It’s time to extinguish any lingering Christmas cheer. Today’s topic is over-bearing and tyrannical tax administration.

To be more specific, we’re going to look at the extent to which taxpayers are mistreated during the process of collecting revenue.

Yes, the amount that governments steal from you also is important, but that’s a topic we’ve already discussed on many occasions.

Moreover, we’re not going to focus on the IRS. Yes, the internal revenue service is infamous for its brutal and intrusive tactics. And I’m embarrassed to note that the United States scored very poorly in a Tax Oppression Index prepared by Switzerland’s Institut Constant.

But I want to focus today on places other than Washington. And the good news (at least relatively speaking) is that some countries scored even lower than the United States. The very worst nation was Italy, and you probably won’t be surprised that Germany (the country that figured out a way to use parking meters to tax prostitutes) and France were among the jurisdictions that also ranked below America.

This story from Brittany provides a rather appropriate glimpse at what it’s like to be a taxpayer in France.

For customers at the Mamm-Kounifl concert-café in Locmiquélic, carrying drinks trays and used glasses back to the bar was a polite tradition. But for social security agency URSAFF, it was also an infringement of labour laws because customers were acting like waiters, French local newspaper Le Télégramme reported.

But what’s really amazing is the way in which France’s revenue-hungry bureaucrats “caught” the alleged scofflaws.

Recommended

“Around half-past midnight, a customer returned a drinks tray. She passed by the bar to go to the toilets. That was when it all kicked off. My husband was pinned against the glass by a man. A woman leapt on me, showing her ID card and that’s when I realised it was a URSSAF check. They told me I had been caught using undeclared labour,” owner Markya Le Floch told Le Télégramme. …The authorities initially fined the pub owners €7,900 and briefly placed them in police custody. …URSSAF are still pursuing a social case and are now seeking €9,000 due to non-payment of the original fine.

Wow. This may be even more Orwellian than the FDA raid against the Amish farm that was selling unpasteurized milk to consenting adults. Or more absurd than the DEA busting a grandmother for buying cold medicine.

Imagine if the IRS adopted this French policy. If you take your significant other on a fancy date to McDonald’s and then carry your trash to the garbage receptacles, you’ll be guilty of providing “undeclared labor” and the tax police can then decide to impose taxes and fines because there could have been a taxable employee fulfilling that role.

I’m not joking. That seems to be the premise of the case in France.

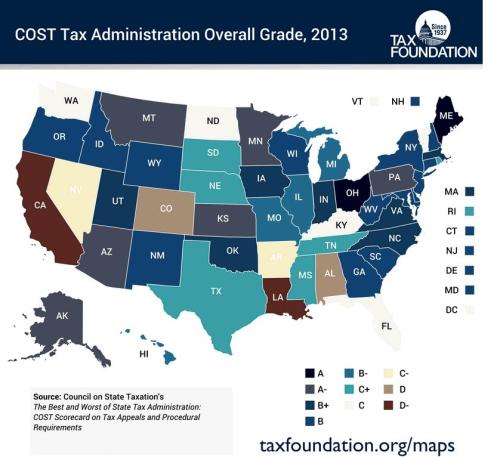

Let’s now look at how taxpayers are treated by the various states here in America. Using data from the Council on State Taxation, the Tax Foundation hasput together a map with grades for each state based on “good government” principles of tax administration.

I’m surprised that Maine and Ohio rank so highly, particularly since neither state gets very good grades based on either Tax Freedom Day, aggregate tax burden, or the State Business Tax Climate.

But I’m not surprised that California ranks at the bottom. The state routinely gets bad grades on various measures of fiscal policy. No wonder so much income is moving out of the state. As for Louisiana, I can understand why Governor Jindal is so anxious to get rid of the state income tax.

Though the absence of a state income tax doesn’t guarantee good tax administration. Nevada, for instance, gets a poor grade in the COST survey.

P.S. If you like cartoons mocking California’s tax-and-spend politicians, clickhere, here, here, here, here, and here.

P.P.S. I’ve only shared one French-related cartoon, but you can seem my attempts at humorous captions here, here, and here.

Join the conversation as a VIP Member