I try to be self aware, so I realize that I have the fiscal version of Tourette’s. Regardless of the question that is asked, I’m tempted to blurt out that the answer is to reduce the burden of government spending.

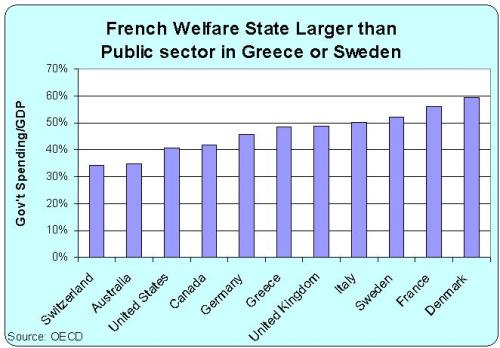

But sometimes that’s exactly the right prescription, particularly for an economy weighed down by a bloated public sector. And, as you can see from this chart, the French welfare state is enormous.

Only Denmark has a bigger burden of government spending, but at least the Danes are astute enough to compensate with hyper-free market policies in other areas.

So is France also trying to offset the damage of excessive spending with good policy in other areas? Au contraire, President Hollande is compounding the damage with huge class-warfare tax hikes.

Here’s what the Wall Street Journal says about Hollande’s fiscal proposal – including the key revelation that spending will go up rather than down.

Remember all that euro-babble before the French election about fiscal “austerity” harming growth? Well, meet the new austerity, same as the old austerity, which means higher taxes on the private economy and token discipline for the state. Growth is an afterthought. That’s the lesson of French President François Hollande’s new “fighting” budget, which is supposed to reduce the deficit to 3% of GDP from 4.5% and represent the country’s toughest belt-tightening in three decades. …More telling is that two-thirds of the €30 billion in so-called savings is new tax revenue, and one-third comes from slowing spending growth. Total public expenditure—already the second most lavish in Europe—will increase by €6 billion to 56.3% of GDP.

Recommended

The spending cuts are fictional, but the tax increases are very, very real.

The real austerity will be imposed on taxpayers, and not only on the rich. Income above €150,000 will now be taxed at 45%, up from the current 41%. Mr. Hollande’s 75% tax rate on income over €1 million comes into effect for two years, reaping expected (and predictably paltry) revenue of €200 million. That’s dwarfed by the €1 billion from reducing the threshold for the “solidarity” tax on wealth to €800,000 from €1.3 million. The French Socialists will also now tax investment income at the same high rates as regular income. The rates have been 19% for capital gains, 21% for dividends and 24% for interest income. If Mr. Hollande’s goal is to send capital out of France, that should help.

Anybody want to take bets, by the way, on whether the “temporary” two-year 75 percent tax rate still exists three years from now?

I say yes, in large part because the tax almost surely will lose revenue because of Laffer Curve effects. But rather than learn the right lesson and repeal the tax, Hollande will argue it needs to be maintained because revenues are “unexpectedly” sluggish.

It’s also remarkable that Hollande wants to dramatically increase tax rates on capital gains, dividends, and interest. These are all examples of double taxation.

And when you factor in the taxes at both the personal and business level, these charts show that France already has the highest tax on dividends in the developed world and the third-highest tax on capital. And Hollande wants to make a terrible system even worse. Amazing.

I’ve already predicted that France will be the next major economy to suffer a fiscal crisis. I was too clever to give a date, but Hollande’s policies are accelerating the day of reckoning.

P.S. The WSJ also takes some well-deserved potshots at the latest fiscal plan in Spain. Since I endorsed Hollande in hopes that he would engage in suicidal fiscal policy, this post is focused on the French fiscal plan. But Spain also is a disaster.

Join the conversation as a VIP Member