As regular readers know, one of my great challenges in life is trying to educate policy makers about the Laffer Curve, which is simply a way of illustrating that government won’t collect any revenue if tax rates are zero, but also won’t collect much revenue if tax rates are 100 percent. After all, very few people will be willing to earn and report income if the government steals every penny.

After all, very few people will be willing to earn and report income if the government steals every penny.

In other words, you can’t estimate changes in tax revenues simply by looking at changes in tax rates. You also have to consider changes in taxable income. Only a fool, for instance, would assume that you can double tax revenue by doubling tax rates.

But how do you explain this to the average person? Or, if you want a bigger challenge, how do you get this point across to a politician?

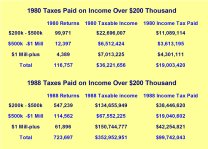

Over the years, I’ve picked up a few teaching examples that seem to be effective. People are always shocked, for example, when I show them the IRS numbers on how rich people paid a lot more tax when Reagan cut the top tax rate from 70 percent to 28 percent.

Over the years, I’ve picked up a few teaching examples that seem to be effective. People are always shocked, for example, when I show them the IRS numbers on how rich people paid a lot more tax when Reagan cut the top tax rate from 70 percent to 28 percent.

And they’re also more likely to understand why class-warfare tax policy won’t work when I show them the IRS data on how upper-income taxpayers have considerable control over the timing, level, and composition of their income.

Perhaps my favorite teaching technique, though, is to ask folks to pretend that they’re running a restaurant and to think about what might happen to their sales if they double the price of hamburgers. Would it make sense to assume that they would get twice as much revenue?

Almost everybody understands that hamburger sales would plummet and that they would likely lose revenue.

Recommended

Well, great minds (or at least wonky minds) think alike, because the Tax Foundation has released a great video on dynamic scoring and they use donuts to make the same point.

The video suggests that it would be a good idea to modernize the revenue-estimating process.

I fully agree. The Joint Committee on Taxation, which is responsible for revenue estimates on Capitol Hill, is notorious for using antiquated and biased methodology.

I elaborate (and use my hamburger example) in this video I narrated for the Center for Freedom and Prosperity.

P.S. The Joint Committee on Taxation also is responsible for producing biased estimates of so-called tax expenditures.

P.P.S. Only 15 percent of CPAs (the folks who see first-hand how taxes impact behavior) agree with the Joint Committee on Taxation’s methodology.

Join the conversation as a VIP Member