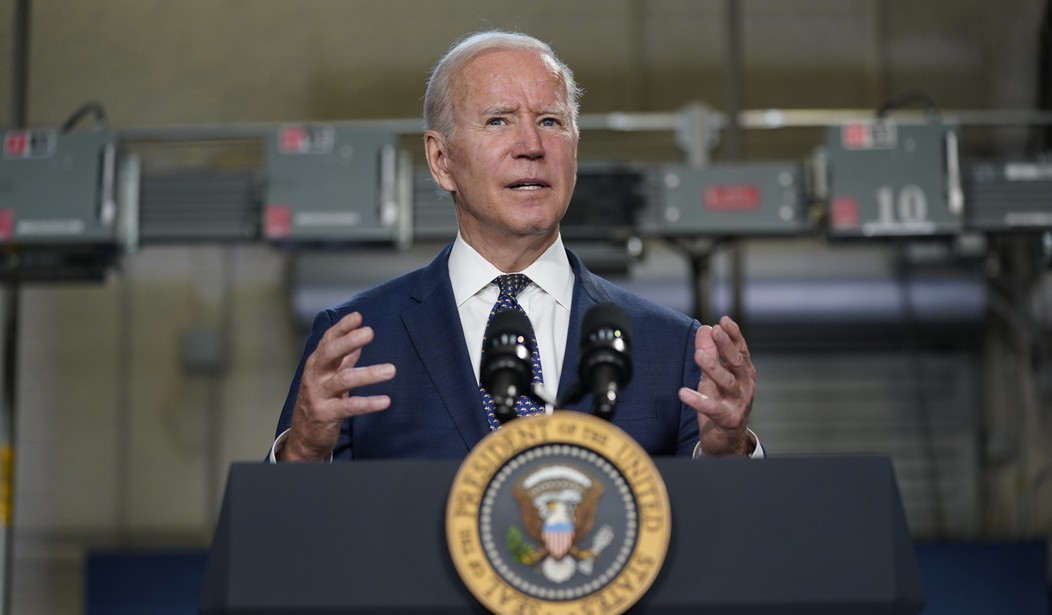

During the 2020 campaign Joe Biden promised that taxes on small businesses would not go up. So why is he now pushing numerous tax hikes that would hit small businesses?

His promise is not up for interpretation. During a Democratic debate in February 2020, Biden said: “No. Taxes on small businesses won’t go up.”

Now that he is safely in office, it appears he has no intention of keeping this promise. The $3.5 trillion in tax hikes Biden has proposed includes several small business tax hikes. His proposal to increase the top marginal income tax rate would hit small businesses organized as pass-throughs. His proposal to raise the corporate income tax rate would target the one million small businesses organized as C-corporations.

Finally, his plan to create a second death tax through repealing step-up in basis will hit family-owned businesses and add an immense amount of tax complexity.

Most small businesses pay taxes on the individual side of the code. Biden's increase in the top marginal income tax rate to 39.6 percent will hit small business organized as “pass-throughs” like sole proprietorships, LLCs, partnerships, and S-corporations. Therefore, by raising to top marginal income tax rate, Biden is raising taxes on these small businesses.

Currently, 90 percent of small businesses are organized as pass-throughs, employing 54 percent of the private sector workforce. In 2017, individuals reported $1.03 trillion in net income from pass-through firms, accounting for 9.3 percent of income reported on individual tax returns.

Recommended

According to the National Federation of Independent Business (NFIB), a 5 percent increase in the individual income tax rate has historically reduced capital investments made by small businesses by 10 percent. Simply put, a significant amount of small businesses and small business revenues would be negatively affected by a top marginal income tax increase from 37 percent to 39.6 percent.

While the Left and the media portray corporations as large, extremely profitable businesses, many corporations are small businesses.

One million small businesses with less than 500 employees are organized as C corporations, as noted by the Small Business Administration. According to the Congressional Research Service, 55 percent of C corporations had fewer than five employees, and 99 percent of C corporations had fewer than 500 employees.

So Biden's plan to raise the corporate income tax would not just impact big businesses – it would also harm the many small businesses structured as C corporations.

Finally, Biden’s repeal of step-up in basis will impose a second death tax on small, family-owned businesses. Repealing step-up in basis will impose the capital gains tax, which Biden has also proposed raising, on the unrealized gains of every asset owned by a taxpayer when they die. This will be separate from and in addition to the existing 40 percent Death Tax.

Biden’s repeal of stepped-up basis means that Americans will be forced to pay a capital gains tax on decades of “gains” that are actually just inflation. Assets such as homes, buildings, and land are typically held for decades.

Because many family-owned businesses are asset rich but cash poor, under the current law families already have to liquidate equipment, land, and other assets in order to pay the Death Tax. The second death tax will compound this problem, forcing family-owned businesses to sell a significant portion of their business or go into significant debt to pay their tax liability.

This law would also create new complexities for these taxpayers. As noted by an Ernst and Young study, “Family-owned businesses may also find it difficult to comply because of problems in determining the decedent’s basis and in valuing the bequeathed assets. It seems likely that these administrative problems could lead to costly disputes between taxpayers and the IRS.”

Tax compliance is already a significant burden for small businesses. Biden's plan will both increase taxes and increase tax complexity.

As stated by the NFIB, tax compliance costs are 67 percent higher for small businesses than for big businesses, costing small-business owners $18 to $19 billion per year. Paperwork costs often come to $74.24 per hour. It’s also important to remember that few small businesses have internal staff who can handle taxes. As the NFIB notes, “administrative tasks fall to owners, diverting them from their core businesses. Lacking tax expertise, 89 percent of owners rely on outside tax preparers.”

Biden needs to withdraw these tax increases if he wants to keep his word to the American people.

Join the conversation as a VIP Member