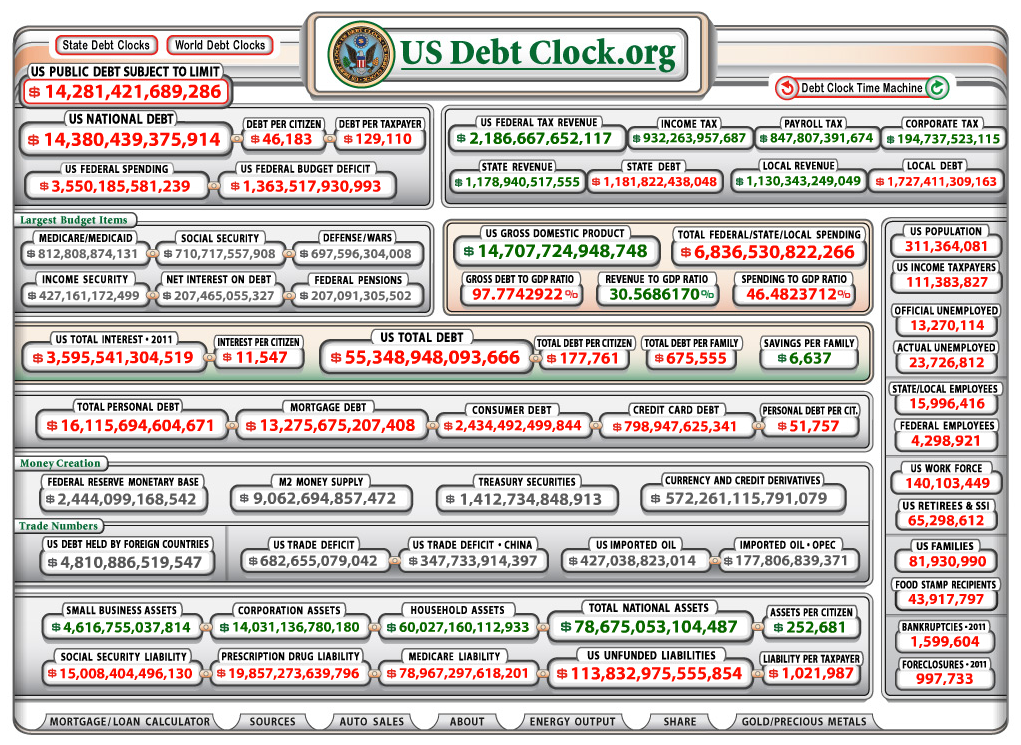

Treasury Secretary Timothy Geithner warned Congress Thursday that it must raise the statutory limit on the nation’s debt by the end of March or risk an unprecedented and economically devastating default on American debt.

Geithner, in a letter responding to a request from Senate Majority Leader Harry Reid (D-Nev.), said that his department estimates that the debt limit will be reached between March 31 and May 16. Geithner is requesting action “early this year, well before the threat of default becomes imminent.”

“Never in our history has Congress failed to increase the debt limit when necessary,” Geithner said in the letter, which was sent to all members of Congress. “Failure to raise the limit would precipitate a default by the United States. Default would effectively impose a significant and long-lasting tax on all Americans and American businesses and could lead to the loss of millions of American jobs.”

The official word from the administration starts the clock on what’s likely to be one of the most difficult legislative issues in the early days of the 112th Congress. To underscore the gravity of allowing the debt ceiling to be reached, Geithner listed consequences, which include a “substantial tax on all Americans,” a rise in borrowing costs, interest rate hikes and an increase in mortgage interest rates.

Recommended

So, can the American people now expect a substantial tax hike to cover the irresponsible practices of our politicians?

In a letter sent to Senator Michael Bennet today, Geithner continued his calls to raise the debt ceiling, despite his previous warning of immediate dire consequences if the debt ceiling were reached (which today it was) not exactly happening as scheduled:

I hope that Congress will act in a timely manner to increase the debt limit and protect the full faith and credit of the U.S. government.

The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past. This would be an unprecedented event in American history. A default would inflict catastrophic, far-reaching damage on our Nation's economy, significantly reducing growth and increasing unemployment.

The fact that the United States would not have enough money to meet all of its obligations would have serious economic consequences. If the United States were forced to stop, limit, or delay payment on obligations to which the Nation has already committed- such as military salaries, Social Security and Medicare, tax refunds, contractual payments to businesses for goods and services, and payments to our investors-there would be a massive and abrupt reduction in federal outlays and aggregate demand. This abrupt contraction would likely push us into a double dip recession.

First, the Obama Administration and Geithner have continually warned about a "double-dip recession," yet, America is still in a recession and hasn't gotten out of it. "Recovery Summer," in fact was the opposite, the economy hasn't recovered. The idea that we may fall into another recession or "double dip," doesn't make much sense considering the first recession starting in 2008 never ended - unemployment is still high at 8.7 percent or in reality, full unemployment lands at 15.9 percent and the housing market still hasn't reached rock bottom. Second, Geithner has reiterated the "kill grandma" and "military won't get paid," scaremongering tactics in order to push his big government, bigger debt agenda. Third, Geithner states in the letter "The debt limit does not authorize new spending commitments. It simply allows the government to finance existing legal obligations that Congresses and presidents of both parties have made in the past." Although the debt ceiling may not have an immediate impact on new government spending, continually raising the debt ceiling doesn't deter politicians or the president to stop spending either, especially when more debt is always easily allowed by simply voting to raise the debt ceiling.

Although the debt ceiling debate is still looming as Congress has not yet voted on whether to raise the limit, and yes, defaulting on U.S. loans would have serious consequences on the economy, Geithner's predictions of immediate chaos once the debt ceiling was reached (remember, he set a end of March deadline before "economic chaos" set it) were and still are over the top.

What we should be worried about is the big number that will be set as the new debt "limit." To cover the federal deficit of $1.65 trillion in 2011, the White House is asking for an additional $2 trillion to be added to the debt ceiling. If the White House gets their wish, the new debt limit will be nearly $17 trillion. It is also important to note that the U.S. has not defaulted on its loans and the Treasury still has some time to avoid a default despite the U.S. hitting the debt limit.

Join the conversation as a VIP Member