Obamacare was put together by people who don’t understand economics.

This is probably the understatement of the year since I could be referring to many features of the bad law.

The higher tax burden on saving and investment, making an anti-growth tax system even worse.

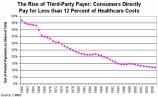

The exacerbation of the third-party payer problem, which is the nation’s biggest healthcare problem.

The exacerbation of the third-party payer problem, which is the nation’s biggest healthcare problem.

The increased burden of government spending, worsening America’s entitlement crisis.

Those are all significant problems, but today I want to focus on how Obamacare encourages people to be less productive. And I’m going to use a rather unexpected source. The left-leaning San Francisco Chronicle has a financial advice column that inadvertently show how Obamacare discourages people from earning income.

The article nonchalantly explains that people may want to reduce their income so they can get more goodies from the government.

People whose 2014 income will be a little too high to get subsidized health insurance from Covered California next year should start thinking now about ways to lower it to increase their odds of getting the valuable tax subsidy. “If they can adjust (their income), they should,” says Karen Pollitz, a senior fellow with the Kaiser Family Foundation. “It’s not cheating, it’s allowed.” Under the Affordable Care Act, if your 2014 income is between 138 and 400 percent of poverty level for your household size, you can purchase health insurance on a state-run exchange (such as Covered California) and receive a federal tax subsidy to offset all or part of your premium. …getting below the 400 percent poverty limit could save many thousands of dollars per year.

Recommended

You may be thinking that this is just a theoretical problem, but the article cites a very real example.

To get a subsidy, the couple’s modified adjusted gross income for 2014 income would need to fall below $62,040, which is 400 percent of poverty for a family of two. …Proctor estimates that her 2014 household income will be $64,000, about $2,000 over the limit. If she and her husband could reduce their income to $62,000, they could get a tax subsidy of $1,207 per month to offset the purchase of health care on Covered California. That would reduce the price of a Kaiser Permanente bronze-level plan, similar to the replacement policy she was quoted, to $94 per month from $1,302 per month. Instead of paying more than $15,000 per year, the couple would pay about $1,100.

To put it in even simpler terms, this couple has figured out that they can get almost $14,000 of other people’s money by reducing how much they earn by just $2,000.

That, in a nutshell, is the perfect illustration of the welfare state. It tells people that they can get more by producing less. And the system is based on the theory that there will always be some suckers who work hard to provide the subsidies.

But as we’ve seen in Greece, Italy, Spain, and elsewhere, this system eventually breaks down as more and more people learn that it’s easier to ride in the wagon than it is to pull the wagon (as powerfully illustrated by these two cartoons).

And remember that the United States isn’t too far behind Europe’s welfare states.

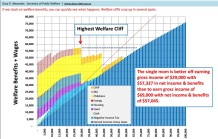

Thanks to the plethora of welfare programs and income-redistribution schemes that already exist, millions of Americans have an incentive to earn less money and get trapped in government dependency. This graph, for instance, shows that various handouts mean that a single mom with $29,000 of income can be better off than a self-reliant person with $69,000 of income.

This graph, for instance, shows that various handouts mean that a single mom with $29,000 of income can be better off than a self-reliant person with $69,000 of income.

And a local CBS station discovered that a low-income household could be eligible for more than $80,000 of goodies from the government. Earning more money, though, would mean fewer handouts.

The same problem exists, by the way, in other nations such as Denmark and the the United Kingdom.

Remember Julia, the mythical moocher created by the Obama campaign to show the joys of government dependency? As illustrated by this Ramirez cartoon, Julia symbolizes the entitlement mentality. But the cartoon doesn’t go far enough. It should show how Julia decides to lead a less productive and less fulfilling life because she gets hooked on the heroin of handouts.

P.S. Some honest liberals recognize that redistribution can trap people in poverty.

P.P.S. Unsurprisingly, Thomas Sowell explains this issue with blunt and powerful logic.

P.P.P.S. To close with some humor, here’s a new Declaration of Dependency put together for our leftist friends. Though they may want to think twice beforeasking for a divorce from Red State America.

Join the conversation as a VIP Member