In an era where global alliances are more crucial than ever, the proposed $15 billion merger between Nippon Steel and U.S. Steel emerges as a pivotal moment not only for the steel industry but for U.S. international relations, particularly with Japan. This strategic alliance transcends mere corporate interest—it is a testament to the robust partnership between two leading world democracies.

Through ally-shoring with Japan via the Nippon-U.S. Steel merger, the U.S. will be able to reduce dependence on China for steel production, strengthen economic ties with one of our closest allies, enhance national security, and build more resilient supply chains. Blocking this merger under shortsighted pretexts not only undermines a longstanding alliance but also signals a retreat from the global economic stage at a time when ally-shoring is crucial to defend against China.

On a broader scale, decades of allied-foreign investment in American companies are proven to bring in not only much needed capital but also innovation while simultaneously saving or creating American jobs and reviving dying manufacturing towns. The Bureau of Economic Analysis reports that more than seven million Americans are domestically employed by companies with foreign investment. Behind the United Kingdom, Japanese-owned companies employ the highest number of U.S. workers, with 856,000 employees reported in 2015 by the Pew Research Center, a number that is likely much higher today with the growth of Japanese-owned auto manufacturing companies, Toyota, Honda, and Mitsubishi.

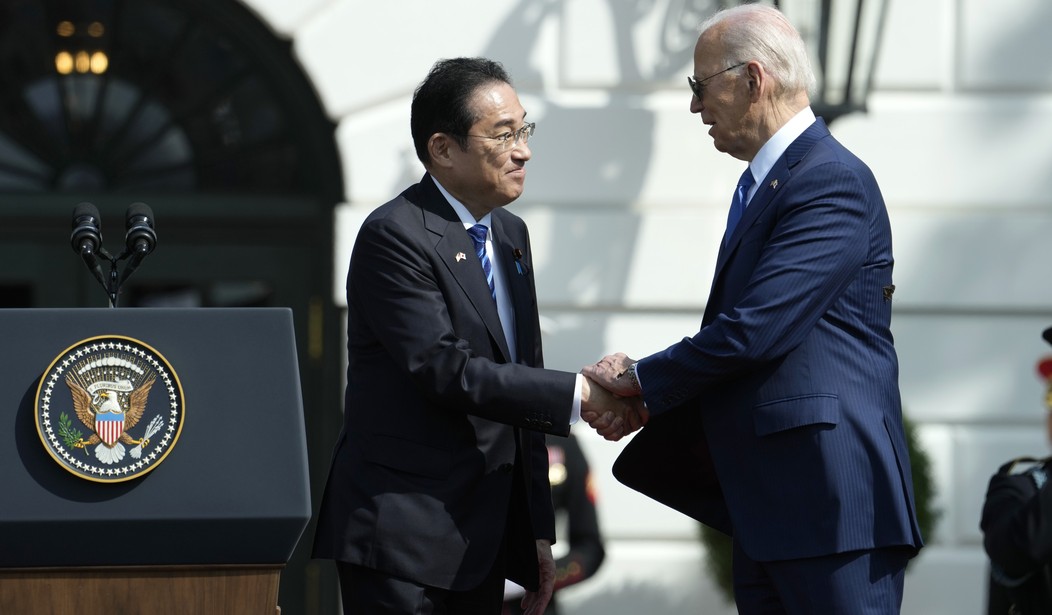

The U.S.-Japan alliance has been a bedrock of stability in the modern era, underpinning both security and prosperity across the globe. Japan has stood by the United States through various crises, aligning with American interests to promote peace, democracy, and economic stability. The Biden administration’s looming decision to block the merger based on alleged “national security concerns” is an insult to one of our closest allies and will have economic and trade implications far greater than the administration has apparently thought through. Killing a deal that is mutually beneficial to both the United States and Japan for political gain shows Japan, and other American allies, that decades of partnership throughout instability, hardship, war, and crises can be thrown away if it benefits American politicians in an election year.

Recommended

Nippon Steel has worked in good faith to negotiate with the unions and come to the table with a deal that will ease worries about new leadership from a foreign parent company. The company committed to relocate its U.S. headquarters to Pittsburgh, vowed to not lay off any workers or close plants at least until 2026, and invest over $2.7 billion in American facilities. This infusion of capital and innovation will not merely preserve jobs but will create them, enhancing the technological prowess and global competitiveness of U.S. Steel. Moreover, it offers a sustainable path forward for an industry that has faced its share of challenges, from aging infrastructure to aggressive competition from global players, particularly China.

Blocking the Nippon Steel and U.S. Steel merger would be a grave mistake. It would signal to the world that the U.S. is choosing isolation over innovation, protectionism over progress. This merger is a golden opportunity to strengthen our industrial sector, bolster our national security, and reaffirm our commitments to our closest allies. It is a forward-thinking, strategic move that aligns perfectly with our national interests and our economic aspirations. As such, it deserves robust support from policymakers, industry stakeholders, and the public alike. Let us not shy away from this opportunity to lead on the global stage. Let us embrace this merger and all the potential it holds for a stronger, more prosperous America.

Amanda Peterson is an economic and political analyst and activist based in America’s steel manufacturing heartland. She is president of Excelsior Podcast Studios in Minneapolis, Minnesota, and writes extensively on economic policy that impacts the Great Lakes Region.

Join the conversation as a VIP Member