Advertisement

This year, Americans celebrated their "Tax Freedom Day" on April 23. This is the day when Americans have earned enough money to cover their total federal, state, and local tax bill for the year, on average.

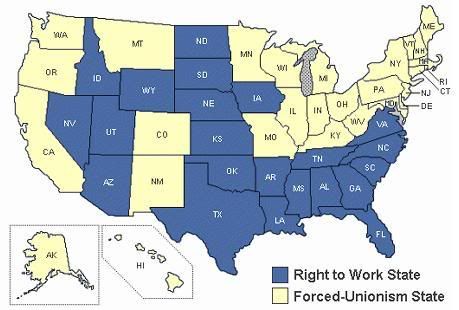

The Tax Foundation and U.S. Census Bureau data have found that in 2008, the average Tax Freedom Day in the 22 states with Right to Work laws was April 18, five days earlier than the national average. For the 28 non-Right to Work states as a group, their Tax Freedom Day came nine days later than the average in Right to Work states.

In addition to a higher tax burden, forced-union states’ cost of living is higher as well. Economist Barry Poulson from the University of Colorado figured that living costs average nearly 18% higher in metro areas in non-Right to Work states than in Right to Work states.

Recommended

Advertisement

Why?

The National Right to Work Committee says that "where forced dues are legal, union officials use their power to disrupt labor markets, jack up costs, and bankroll regulation-happy, Tax-and-Spend state legislators and governors."

Hopefully the Minnesota state legislature will come to understand the benefits of a Right-to-Work state and come on board for the sake of all Minnesotans.

For more information on the report, click here.

Join the conversation as a VIP Member