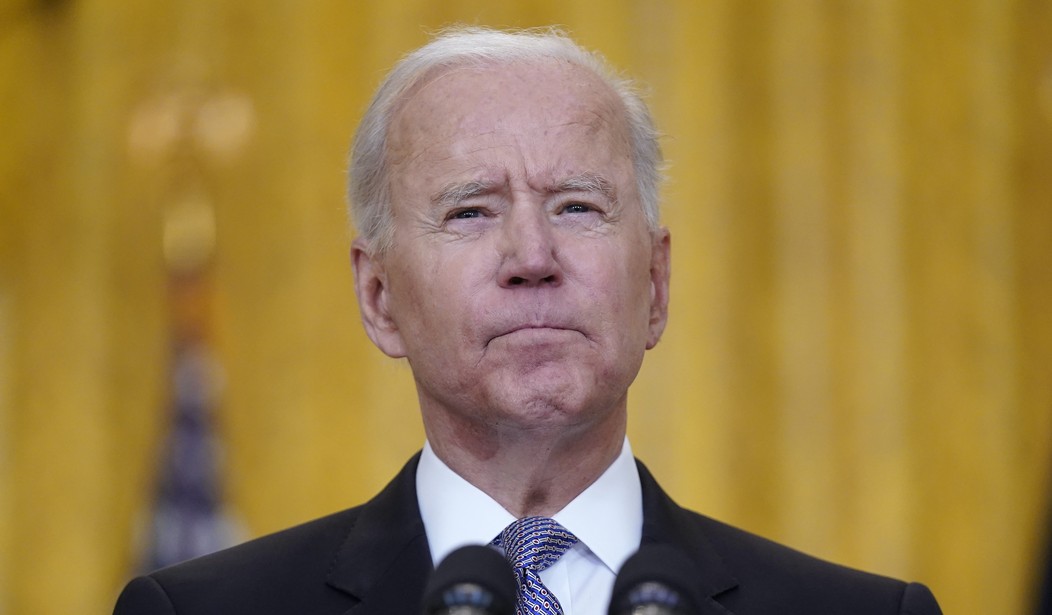

A new nationwide survey found voters blamed President Biden more than anyone else for rising inflation.

Conducted in partnership with Convention of States Action, the Trafalgar Group poll of likely general election voters saw 39 percent of respondents blame the president, while 17.7 percent blamed former President Trump. About 14 percent of respondents pointed fingers at the current Congress, and 10.9 percent said the previous Congress bears responsibility. Another 17.9 percent said they did not know.

The partisan breakdown was even more stark, with 64.3 percent of Republicans saying Biden is culpable for rising inflation. Democrats were more split in their blame of Trump (27.3 percent) versus Biden (21.5 percent).

Some critics on social media pointed out that the Federal Reserve's "reputation escapes unscathed as usual."

In a recent Deutsche Bank report about inflation, the bank took issue with the Federal Reserve's new framework tolerating higher inflation.

"We are witnessing the most important shift in global macro policy since the Reagan/Volcker axis 40 years ago. Fiscal injections are now 'off the charts' at the same time as the Fed's modus operandi has shifted to tolerate higher inflation," the report said. "Never before have we seen such coordinated expansionary fiscal and monetary policy. This will continue as output moves above potential. This is why this time is different for inflation."

The bank added: "We worry that the painful lessons of an inflationary past are being ignored by central bankers, either because they really believe that this time is different, or they have bought into a new paradigm that low interest rates are here to stay, or they are protecting their institutions by not trying to hold back a political steam roller. Whatever the reason, we expect inflationary pressures to re-emerge as the Fed continues with its policy of patience and its stated belief that current pressures are largely transitory. It may take a year longer until 2023 but inflation will re-emerge. And while it is admirable that this patience is due to the fact that the Fed’s priorities are shifting towards social goals, neglecting inflation leaves global economies sitting on a time bomb."

Join the conversation as a VIP Member