In recent months, I’ve displayed uncharacteristic levels of optimism on issues ranging from Obamacare to the Laffer Curve.

But this doesn’t mean I’m now a blind Pollyanna. We almost always face an uphill battle in our efforts to restrain the power and greed of the political class.

And in some areas, such as the fight for pro-growth and humane tax reform, I see very little reason for hope.

In honor of tax day, I explained my pessimism in an article for The Daily Caller.

I outlined four reasons to be glum, starting with the fact that tax reform yields big benefits in the long run, but that isn’t a very compelling argument for politicians that rarely think past the next election.

Our tax code is now a 74,000-page monstrosity, and it seems that politicians make the system more convoluted every year with new credits, deductions, exemptions, preferences, exclusions, and other special provisions. …In theory, it makes sense to scrape off these barnacles and restore the ship… Our political system, though, is dominated by lawmakers who tend not to think past the next election cycle.

I then mention that too many people now see the tax code as a tool for directly taking money from others.

…a growing number of Americans now see tax returns as a vehicle for getting money from the government. I’m not talking about the fiscal illusion that results when some people over-pay their taxes and then are happy to get a refund. …I’m talking about a different crowd. There are now millions of Americans who benefit from redistribution programs that are laundered through the tax code. …“refundable” credits allow people to get checks from the government even if they didn’t pay any tax. …Needless to say, those people don’t have much incentive to oppose the current system.

Recommended

My third concern deals with the under-appreciated fact that the Washington establishment gets rich from the current system.

The metropolitan DC area is now the wealthiest region of the nation; it includes 10 of America’s 15 richest counties. …One of the main sources of that unearned — and undeserved — prosperity is the tax code… many people make big bucks manipulating the tax code. Lobbyists obviously would hate a simple and fair flat tax… Many of these insiders are former politicians and former Capitol Hill staffers — particularly those that worked on the tax-writing committees. They make big bucks, and the current staffers look forward to the day when they can cash in on their “government service” and start “earning” huge salaries. Needless to say, these people are not exactly advocates of reform.

Last but not least, I explain that high-tax governments are undermining tax competition with financial protectionism, thus giving them more leeway to impose bad policy.

Beginning with the Reagan and Thatcher tax cuts, the world experienced a virtuous period of tax competition that lasted for about 30 years. Even politicians in statist nations such as France and Germany felt compelled to lower tax rates… In recent years, however, high-tax nations and left-wing international bureaucracies such as the Paris-based Organization for Economic Cooperation and Development have worked to undermine tax competition and make it easier for politicians to impose class-warfare tax policy. They first went after so-called tax havens… Now the OECD has a new plan to go after multinational companies and significantly boost their tax burdens, presumably through the creation of a global tax return and a policy called “formula apportionment.” …every time they make progress, politicians feel less pressure to lower tax rates and reform tax systems. Why bother improving the tax code, after all, if you think that taxpayers have no choice but to submit?

I also should have added another big challenge. In the absence of good entitlement reform, the burden of government spending will dramatically increase in coming decades and create pressure for additional tax hikes. That’s not an environment conducive to tax reform.

Unless, of course, you’re a politician and you somehow think adding a value-added tax on top of the current income tax can be considered reform.

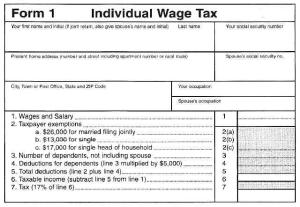

I don’t see this simple system in America’s future

P.S. I’ve referenced the flat tax in this post, but all of these obstacles also explain why there’s even less chance of a national sales tax.

Join the conversation as a VIP Member