A bipartisan Congressional panel yesterday released its findings regarding Apple's international tax regime and, specifically, how it was able to pay a relatively low tax rate when the U.S. corporate statutory tax rate is 35% (the highest in the developed world). The investigation turned up no wrongdoing, and that Apple follows the letter of the law and pays every dime of its legally-required taxes.

Nonetheless, Congress summoned Apple CEO Tim Cook in front of the Senate Permanent Subcommittee on Investigations to testify on Apple's tax compliance. The Congressional report found that, had Apple not shifted its profits to other subsidiaries around the word,

Over all, Apple’s tax avoidance efforts shifted at least $74 billion from the reach of the Internal Revenue Service between 2009 and 2012, the investigators said. That cash remains offshore, but Apple, which paid more than $6 billion in taxes in the United States last year on its American operations, could still have to pay federal taxes on it if the company were to return the money to its coffers in the United States.

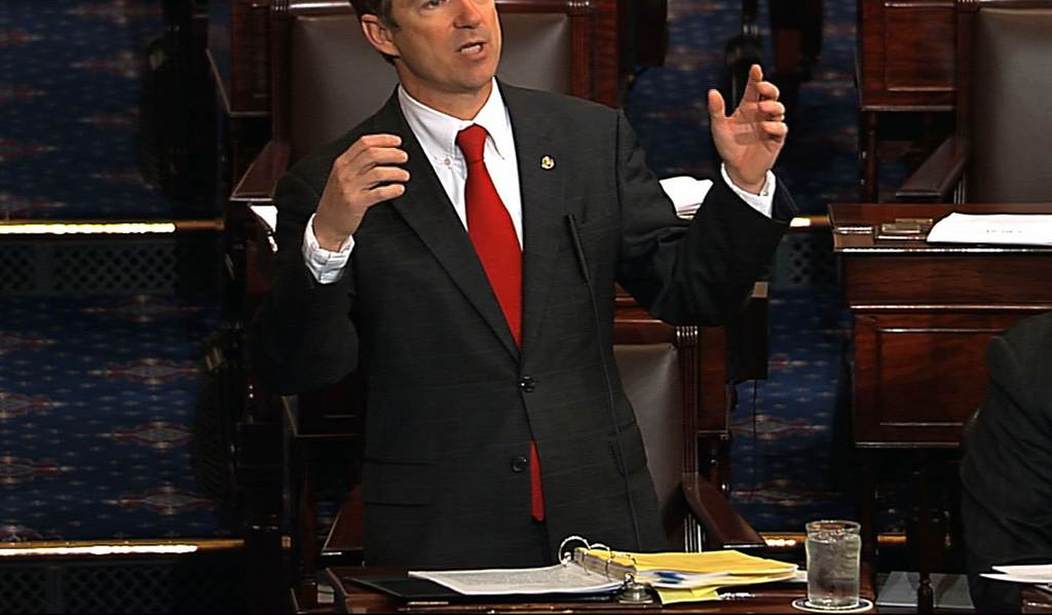

Sen. Rand Paul, who is not the chair or ranking member of this morning's committee, offered an unconventional opening statement for the record. "Frankly, I'm offended by the tone and tenor of this hearing," Sen. Paul Said. "Tell me a politician up here that doesn't try to minimize their taxes... Instead of Apple executives, we should have brought in here a giant mirror."

"I frankly think that the committee should apologize to Apple," Paul said.

Sen. Paul said that he was also "offended by the spectacle of dragging in executives that aren't doing anything illegal," a framing that subcommittee chairman Carl Levin (D-Mich.) took issue with.

Recommended

"We did not drag them in front of this subcommitee," Levin said. "This subcommittee is not going to apologize to Apple."

Sen. Paul also took to Twitter to express his outrage.

Instead of examining our broken tax system, the US Senate is about to harass Apple-one of the greatest business success stories in history.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

I am offended by a $4 trillion government bullying, berating and badgering one of America's greatest success stories.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

I am offended by the spectacle of dragging in here executives from Apple using the brute force of government to bully a great success story.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

To US Senate: I say, instead of Apple executives, you should have brought in a giant mirror if you want to see who is responsible.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

Today we could vote to lower the corporate income tax but we won't. Today we could vote to let profits come home at 5% but we won't.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

Instead of doing the right thing we drag businessmen and women in here to berate them for trying to maximize their profits for shareholders.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

Money goes where it is welcome. If you want more money to be earned in the United States, make profit welcome here.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

Apple has done more to enrich people's lives than politicians will ever do.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

To the Apple executives here, I apologize for this theater of the absurd.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

I will do everything in my power to make our tax code simpler. I will not be a party to witch hunts that mistake cause for effect.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

If there is anyone to blame here it is not Apple, it is Congress and the tax code it created.

— Senator Rand Paul (@SenRandPaul) May 21, 2013

Join the conversation as a VIP Member