MF Global blew up because it made really dumb bets on European debt, and levered them 40:1. Lehman and Bear Stearns blew up in 2008, because they made highly levered bets on home mortgages and were levered 30:1.

Yesterday, Goldman ($GS) and Morgan Stanley ($MS) are considering accounting changes that will allow them to lever up their balance sheets.

Currently, Goldman and Morgan carry loans on their balance sheets at a mark to market value. This means that when do their books, they find the actual market price of the security and record it. This causes variation in the value of their assets, since markets fluctuate. It also causes disruptions in their operations, because as the value of their assets goes up or down, the amount of leverage they can have on those assets goes up or down.

This also affects financial results, because if during the year a loan loses value, they reflect it on their bottom line. They do this even though they will carry the loan through its entire life.

They are ruminating about changing mark to market accounting for these loans to historical cost. To be honest, if the intent is to hold the loan for the life of the loan, it’s probably more accurate to reflect the loan on their financial statements at historical cost and not mark to market. But what does this change mean?

It means that they will write up the value of most of the loans on their books. This accounting change will suddenly give them more equity. If they have more equity, they can create more leverage for themselves. More leverage means they can assume more risk.

Recommended

In 2008, both Goldman and Morgan revamped their businesses and became bank holding companies. The advantage to this was they could go to the Federal Reserve window and borrow funds directly from the government, just like any other bank. Currently, they can borrow at practically 0% interest.

But what are Goldman and Morgan really? Not traditional banks. Their profits are driven by their trading activity. Being a bank gives them a huge advantage over other hedge funds in the market because their cost of capital is significantly lower. If they bring about the accounting change, they will be able to borrow even more at these low rates and fuel their trading strategies to make money.

The other fly in the ointment is that the government has deemed them too big to fail. We may get a situation where banks are levering up, borrowing at the Fed window, and if they get into trouble force a taxpayer bailout because the government doesn’t want to deal with the consequences of them going under.

Doesn’t that make you rest easy this weekend?

Weekend Links:

3 first time tips for Starting a Company. One I disagree with. Don’t quit your day job until you have customers. Once you have customers, you have cash flow and can attract investors.

Michael Yon has been covering the War on Terror. He gives an unvarnished account of the action there. Currently, there is a big controversy about Medvac helicopters. Yon’s opinion is we need to arm them. I don’t disagree.

Can you move from being a thought leader to a business leader?

The way companies are getting financed is completely changing.

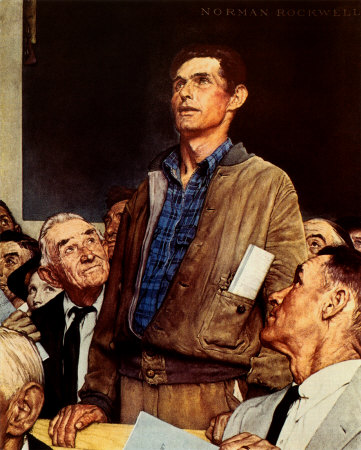

A peek into why we are fighting the war on terror. One of the things Norman Rockwell illustrated back in the day were the four freedoms that we enjoyed in the US. One is freedom of speech.

One of the key lessons when you are an entrepreneur is to pivot. You have an idea, you start to put it into motion. Then all hell breaks loose. It’s key to listen to the market and figure out how to match your business with what it wants. Very tricky, and not easy to quantify. Do it successfully, and you make some money. Miss the pivot, and you are out of business.

An ap for those in combat. Sometimes Skype isn’t dynamic enough. When my uncle was in Vietnam, he sent us reel to reel tapes. We would listen to them over and over again.

Join the conversation as a VIP Member