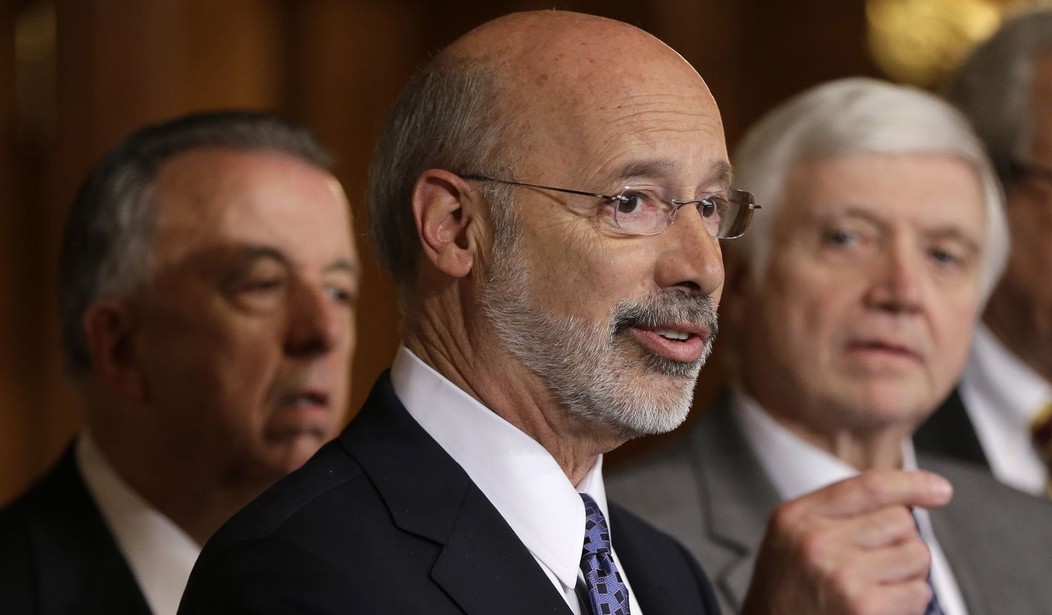

Pennsylvania Gov. Tom Wolf’s plan to join the Regional Greenhouse Gas Initiative (RGGI) passes neither the sniff test nor basic fact-checking, concludes an analysis by scholars at the Allegheny Institute for Public Policy.

“Wolf’s desire to join RGGI seems to be more about exacting a carbon tax and little to do with environmental concerns,” say Elizabeth Miller, a research associate at the Pittsburgh think tank, and Frank Gamrat, the institute’s executive director.

“A closer look at RGGI reveals that the cooperative is more of a taxing entity and less the environmental proponent it claims to be,” the researchers say (in Policy Brief Vol. 19, No. 37).

RGGI is the first supposedly “market-based” program in the United States to implement a “cap-and-trade” regimen aimed at, again supposedly, decreasing greenhouse emissions, claimed by proponents to be the leading cause of “climate change.”

Ten states -- Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island, Vermont and New Jersey – joined the consortium in 2009. New Jersey left the group in 2011 but plans to rejoin next year.

Simply put, RGGI requires fossil-fueled electric-power generators with a capacity of 25 megawatts (MW) or greater to buy allowances equal to their carbon dioxide emissions caps.

A group known as RGGI Inc. oversees the program. It determines the cap. Each plant (the number now is up to 165) must purchase credits to equal its CO2 emissions over a three-year period. Each state sells the credits at auction, supposedly investing the proceeds in energy efficiency, renewable energy and other areas said to benefit consumers.

Recommended

“RGGI maintains that its cap-and-trade program is market-based,” Miller and Gamrat note. “But the mechanisms it uses … are not characteristic of free-market mechanisms.”

Given the complexities of the program, one must wonder why it would not be more practical to simply impose a higher tax on electricity use to deter consumption rather than going through elaborate auctions and cap-setting.

Well, that’s because RGGI’s success and effectiveness are as questionable as its motives are dubious.

To wit, in 2009 its complex, market-perverting formulary led to a situation in which emissions were taxed but not reduced.

“(T)he scheme is little more than a tax-revenue generator as emissions have fallen below the cap-constrained market,” Miller and Gamrat note. “So much for having an impact on the environment.”

RGGI also has touted how the program has reduced asthma attacks and saved lives. What’s not to like for Pennsylvania? But the Keystone State’s percentage of adult asthma already is lower than all current RGGI states except New York.

Additionally, RGGI touts the economic benefits of its scheme. But based on the member states combined gross domestic product of $3.25 trillion, the supposed $4 billion benefit is a mere 0.12 percent of that total GDP.

And for all the environmental good that is claimed, the New York and New Jersey experience shows RGGI proceeds have been used to pay down state deficits.

One can only wonder how the Wolf administration might divert RGGI tax receipts. But we don’t need to wonder; the governor already has said he’ll use RGGI to fund his $4.5 billion “Restore Pennsylvania Infrastructure” program. Just think of the potential machinations there.

“This underscores the point that environmental concerns can be, and are being, used as pretext to gather support for taxation and government revenue,” Miller and Gamrat say.

“By levying an additional cost on electric power generation, the price of electricity is artificially driven up and passed on to consumers, especially businesses,” the researchers stress. “Consumers face increased utility costs and additional costs due to secondary effects of higher energy prices.”

This is not mere postulation. A Cato Institute study found a marked reduction in both energy-intensive industries and in the overall goods-producing sector in RGGI states. But the 2017 review found only a slight decrease in non-RGGI states (Pennsylvania included) in the former and a double-digit percentage increase in the latter.

Additionally, the Cato study found a sharp electric rate increase in states that had adopted RGGI.

This is what Gov. Wolf wants to bring to Pennsylvania, which is counterintuitive considering the commonwealth has seen a whopping decline in CO2 emissions without joining RGGI, thanks in large part to natural gas.

“Pennsylvania has reduced carbon dioxide emissions through market solutions and without the tax burden that RGGI would levy,” Miller and Gamrat remind.

“The increased energy prices for taxpayers, loss of jobs due to mounting energy costs and second-order effects resulting from high electricity costs are strong arguments against joining RGGI.”

Join the conversation as a VIP Member