based information, evidence from the ground, and discussions with other nations. The news sent the stock tumbling again, this time testing Monday’s low before finding equilibrium and rebounding again.

It was an impressive session for the beleaguered company, which still faces a lot of questions about its planes and its handling of this crisis. Yesterday, satellite images influenced the Boeing decisions in Canada and at the White House.

Market breadth is improving and every sector in the S&P rallied on the session.

New York Stocks Exchange

- Advancers 2,009

- Decliners 930

- Up Volume 2.9 billion

- Down Volume 777.2 million

- New Highs 171

- New Lows 15

NASDAQ

- Advancers 1,896

- Decliners 1,168

- Up Volume 1.46 billion

- Down Volume 840.2 million

- New Highs 85

- New Lows 37

S&P 500 Index | +0.70% |

Communication Services (XLC) | +0.30% |

Consumer Discretionary (XLY) | +0.35% |

Consumer Staples (XLP) | +0.57% |

Energy (XLE) | +1.01% |

Financials (XLF) | +0.68% |

Health Care (XLV) | +1.08% |

Industrials (XLI) | +0.88% |

Materials (XLB) | +0.48% |

Real Estate (XLRE) | +0.48% |

Technology (XLK) | +0.66% |

Utilities (XLU) | +0.10% |

Coiled Spring

Recommended

I see the index as a coiled spring ready to explode to a new all-time high. The index must close about 2,810, which is only a few ticks from yesterday’s close. However, it has been a monumental resistance point.

Phoenix Rising

While the S&P 500 is on the cusp of a major breakout, several household names that were once hot stocks, are enjoying mind-boggling returns this year:

- Diebold Nixdorf (DBD): +321%

- Pier 1 Imports (PIR): +259%

- Fannie Mae (FNMA): +154%

- Avon (AVP): +81%

Each of these stocks was once a high-flyer and still have name recognition, which may be a reason for their remarkable bounce. Potentially, all have a lot more to the upside. They are high-risk stocks. However, imagine being up more than 300% since the New Year.

Portfolio Approach

We kept our powder dry yesterday but I’m eager to make some moves. Stay tuned.

Communication Services 1 | Consumer Discretionary 3 | Consumer Staples 1 |

Energy 1 | Financials 1 | Healthcare 2 |

Industrial 3 | Materials 3 | Real Estate 0 |

Technology 2 | Utilities 0 | Cash 3 |

Today’s Session

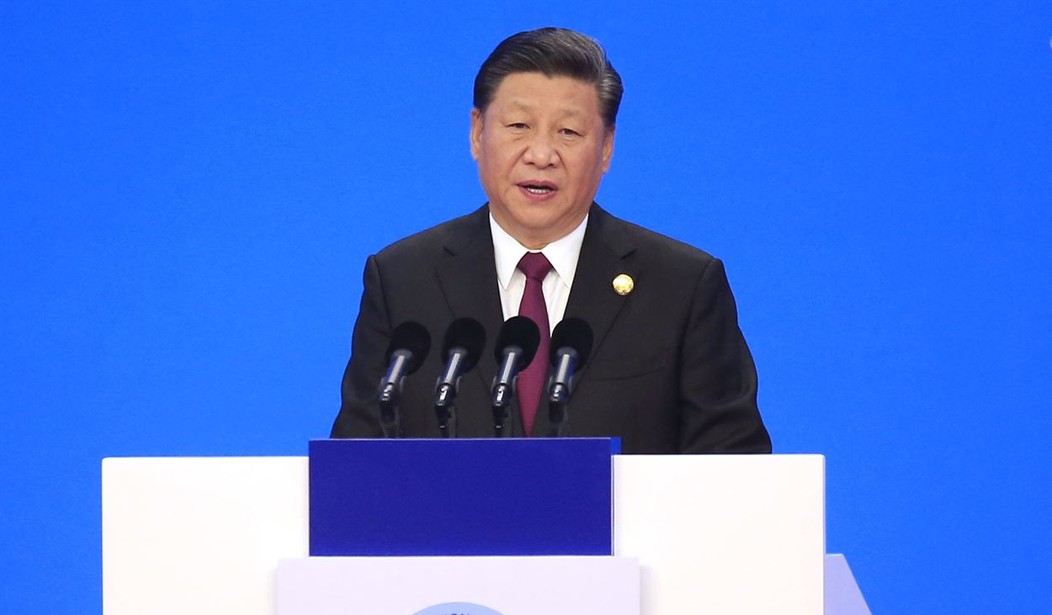

Yesterday, the market reacted to President Trump's comments on China trade by initially moving lower when he suggested there is no urgency on his part. Then, it moved higher when he said there is a 50-50 chance of a deal.

This morning, equity futures slipped on a Bloomberg report which proposed the next meeting between Trump and Xi could be in April or later. In some ways, that was already becoming obvious. Ironically, the same people that said the administration was rushing a deal are now complaining the meeting could be delayed.

A deal probably happens, and it will be to the advantage of the United States.

Join the conversation as a VIP Member