Having been associated with Wall Street for over 40 years I have seen and heard just about everything. In that time I have also seen the high profiles who have done the crime and also done the time. Everyone from Michael Milken to Bernie Madoff have had their comeupence. In the last few years, under the Obama-Holder (fast and furious) it seems that a new paradigm has taken place.

Everything from derivative trading to high frequency trading to borrowing client’s money for margin calls has called for a scapegoat, someone to take the fall. In the past Mr. Big, doing a perp walk and then heading for a little white collar vacation was the rule of thumb. Now, however, since the too big to fail banks and myriad others write such significant contributions to the powers to be, then the rules of the game have changed.

The Justice Department has explicitly stated that arresting significant figures at financial institutions would be too disruptive to not only the institutions themselves which are the real fabric of

Almost 30% of the profits to JP Morgan came from the Whale’s trading in

Recommended

So here comes the fatherly advice to all you high frequency algorithmic writers, someone will take the fall, and it won’t be the CEO.

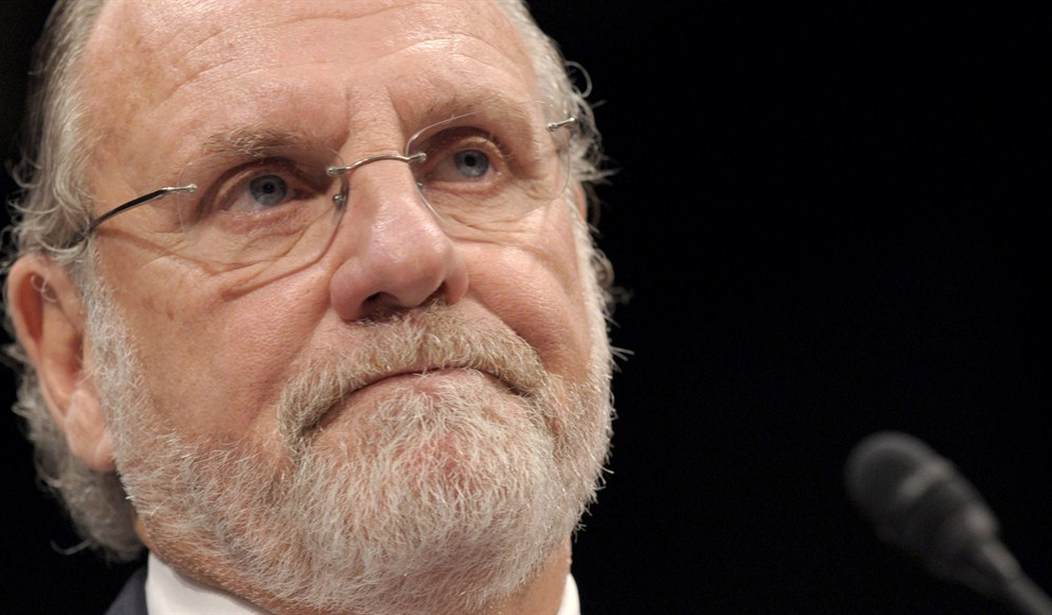

Dimon and Corzine and many others are still out and about. They will not suffer any repercussions. But someone, and that someone will be you, has to take the fall. If you truly think your firm will protect you then you have taken a large drink of koolaid. With the FBI, Justice Department, SEC, and CFTC investigating, your days are numbered. But certainly not the CEOs.

Run Away, Run Away and don’t come back if you know what’s good. It really is time to take a little fatherly advice.

Join the conversation as a VIP Member