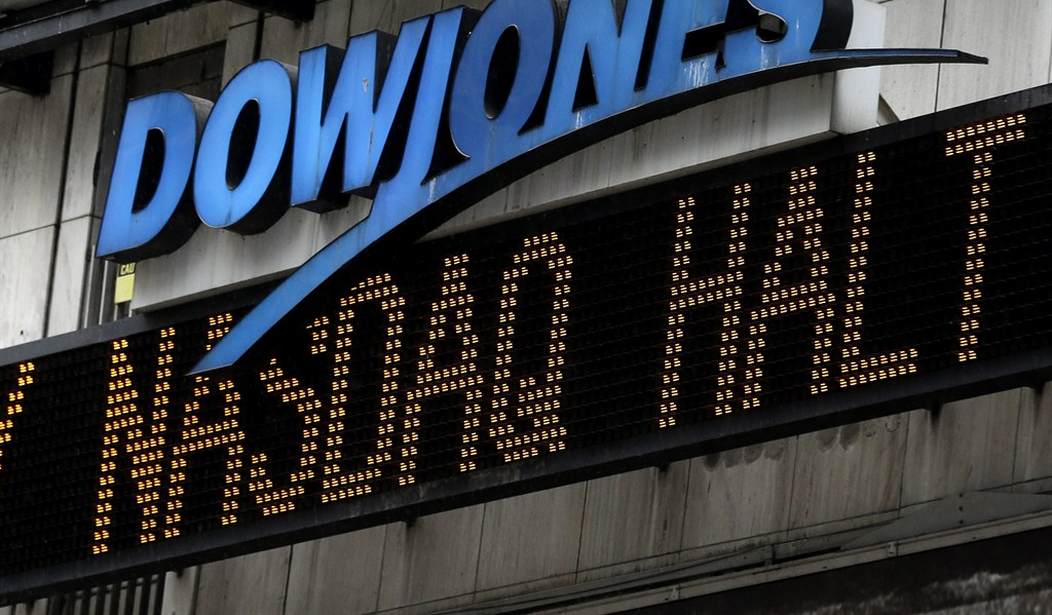

"Fool me once, shame on you, fool me twice, shame on me." Because that's the message from the latest Gallup poll that shows investor confidence in the stock market has not rebounded to the same degree as the stock market - not even close.

In fact, considering 54% of non-retirees were still relying on retirement savings accounts (401Ks) in 2008, , it is somewhat amazing that only 48% feel that way today, even as the Dow has rallied 150% from its March 2009 bottom.

Although the Dow has drifted from an all-time high, confidence has not climbed back to the level of 54% of non-retirees using the stock market as their primary source of economic preparation for their golden years. The most recent crash seems to have been the last straw; there has been a mini-crash in some of the high flyer stock names.

This happens to be a tough time for the market, which adjusted for inflation, is almost unchanged from its high of January 2000 (Dow at 16,084 in 2014 = 11,722 in 2000).The fact is investor trepidation has actually played a major role in the market's lackluster performance since the tech crash, as they were easily shaken out of positions, and have been willing to chase performance.

That old adage about buying low and selling high, rivals wash behind your ears for commonsense things we never really do.

Pushing Around the Little Guy with the Help of the Little Guy

Of course perched over all this action, are those Pharaohs of Wall Street that play the public like marionette puppets, and play the market like a fiddle. They get to move the needle through deep pockets, and even deeper messaging. Yesterday, David Einhorn's assessment that Athena Health (ATHN) was a bubble stock sent shares crashing lower. Why would holders of that stock sell unless there was little conviction about the stock to begin with? Of course there comes a point when the pain is so terrible, people simply bite the bullet.

Recommended

Knowing they have the clout to start this type scenario has resulted in a landslide in social media stocks, where companies that beat estimates are crushed, and companies that offer higher guidance are crushed as well. Companies that seem to deliver everything, which usually makes Wall Street happy, watch their shares get sacked. (We have a few of these ideas open, and it is a challenge to ask people to hold, even though in the past, similar situations have ended with stocks recovering.)

|

Pharaohs & Riches

$3.5b David Tepper |

Of course, the money these guys pocket is also something of a put off for regular people trying to get their money to grow in this stagnant economy. It is hard to fathom how any single person could earn a billion dollars in a single year (an amount that would have landed a hedge fund manager in fifth place last year), coupled with talk of the game being rigged, and stocks that were cheered weeks ago, are being jeered today. I get why people would be leery.

However, long stretches of time, like 20 years or more; have more than proven that stocks are the best bet in town. Now, young adults think its savings accounts, and even after the ugly bursting of the bubble, more people would rather invest in real estate than in stocks.

This is not the best morning to tout the benefits of owning stocks, but relying on social security (31% say it is the best bet for retirement) is nuts! Your golden years will be anything but that, if you are banking strictly on those government checks to afford you a wonderful life versus, living from week to week. If you own Fire Eye from $100, or Athena Health from $200, you are probably cursing my name right now; but I bet even those names prove to be better retirement vehicles than social security.

Join the conversation as a VIP Member