In the August issue of Townhall Magazine, where this article originally appeared, Sean Chaffin profiles New York Times bestselling author and radio host Dave Ramsey, who spreads the word that debt is dumb, cash is king, and building wealth just takes some common sense.

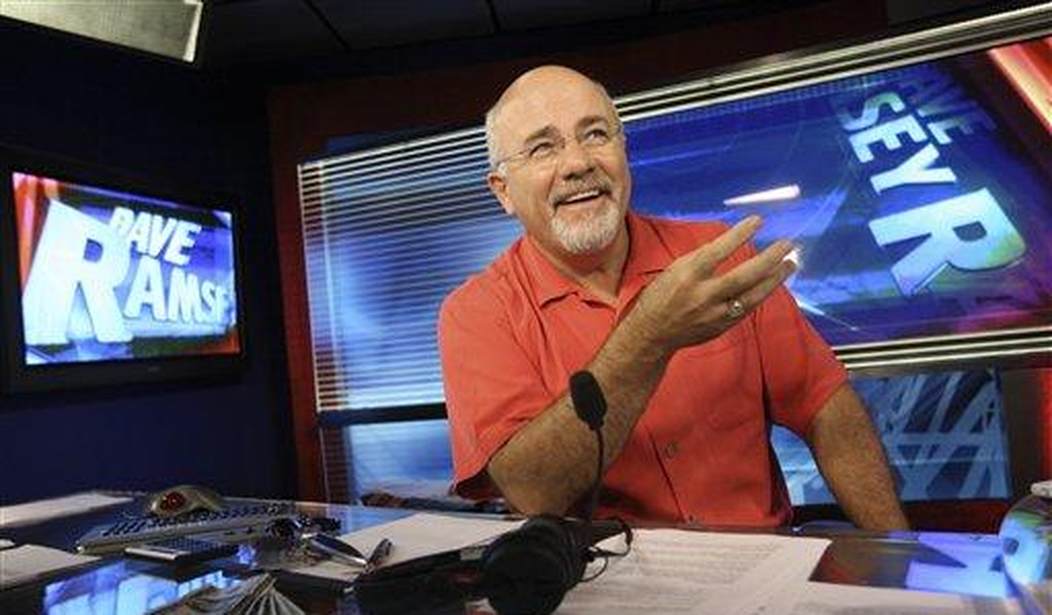

The call is from Tiffany in Atlanta, Georgia. Dave Ramsey, with his closely-shaven head and goatee, looks on intently, listening from his Nashville studio. Tiffany details her problem, which is beamed out to more than 500 radio affiliates as well as a video web stream. Tiffany says she and her husband make $65,000 a year, but are stuck with more than $300,000 in debt, with the great majority in the form of student loans.

It’s the type of call Ramsey fields often—someone who has a massive amount of debt and is scared, looking for practical help to get out of the situation.

“List your debts smallest to largest, make minimum payments on everything except the smallest one, and attack the smallest one with a vengeance,” he advises Tiffany. “Here’s the math issue that’s scaring me for you guys ... you’ve got to get your income up. Your ratio of income to debt is driving me nuts here. It’s scary. Your shovel to the size of the hole you’re in, it’s out of whack. You’ve got to get your income up, way up.”

Ramsey dishes out the kind of savvy, tough love that has attracted millions of fans across the country. According to NerdWallet.com, which uses sets of data that include the U.S. Census and the Aggregate Revolving Consumer Debt Survey, the average indebted American owes $15,191 in consumer credit debt and $33,607 in student loan debt. With these figures in mind, Ramsey’s goal is to educate his audience so that they’re not just “normal” Americans—deeply in debt and living above their means. As he frequently notes: “Being broke sucks.”

THE BORROWER IS SLAVE TO THE LENDER

“WE’RE DEBT FREE!” Nashville residents Anderson and Kerri scream from the coffee shop lobby of Ramsey’s head- quarters—known as Financial Peace Plaza. It’s just an every- day event on “The Dave Ramsey Show,” where the screams and stories of overcoming the shackles of personal debt are meant to serve as an inspiration for others in similar circumstances. Many have gone through Ramsey’s series of classes and audio programs known as Financial Peace University, which details “baby steps” to get out of debt as well as providing some emotional support from others in the same situation.

Recommended

The young couple, both in their early-20s (Anderson works as a photographer and Kerri as an accountant), have paid off $35,000 in 16 months and seen their income rise regularly during that time. The debt was all in the form of student loans for Anderson’s education, and the couple was determined to rid themselves of the burden early in their marriage.

“I was working at Chick- fil-A at the time and my employer had given us Financial Peace University when he found out we were going to get married, probably because we were young and he thought, ‘You guys are probably going to need this,’” Kerri says. “For me, I was definitely kind of scared of money,” Anderson admits. “Then when we got these materials in our hands. We realized that they would actually be able to help us. We tried to shift it into high gear.”

