Welcome to John Ransom's Stocks In The News, where the headline meets the trendline.

Stocks in the News is produced by Ransom Notes Radio and Goodfellow, LLC. Crista Huff manages Goodfellow LLC, a website that recommends outperforming stocks using fundamental and technical analysis.

eBay Inc., (SYMBOL: EBAY) and the headline says:

EBay to bolster PayPal business with Braintree acquisition -- Reuters

eBay’s payments company, PayPal, will acquire mobile payment processor Braintree for $800million cash.Braintree will enhance PayPal’s merchant relationships with innovative mobile payments technology, 40 million consumer accounts, and $12 billion in annual payment volume.Braintree will operate as a separate service, and the deal is expected to close this year, resulting in a very small charge against eBay’s 2013 earnings.

Excluding the Braintree acquisition, eBay’s earnings are expected to grow 15-18% per year for each of the next three years.The PE is 21, in a five-year range of 5-27.

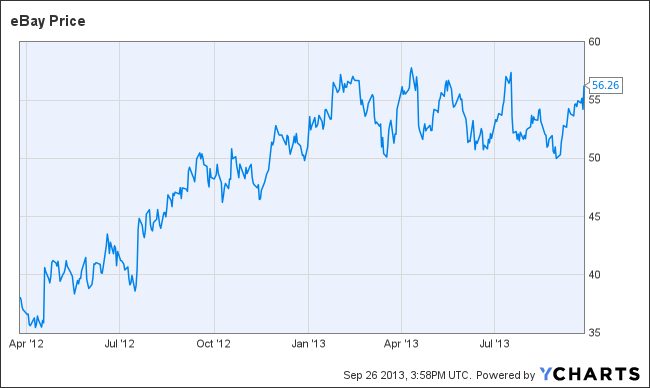

eBay shares have been trading between $50 and $58 since last November.For new investors and traders …..

Our Ransom Note trendline says:BUY EBAY BELOW $52.

Stock number two is:

Air Products & Chemicals Inc., (SYMBOL: APD) and the headline says:

Changes Afoot; CEO to Retire as Proxy Fight is Avoided – Citi Research

“This morning [Air Products and Chemicals] announced that current CEO John McGlade will retire in 2014 … effectively avoiding a proxy fight with Pershing Square [Capital Management],” reports Citi Research.Air Products will also add 3 new members to its Board of Directors at the behest of Pershing Square’s Bill Ackman, owner of $2.2 billion in Air Products stock, and famed for his recent spectacular loss on J.C. Penney shares.Pershing Square has agreed in writing to work confidentially with the board toward additional desired changes.

Recommended

S&P expects earnings to grow 18% this year.The dividend yield is 2.6%, and the ex-dividend date is tomorrow, September 27.

The stock broke through long-term upside resistance around $105 in July, but no one has missed the opportunity to own Air Products shares before their next run-up.Bill Ackman views the shares as undervalued, and so do we.

Our Ransom Note trendline says..... BUY AIR PRODUCTS AND CHEMICALS.

Stock number three is:

Hertz Global Holdings Inc., (SYMBOL:HTZ) and the headline says:

Hertz cuts revenue forecast due to weak airport car rentals – Reuters

Hertz Global Holdings, owner of airport car rental brands Hertz, Dollar, and Thrifty, is guiding Wall Street’s full-year earnings estimates down about 8% from previous expectations, due to weaker volume in Hertz-brand airport car rentals.

The company has seen rapid earnings growth in recent years, now expected to grow 30% this year, with continued aggressive growth going forward.The PE is 12.

The stock had a huge run-up to long-term resistance at $27 this year, and has since traded sideways, with support around $22.50.Traders and investors should take advantage of today’s sell-off and buy this undervalued, aggressive growth stock.

Our Ransom Note trendline says: BUY HERTZ GLOBAL HOLDINGS.

<

Ransom Note: Regarding the buy recommendation on Air Products and Chemicals stock today, I think every stock investor should own chemical stocks right now, more than any other industry. They all have very attractive multi-year double-digit earnings growth going forward, fair PEs, and big dividends.

All of the charts are extremely bullish, generally breaking out of long-term trading ranges, but no one has missed the boat on a chemical sector run-up.

Dow Chemical (DOW) shares are up 25% since you said "buy" in February. Earnings are growing aggressively at 24% this year, and going forward. The dividend yield is 3.2%. The PE is 16.

DuPont (DD) shares are up since you said buy in July. Earnings are growing 16% this year, the PE is 15, and the dividend yield is 3%.

Air Products and Chemicals' earnings are expected to grow 18% this year, and the yield is 2.6%.

Join the conversation as a VIP Member