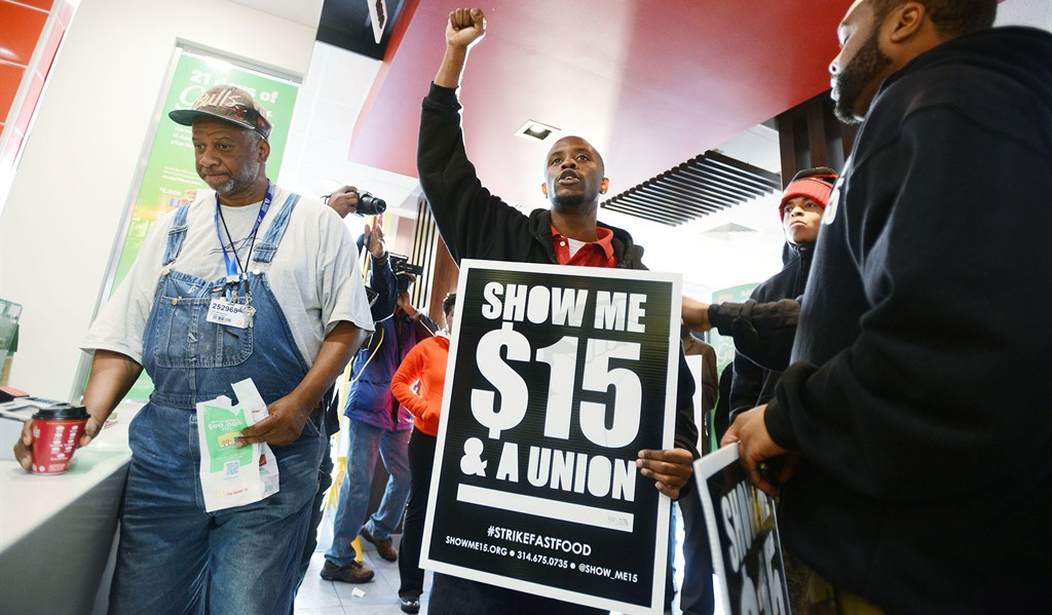

It appears as though the #FightFor15 may have been a tad misguided. New research from the San Francisco Fed shows that simply raising wages does not do much to help lift people out of poverty, and that increasing the earned income tax credit is likely a better way to help people.

The reasoning behind this is that many families living in poverty don't actually work, meaning that increasing their (nonexistent) wage doesn't help their situation. Additionally, most who live below the poverty line already make above the minimum wage. Thirty-six percent of poor workers make over $12 an hour.

David Neumark, the author of the study, said that raising wages does not help poor families living below the poverty line, and suggested adjusting tax credits.

"Mandating higher wages for low-wage workers does not necessarily do a good job of delivering benefits to poor families," Neumark wrote. "Simple calculations suggest that a sizable share of the benefits from raising the minimum wage would not go to poor families."

Increasing the earned income tax credit is a more effective way to fight poverty, he said. A family of four can get a credit of up to $5,548, which Neumark said is more tailored toward low-income families than hikes in the minimum wage.

"The earned income tax credit targets low-income families much better, increases employment and reduces poverty, and for all these reasons seems far more effective," he wrote. "Policymakers are likely to do a better job fighting poverty by making the EITC more generous than by raising the minimum wage. Furthermore, using both of these policies together is more effective than minimum wage increases in isolation."

Recommended

For anyone who has studied economics, this makes perfect sense. While it may seem good on paper to raise the minimum wage, the majority of people on minimum wage are not trying to raise families on it. Additionally, cities who have raised their minimum wages have seen disastrous effects on employment rates as businesses were unable to keep up--or simply moved to another town with a lower wage.

Join the conversation as a VIP Member