The couple tells Ramsey how they avoided eating out and cutting back on extraneous expenditures—and their smiles give away the joy they feel about their accomplishment. It’s a common refrain from a couple who has dug themselves out of their debt by beginning what Ramsey calls a “debt snowball”— deeply focusing on throwing as much money as possible at a mountain of debt and knocking off smaller debts first to build momentum and gain some traction.

“Saying no is a powerful thing,” Ramsey notes during the discussion. “As young as you’ve done this, if you’ll just stay on this track, stay on this path—I mean the wealth that you’re going to have, the ability to give and to live that you’re going to have is astronomical.”

Ramsey has been advising on personal finance for more than 25 years and one of his tenets to personal success in wealth building is to eliminate all personal debt—enabling one to save, invest, and give to worthy causes.

One of Ramsey’s defining words of wisdom (and an almost daily saying on the show) comes from Proverbs 22:7, which states: “... the borrower is slave to the lender.” The verse also underscores Ramsey’s beliefs about money. An evangelical Christian, Ramsey believes deeply in his teachings and how successful personal finance not only allows one to help himself and family, but also to tithe and give to worthy causes.

A major key to Ramsey’s success is his own personal story of overcoming debt and a bankruptcy because of his own hubris. A graduate of the University of Tennessee, Ramsey had established a multi-million dollar real estate portfolio by the age of 26. Highly leveraged, however, his real estate holdings came crashing down by age 30, and he and his wife Sharon were forced to declare bankruptcy. The event was a major turning point in his life.

“I didn’t need a get-rich-quick guy to pump me up or tell me to be positive. I didn’t need a secret formula to riches,” he writes in his best-selling book, “The Total Money Makeover.” “I was positive of only one thing: I was sick and tired of being sick and tired. I was sick and tired of sitting down to ‘do the bills’ and having a heaviness come over me.”

In essence, Ramsey became the guinea pig for his new plan. Much of this involved hard work and sacrifice, the good old “pull yourself up by the bootstraps mentality.” He rebuilt his family finances, determined never to be indebted again. The plan worked and became the idea for a new business venture— begun at a card table in his living room. His plan was to help others reach their own financial security, and one day, help Americans rethink their views about personal finance and debt.

MEDIA MAN

Fresh off his own financial crisis, Dave Ramsey believed that his plan for financial security might work well for others. In 1992, he founded his company, The Lampo Group, and began offering financial counseling to those hoping to improve their money management. Additionally, he self-published the book, “Financial Peace,” and began selling it through the mail and from the trunk of his car. Also that year, Ramsey was a guest on a radio show on WWTN 99.7-FM in his home state. The station later asked him to host a program fielding financial questions called “The Money Game.”

In the next few years, Ramsey’s philosophy would expand into seminars called Financial Peace University with 1,000 families taking the class by 1996. Videos of the program were also filmed, and classes were held in bookstores, churches, libraries, restaurants, businesses, and schools in 32 states in only a short time, according to DaveRamsey.com. There seemed to be a market for the advice Ramsey was offering.

As the word began to get out, the radio program added more and more affiliates, and Ramsey made numerous media appearances—from the “Today” show to People magazine. More best-selling books followed as well as the broadcaster’s live events, which offer financial, family, and career advice with Ramsey and numerous speakers that fit in with his message of living within one’s means and taking control of one’s future. “The Money Game” would soon take on the brand that was being built, and was renamed “The Dave Ramsey Show” in 1998.

Ramsey’s radio show remains a powerhouse, teaching more than just a debt-free lifestyle, however. Topics range from entrepreneurism and small business management to real estate issues and even dealing with “unique” family situations.

College debt and how to avoid it has become a frequent topic as a growing number of American graduates leave school with heavy loan burdens and face years of debt.

Talkers magazine publisher Michael Harrison says Ramsey is highly regarded in the industry because of his proven success and the very professional organization he runs, not to mention he’s simply a nice guy. The host’s Christianity is a major part of the show and Ramsey firmly believes in being a good steward of the money God has given one. He reads a daily Bible scripture, but also makes it known that it is not merely a Christian show. His financial principles apply to those of any faith (or none). And on a business level, Harrison adds, his shows generate both ratings and revenue for his affiliates.

The show’s success was built through years of hard work and hustle, which is also a daily theme.

“His route happened because of a patient and persistent build over a long period of time,” Harrison says. “Ramsey was not an overnight success. He built the show over the course of years. He showed up at all the conventions and did significant advertising in the trades. His live consumer shows are unparalleled in scope and impact. Ramsey sets a good example for the talk show host of the 21st century. He is entrepreneurial and operates on multi-media platforms.”

