Every so often, I share breakthrough stories about advances in “human rights” around the world.

- In France, it is against the law to say your husband is under-endowed or that your wife is fat.

- Across Europe, a satellite dish is now a human right.

- In Finland, broadband access is a basic right.

- There’s now an entitlement for free soccer broadcasts in Europe.

- In Italy, you have the right to…um…your testicles.

Now, in honor of Sandra Fluke, the United Nations has decided that contraception is a human right. Not just a human right, a universal human right. The New York Times reports on this big news.

The United Nations says access to contraception is a universal human right that could dramatically improve the lives of women and children in poor countries.

So what’s the big deal? Surely people should have the right to buy a condom.

Yes, but we’re talking about the United Nations, so you won’t be surprised to learn that there shouldn’t be any “financial barriers” to birth control, which means people have the right to have other people pay for their fun and games.

It effectively declares that legal, cultural and financial barriers to accessing contraception and other family planning measures are an infringement of women’s rights. …The global body also says increasing funding for family planning by a further $4.1 billion could save $11.3 billion annually in health bills for mothers and newborns in poor countries.

Well, Sandra Fluke surely will be happy about this news. Even though national governments safely can ignore U.N. pronouncements, this is yet another sign of a growing dependency mindset.

P.S. Speaking of Sandra Fluke, you can enjoy some laughs with this great Reason video, this funny cartoon, and four more jokes here.

Richard Epstein Discusses the Flat Tax

Recommended

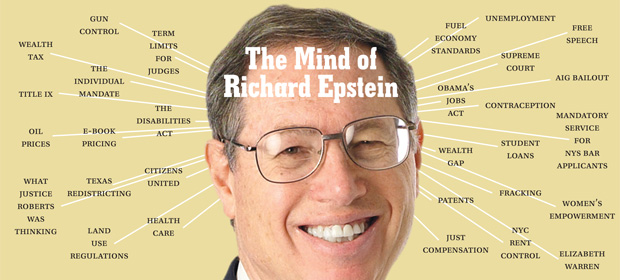

In addition to being my former debating partner, Richard Epstein is one of America’s premiere public intellectuals.

You can watch him make mincemeat out of George Soros in this video, for instance, and you can listen to his astute observations about his former law school colleague Barack Obama in this video.

Given his stature, I’m glad that he agrees that the flat tax is the ideal way of reforming the corrupt internal revenue code. Here’s some of what he wrote about the topic for the Hoover Institution, beginning with an outline of the fundamental issues at stake.

The central challenge for government is to incur minimum political distortions while allowing taxes to raise the revenues needed to discharge essential government functions. …Without question, the form of taxation that best meets these dual requirements is a flat tax on consumption—a position which enjoys virtually no visible political support today. …Unless something is done to alter the direction of political discourse in the United States, the next four years will be a replay of the last four years. We will witness a slow decline in the standard of living across all groups within the United States.

For those not familiar with the lingo, a “flat tax on consumption” simply means a tax system with one rate and no double taxation of income that is saved and invested. That can be a national sales tax or value-added tax, but it usually refers to the “Hall-Rabushka” flat tax championed by Dick Armey and Steve Forbes. If you want more information, click here and here.

Epstein then gives some of the economic arguments for tax reform.

A sound tax system has as few moving parts as possible. We should scrap the current system in favor of a flat tax on consumption. Radically simplifying the tax system to a flat tax on consumption would facilitate two desirable economic changes. First, it reduces taxes to zero when capital is redeployed from one venture to another, which in turn would induce better investor monitoring of current firms. The ability of investors to sell out without adverse tax consequences thus provides an added incentive for efficient market behavior. Second, it eliminates the need to draw any distinction between ordinary income and capital gains, which is one of the weak points of the current system.

And he gives some reasons why the current system is unpalatable.

Current tax policy puts items like income and deductions into political play, generating deleterious short-term consequences. Evidence of this can be seen in the rapid response of investors, who are anticipating the future tax hikes and scaling back on their investments. The adverse responses are not confined to large firms but also extend to wealthy individuals who will bear the brunt of any tax increase. The proposed increase in the estate and gift taxes, targeted exclusively at high-income taxpayers, has set off an immediate flurry of tax planning efforts by well-to-do individuals to minimize the bite of these unknown and unwelcome tax changes. Typical of the common hijinks are the estate planning tactics recently reported in the Wall Street Journal by Annamaria Andriotis, which should belie the naïve belief that high-income taxpayers don’t respond to incentives. It is not just that people go to extra lengths to alter their patterns of giving in order to take full advantage of the life-time exemption from the gift and estate taxes and annual exclusions (now $13,000 per each donor/donee pair); it is that they engage in the conscious destruction of wealth in order to minimize the impact of taxes.

He also provides the Laffer-Curve argument for better tax policy.

The President thinks that revenue growth from taxes can be reduced to a simple task of addition and multiplication. Start with the current tax base, and multiply it by the increased tax rates in order to determine the added tax revenues. …Since the advent of the income tax in 1913, tax rates have gyrated from high to low and back again. …the typical response to these tax reductions is a spur in economic activity that results in the collection of larger amounts of capital gains taxes from wealthy individuals, who also prosper under the regime by their higher after-tax earnings. …If we sock it to the rich, we run the risk of impoverishing the nation.

Esptein concludes by explaining the world is not a zero-sum exercise. Good tax policy can make everybody better off.

Too many people agree with the implicit supposition of the President that taxation is a zero-sum game, whereby the rest of the population can gain amounts that are taken from the rich through taxation. Not so. The explicit tax increases on the rich will be passed on in a variety of ways to the population as a whole so that everyone is made worse off in the name of income equality.

I certainly agree. Statists assert that people like me and Espstein believe in trickle-down economics. That’s obviously a pejorative term, but we do believe in a system where more entrepreneurship and capital formation leads to higher living standards.

How can anybody look at this chart and think otherwise?

If you want more information, here’s my video on the flat tax.

This system is working in about 30 nations around the world. Isn’t it time America had a tax system that made sense?

Join the conversation as a VIP Member