Here are the hard truths of our threatening situation with social Security and Medicare. We have a looming major fiscal crisis which no one denies. There are solutions but no politically easy ones and our options get worse with time.

Yet every time a working politician suggests considering even mild changes, the formidable senior lobby and AARP erupt in outrage and beat down the hapless reformer. Former allies of responsible reform flee and the status quo Is again preserved.

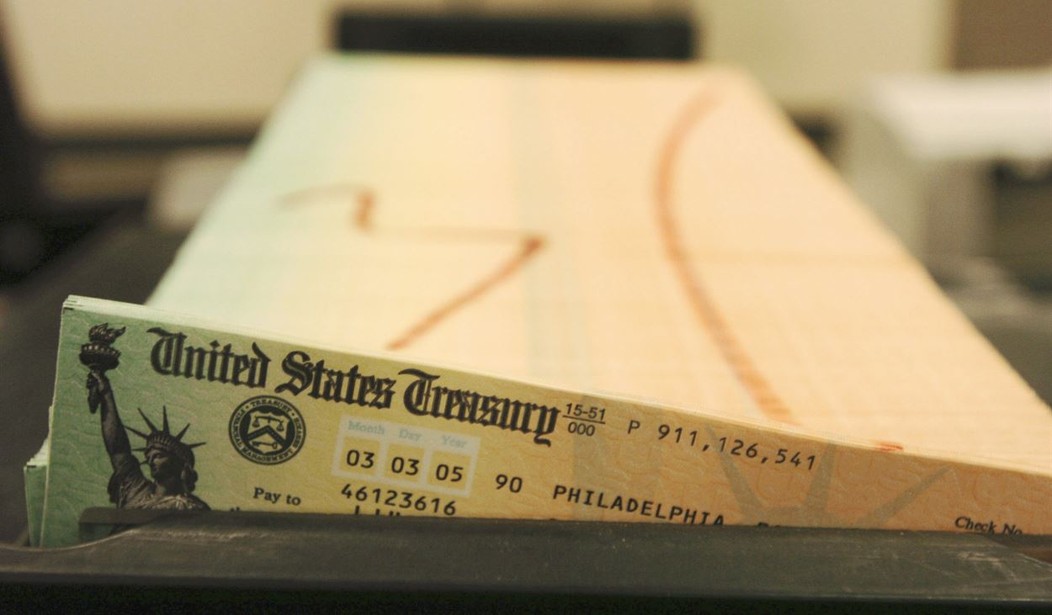

Facts, as they say, are stubborn things. Social Security is by design a mandatory government administered defined-benefit retirement trust, funded by payroll taxes. However the inflows to the trust are insufficient to support the benefits promised and, unlike private pension plans, there is no corpus of funds earning compound interest to make up the difference. Thus the fund will become insolvent in nine years. As matters stand, benefits across the board will need to be reduced by 23%.

Worse, deficits in Social Security and Medicare comprise the overwhelming majority of future anticipated federal debt accumulation. So the courageous politicians who assured seniors in this and every election that they will “protect” their Social Security (i.e., do nothing) were not protecting anything except their own political skins.

The problem nobody wants to face is that either benefit levels are too high, payroll taxes are too low or retirees are retired for too long. Politicians long ago raided the “surplus” and replaced the funds with non-income generating IOUs.

Reducing benefit levels, even for high earners, is politically toxic. The mere suggestion evokes hyperbolic charges of “pushing granny over the cliff” and “giving the middle finger to senior citizens”.

Recommended

On the other hand, raising taxes would be nearly as unpopular. It would take a 25% hike in the payroll tax to fill the hole once insolvency occurs. Economic growth and consumer spending, the drivers in our economy, would be crowded out as would several federal programs.

Clawing back the Social Security trust funds so that income could be generated would be nice. But that train has left the station. The funds have long since been spent on other priorities

That leaves only shortening the length of retirements that Social Security supports. This option is also massively unpopular, as public demonstrations against it here and around the globe attest.

Yet when Social Security was established in 1935, the average life expectancy was just 63. Today it is nearly 80. We are now down to just three workers paying into the system for every retiree, compared to 16 at the beginning of Social Security.

These workers’ earnings are paid out as current benefits in what amounts to a giant Ponzi game. Like Ponzi schemes before it, this one is also doomed to failure.

The concept of retirement was basically unknown until recently in human history. Everyone worked as long as they could and the rest were cared for primarily by families. So why is delayed retirement, even modest (two years) and gradually phased in violently opposed?

Part of the reason is that government subsidies are never “enough”. Free money is always popular and beneficiaries quickly develop an entitlement mentality.

Since retiree benefits are funded by payroll taxes, the notion of being “owed” is understandable. Unfortunately for proud seniors, the facts now are that the money flows in Social Security are essentially like other government welfare programs.

Fortunately, most jobs today are not as physically demanding as in the past. Medical care for job related injuries is much improved. Disability insurance and retirement accommodations for workers in occupations like law enforcement and the military are already in place. For the rest, many able seniors experience work as manageable and even enriching.

Regardless, the do-nothing option, so wildly popular in this last election, is no longer feasible. The “private account” reform offered by George Bush in 2005, which was demagogued into the ground by the same crowd proudly blocking all reforms this go-around, would have resulted in the average worker having three times more retirement income by now.

This can has been kicked down to near the end of the road. Our options now are to defer retirement or face serious program cuts. Sad.

Join the conversation as a VIP Member