What's the greatest threat to the market and the economy?

- Change in Fed policy

- Deflation/slowing global economy

- Overleveraged (see chart)

- ISIS/Terrorism

- Ebola

- Crisis of Confidence

- Slowing US economy

For all the scuttlebutt about the Fed initiating another round of extraordinary accommodation, the only change is that the first interest rate-hike will move to December of next year from September 2015. In fact, some members would like to see action sooner rather than later. Moreover, it was leaked earlier this week that Janet Yellen sees the economy improving nicely. Yesterday, Charles Plosser, head of the Philadelphia Fed, echoed that same notion with several comments about the economy moving "more quickly than anticipated.”

On the other hand, James Bullard, President of the St Louis Fed, said he would like to see the Federal Open Market Committee (FOMC) hold off on the last bit of quantitative easing (QE) until December and hike rates in the first quarter of 2015. It seems like an odd statement, since it is a five-month window at most to finish with QE accommodation and then hike rates- Wall Street could not handle such a scenario.

Moreover, it seems ludicrous in so many ways to suggest the Fed buy $15 billion of agency mortgage-backed securities and treasuries bonds, it would be enough to manipulate the stock market higher. Fed action is designed to discourage savings and make equities more attractive, but the math seems dubious.

- October 15 NASDAQ- $119.4 billion in volume

- September 30 NYSE- $ 48.2 billion in volume

The reality is $150 billion or so in trading activity on a daily basis (or $3.0 trillion a month) and $15.0 billion of buying in bonds will make or break the outcome. I know a lot of smart people that trade on Fed news, however, as an investor, you need to know the fundamentals before following the crowd (on that nonsense), if you’re thinking about retiring with greater wealth. As for the economy, none of the Fed money printing has circulated in the economy. I am sure you already know this, but here is further confirmation via the St. Louis Fed in the chart below.

Recommended

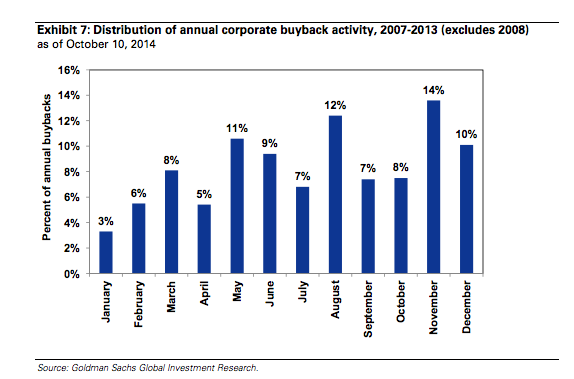

Corporations have benefited from lower rates with huge stock buybacks. Purists argue that it is financial engineering, but others say it is a legit way to reward shareholders. I agree with the latter. It has been amazing, however, how well this works out. Consider Las Vegas Sands: big miss on the top and bottom, but announcing $2 billion in buyback, and upping its dividend by 45% made the stock one of the big winners in yesterday’s session.

The good news for investors is that November is the biggest month of the year for corporate buybacks, and December is not too bad, either.

I still think US global economic slowdown is the biggest threat to our economy and stock market… especially, if we continue down this path. Remember that in November.

Join the conversation as a VIP Member