Based on what’s happened in Greece and other European nations, we know from real-world evidence that even nations from the developed world can spend  themselves into debt trouble.

themselves into debt trouble.

This has led to research that seeks to pinpoint when debt reaches a dangerous level.

Where’s the point where investors stop buying the debt? Where’s the point when interest on the debt becomes too much of a burden?

Most famously, a couple of economists crunched numbers and warned that nations may reach a tipping point when debt is about 90 percent of GDP.

I was not persuaded by this research for two reasons.

First, I think it’s far more important to focus on the underlying disease of too much government, and not get fixated on the symptom of too much borrowing. If I go see a doctor because of headaches and he discovers I have a brain tumor,  I want him to address that problem and not get distracted by the fact that head pain is one of the symptoms.

I want him to address that problem and not get distracted by the fact that head pain is one of the symptoms.

Second, there are big differences between nations, and those differences have a big effect on whether investors are willing to buy government bonds. The burden of debt is about 240 percent of GDP in Japan and the nation’s economy is moribund, for instance, yet there’s no indication that the “bond vigilantes” are about to pounce. On the other hand, investors are understandably leery about buying Argentinian government debt, even though accumulated red ink is less than 40 percent of economic output.

So what about America, where government borrowing from the private sector now accounts for 82 percent of GDP? Have we reached a danger point for government debt?

Recommended

According to Matthew Yglesias (who says I’m insane and irrational), the answer is no.

I have several comments on this video.

1. Some people have complained that the video is deceptive because it focuses on debt held by the public rather than the gross federal debt. The video could have been more explicit and explained why that choice was made, but I have no objection to the focus on publicly-held debt. After all, that’s the measure of what government has borrowed from the private sector. The gross federal debt, by contrast, also includes money the government owes itself (such as the IOUs in the Social Security Trust Fund), but that type of debt is merely a bookkeeping entry.

2. The video asserts that inflation is low and therefore we don’t have to worry that government might have to “print money” at some point to finance additional debt. I don’t think there’s any immediate danger that the Fed will be put in a position of financing the federal government, but I nonetheless don’t like this logic. It’s sort of like saying it wouldn’t be a problem to start eating ten pizzas per day because you currently aren’t heavy. The simple truth is that low inflation now doesn’t mean low inflation in the future.

3. I also reject the assumption in the video that interest rates drive the economy. Indeed, it’s probably more accurate to say that the economy drives interest rates, not the other way around. Suffice to say that the video is based on the same thinking that led the Congressional Budget Office to imply that you maximize growth by putting tax rates at 100 percent.

4. The video also warns that politicians shouldn’t raise taxes or reduce government benefits since either policy would “take money out of people’s pockets.” This is Keynesian economic theory, which I’ve explained many times doesn’t make sense. No need to regurgitate those arguments here.

4. The video also warns that politicians shouldn’t raise taxes or reduce government benefits since either policy would “take money out of people’s pockets.” This is Keynesian economic theory, which I’ve explained many times doesn’t make sense. No need to regurgitate those arguments here.

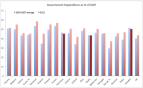

5. Which brings us to the main problem of the video. It ignores the problem of unfunded liabilities. More specifically, it doesn’t address the fact that politicians have made commitments to spend far too much money in the future, largely because of poorly designed entitlement programs. And it is these built-in promises to spend money that give America a very grim fiscal future, as show by this BIS, OECD, and IMF data.

Here’s the video, produced by the Center for Prosperity, that accurately puts all this information together (the data is now several years out of date, but the analysis is still spot on).

Remember, the problem – both today and in the future – is the burden of government spending.

Join the conversation as a VIP Member