The market has started to spin its wheels and that makes people nervous. I will lay out the red flags. I am not talking about the $18 trillion in government debt, the Fed's balance sheet, or the ticking time bomb of pensions, but trends that could arguably derail the stock market rally.

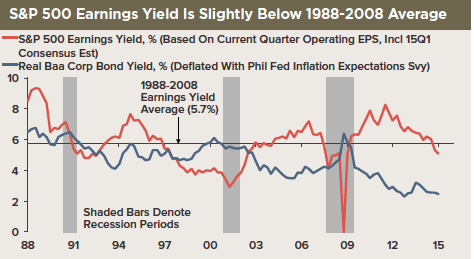

Earnings are beating lowered estimates, but are yielding less than the twenty-year average. Sure, stock yields are attractive versus bond yields, but are they good enough to justify higher share prices? Here is the rub: consensus on earnings points lower and lower for this year, but it should reverse and move higher as we enter 2016. So, should stocks pullback before then and reaccelerate?

I am not sure. Overall, I do not like earnings in retreat, even if a large part can be explained by the strong dollar limiting the top line and pressuring margins. We focus on individual names, yet this is something we will monitor closely.

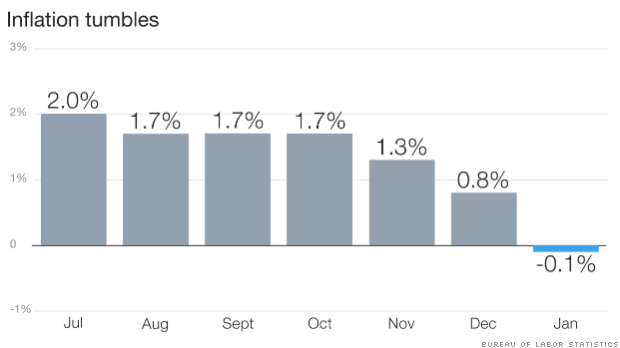

However, there is the deflation question that will not go away. The consumer price index (CPI) inflation reading was negative for January, down three months in a row; it experienced its largest one-month decline since Dec 2008, and has gone down year-over-year. The good news for those worried about the Fed hiking rates is that this puts them off again. The bad news is deflation is insidious.

Then, there is the average daily volume that continues to plummet. The only spikes are associated with periods of duress.

Recommended

In the end, the market moves higher when there are more buyers than sellers, even if the overall volume is light. It is not a red flag, but it is worth monitoring. The flip side is those trillions of dollars on the sidelines; bond market and overseas could still find their way into U.S. equities, making this a moot point.

In the meantime, insider sells are picking...in the last 12 months:

- $6.55 billion in sells

- $177 million buys

We will watch. The worst-case scenario at the moment is a sudden panic from one of the above. We are not too expensive to warrant the selloff from the naysayer crowd. We are overdue for a pullback, but that’s it at the moment.

Join the conversation as a VIP Member