Harrison says it is Ramsey’s likeability and common-sense advice that really connect with listeners, many of whom need real help in their lives, that have helped make Ramsey a success. He comes across as just a regular guy from the South (he grew up and still lives in Tennessee) who was down on his luck at one point, and using his own wits, was able to turn things around.

“He speaks common sense to people who need it—stay out of debt, live within your means—and mixes in just enough spirituality to give his presentation broad appeal,” Harrison says. “Yes, he seems like a regular guy with whom you can easily be friends. Half the battle in making it as a talk show host is to be likable. Ramsey is a likable guy.”

LIVING LIKE NO ONE ELSE TO LIVE LIKE NO ONE ELSE

For most Americans, living within one’s means seems easier said than done. So what are the essentials to Ramsey’s plan in building wealth? Simply put: get your expenses then your income, and get out of debt. Through his books and program he details the “baby steps”: begin with saving an emergency fund ($1,000 for those heavily in debt and then three to six months of expenses for those who have gotten out of debt); start a monthly budget (with both spouses on board and having input); “plastic surgery” (cut up and cancel those credit cards); and then attack debt with “gazelle intensity.”

Ramsey doesn’t just advise paying extra on one’s debt, his affectionate term is “living on beans and rice”—as in living with as few extra expenses as possible (such as restaurant dining) and paying minimum payments on all one’s debts and hammering at the smallest one first. His idea is that seeing one small debt disappear serves as an inspiration to keep getting rid of the others that may be even larger.

And in that “debt snowball,” Ramsey advises debtors to take control of their own destiny. Work extra jobs to bring in extra money. Have a garage sale and sell things for some quick cash. Pay cash for a used car rather than finance a new one that you can’t afford. Pay more on the mortgage to get it paid off much sooner than that 30-year note (he says most on the plan average paying off their homes in seven years). The goal is to suffer a bit now, for a much better life later, debt-free. Or as he often says—live like no one else, so later you can really live and give like no one else.

“Winning at money is 80 percent behavior and 20 percent head knowledge. What to do isn’t the problem; doing it is,” he writes in “The Total Money Makeover.” “Most of us know what to do, but we just don’t do it. If I can control the guy in the mirror, I can be skinny and rich.”

After getting free of the debt albatross, Ramsey’s plan involves investing for one’s retirement and saving for children’s college—all spelled out in detail in his books, seminars, and radio show. Callers are often given books and seminar admission to help them with their own situations. The idea is to build wealth and change one’s “financial legacy.” For many Americans, the Ramsey plan has been a blessing and headed off financial ruin or bankruptcy. It’s not that he is averse to ever spending money—he simply wants Americans to be financially stable and have cash before making those purchases. Earlier this year, Ramsey and his daughter Rachel Cruze released the book “Smart Money Smart Kids,” which is designed to help parents pass on smart financial decisions to their children. The book became yet another best-seller.

SPREADING THE NEWS

Daniel Burnett of Temple, Texas, is a great example of Ramsey’s path to success and shares a similar story as some of Ramsey’s debt-free screamers. A general contractor/carpenter by trade, Burnett can do a bit of everything when it comes to fixing up busted houses: framing, hanging the drywall, texturing, painting, and then installing the doors, windows, and a little bit of everything else. When his brother was shot while serving in Afghanistan, however, Burnett spent seven months helping him through rehab.

“At the end of it I was broke. I needed a new plan,” he says. “Then I got married and realized I really, really needed a new plan—something that made good sense to both of us given our different backgrounds. We read the books, set up, and worked the plan.”

Burnett and his wife’s efforts paid off. He says it takes time to learn new habits, but they stuck with it and made small adjustments to their budget and spending as needed. The Burnetts’ tale is just one of many success stories—they paid off $13,000 in 11 months. Beyond that, he says they developed better communication within their marriage and a sense of trust at a deeper level.

After finding his own success, Burnett has now become a teacher of Financial Peace University at his hometown church. He hopes to share the joy of financial freedom and says one of the biggest aspects of success is perseverance.

“It will not happen by accident, but if you push and you push you will win,” he says. “It is difficult to go against the culture of debt because that debt gives the illusion of putting the responsibility of our happiness and safety net on someone else. When we take on those responsibilities and provide for them ourselves there is a profound sense of contentment and a deep feeling of peace. The effort to get to that state is worth it.”

Sean Chaffin is a freelance writer, journalism teacher in Crandall, Texas, and author of the new book, "Raising the Stakes: True Tales of Gambling, Wagering & Poker Face," which is available at Amazon.com and BN.com. Email him at seanchaffin@sbcglobal.net or follow him @PokerTraditions, which is also the name of the blog he is relaunching.

Join the conversation as a VIP Member