The internal revenue service has allowed itself to become a tool of the White House. To be more specific, bureaucrats at the tax-collection agency sought to undermine a free and fair political process by stifling political speech. And now the IRS is lying about its activities and trying to cover its tracks.

This should be deeply horrifying to all Americans, regardless of political affiliation or philosophy.

This should be deeply horrifying to all Americans, regardless of political affiliation or philosophy.

Particularly since the partisan Democratappointed by Obama to head the IRS refuses to even apologize for the agency’s rogue behavior.

There are several appropriate responses to the IRS scandal, including some genuine budget cuts. But you probably won’t be surprised to learn that some people think the IRS instead should be rewarded with even more money.

Here are some excerpts from a column in today’s Washington Post.

…this is an especially strange time to stick up for the agency, given the suspicious disappearance of a few thousand key e-mails that Congress wants to see. But right now, the IRS desperately needs a champion. …the IRS has been laboring…with fewer resources. Since 2010, when Congress first began hacking away at discretionary spending, the bureau’s funding has fallen 14 percent, in inflation-adjusted terms… These cuts have come even though the agency’s responsibilities and workload have increased, thanks to new laws such as the Affordable Care Act and the Foreign Account Tax Compliance Act… Now House Republicans want to hobble it even more. Last week, the House Appropriations Committee voted to slash the bureau’s budget by another $340 million.

It’s true that both Obamacare and FATCA grant new powers and obligations to the IRS, but we can solve that problem by repealing those misguided laws.

Recommended

But since that won’t happen while Obama is in the White House, let’s consider whether “fewer resources,” “hobble,” and “hacking away” are accurate ways of describing what’s been happening to the IRS’s budget.

But since that won’t happen while Obama is in the White House, let’s consider whether “fewer resources,” “hobble,” and “hacking away” are accurate ways of describing what’s been happening to the IRS’s budget.

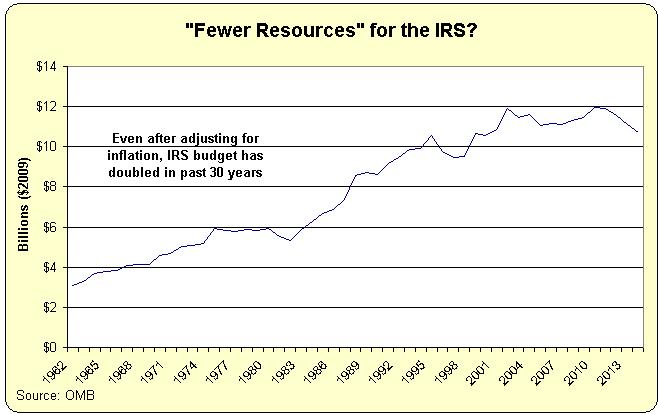

The Office of Management and Budget has detailed tables showing spending by agency. And if you look at the administrative portions of IRS spending (culled from lines 2491-2533 of this massive database), it turns out that spending has increased dramatically over time.

Yes, it’s true that IRS spending has declined slightly since 2010, but the agency’s budget is still about twice as big as it was 30 years ago. And these numbers are adjusted for inflation!

In other words, it’s very misleading to focus merely on the post-2010 budgetary data (just as Krugman was being deceptive when he looked only at post-2007 data when writing about Estonia’s economic performance).

Looking at the historical data reveals that the IRS budget is much bigger than it’s been in the past.

There are a couple of additional points in the column that deserve some attention. The author argues that people who care about the budget deficit should be delighted to give more money to the IRS because it produces a “darn good return on investment.”

If you care about narrowing the budget deficit — as Republicans generally say they do — gutting your chief revenue- collection agency makes little sense. …The IRS generates way more money than it spends, after all. For every dollar appropriated to the IRS in the 2013 fiscal year, the agency collected $255, according to the national taxpayer advocate’s office. That’s a darn good return on investment.

Wow, what a scary mindset. Based on this thinking, why don’t we simply give the government carte blanche to seize our bank accounts? After all, they could probably collect hundreds of thousands of dollars for every dollar spent. That would be an even better “return on investment.”

As an aside, this is an example of why I get so agitated when supposed fiscal conservatives focus on deficits and debt. It creates an opening for people who want to push bad policy. But if youfocus on the real problem of government spending, that problem disappears.

As an aside, this is an example of why I get so agitated when supposed fiscal conservatives focus on deficits and debt. It creates an opening for people who want to push bad policy. But if youfocus on the real problem of government spending, that problem disappears.

But I’m digressing. Let’s get back to the column. There’s one other point that cries out for correction. The author claims that a bigger IRS budget will reduce tax evasion and that this will keep tax rates from going higher.

Some of that money comes from going after tax cheats, and…rampant tax evasion has a tendency to drive statutory tax rates higher so that the government can extract more money from those poor saps still obeying the law.

The only problem with this assertion is that it is grossly inconsistent with the facts.

We have very powerful evidence that politicianslowered tax rates during periods when there were substantial flows of money to so-called tax havens.

We have very powerful evidence that politicianslowered tax rates during periods when there were substantial flows of money to so-called tax havens.

Why? Because they felt competitive pressure to implement less onerous tax rates in order to keep even more money from escaping.

And now we have strong evidence that tax rates are going up as opportunities to escape bad tax policy have decreased.

Why? Because the politicians now feel that taxpayers have fewer escape options.

To summarize this post, the IRS needs and deserves more money in the same way that Charles Manson needs and deserves a group hug.

Here’s one last bit of humor to augment the cartoons I’ve already included. It’s PG-13, so don’t read too closely if you get easily offended.

P.S. Wouldn’t it be wonderful if we could junk the tax code and replace it with a simple and fair flat tax? That would eliminate almost every possible conflict with the IRS and also take away the agency’s discretionary power.

Not a bad fantasy to have, at least for a policy wonk.

Join the conversation as a VIP Member