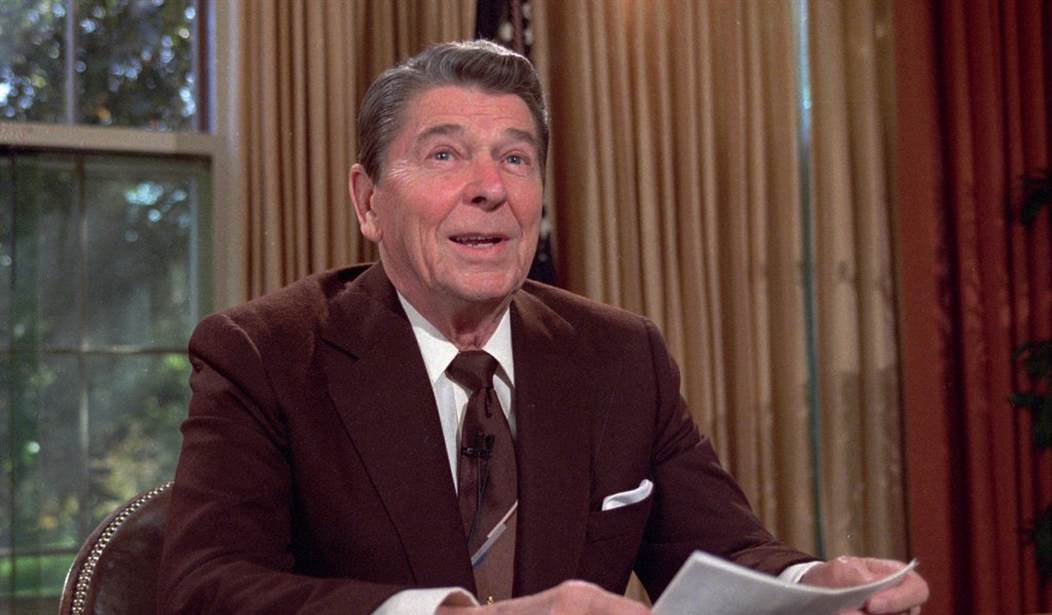

It has been 30 years since the tax code was last reformed. By signing the Tax Reform Act of 1986, President Ronald Reagan reduced income tax rates for every American family and business, simplified the code, and encouraged strong economic growth.

Yet today, the code is far more complex than it has ever been, growth remains stagnant, and businesses are unable to compete against foreign competitors. Regardless of who occupies the White House next year, tax reform must be on the agenda.

Tax reform should not be viewed as a partisan issue. Both the right and the left agreed in 1986 that the tax code was out of date and out of control. The code was plagued with 14 different income tax brackets. The top rate for individuals and businesses was close to 50 percent.

The 1986 tax reform simplified the code by replacing the 14 tax brackets with two and reducing the top income tax rate to 28 percent. The corporate tax was also lowered to a 34 percent, incentivizing both innovation and competitiveness.

These reforms spurred economic growth. In the years following tax reform average GDP growth rose to 4.2 percent. Today, our economy is stuck at a stagnant 2 percent and tax reform could again economic growth and reduce the deficit. The Congressional Budget office estimates that every 0.1 percent of higher economic growth would create an additional $286 billion in federal revenue. Tax reform, if done in a pro-growth way, would ensure that our average growth would increase, boosting the economy.

In 1986, a major driving force for reform was tax simplification. At more than 26,000 pages long, the tax code was far too complex. Since then, the size of the code has expanded to 74,000 pages, close to three times as long as it was in 1986.

Recommended

The top income tax rate has also increased to 39.6 percent, and the number of brackets to seven. Similarly, the corporate tax rate has remained stagnant even as other countries have lowered their rates. The U.S. is one of only two countries (with Chile) to have a higher corporate rate than it did in 2000. Today, our high rate makes it difficult, if not impossible for our businesses to compete with much lower rates like Canada (26.3 percent), the United Kingdom (20 percent), and Ireland (12.5 percent).

The length and complexity of the tax code make it difficult for Americans to complete their taxes without having to hire a costly professional. A study released by the Tax Foundation estimated that Americans will spend $409 billion and 8.9 billion hours completing their taxes this year.

This 1986 tax reform effort was bipartisan with members from both sides of the aisle in Congress supporting the legislation. But today, this bipartisanship is nowhere to be found.

Thankfully, we dodged the Hillary Clinton tax hike bullet. Throughout her campaign, Hillary called for a slew of tax increases including a payroll tax, a capital gains tax hike, and a hefty increase in the death tax bringing it to 65 percent. Hillary did not offer any income tax rate reduction for any American. Instead, Hillary’s tax plan would have raised taxes on the American people by over $1,000,000,000,000 over the next 10 years, based on the numbers given by her own campaign. Needless to say a Clinton presidency would have made the code more complex

The Trump victory has opened the door wide open for tax reform. The House Republican “Better Way” tax reform Blueprint, and President-elect Donald Trump both propose simplifying and updating the code and reducing rates for all Americans. These plans would also help to keep American businesses competitive decreasing business taxes for both corporations and businesses organized as pass through entities. They also call for repeal of the Death Tax, the AMT, and many distorting credits and deductions.

Since 1986 the tax code has become more complex, burdensome, and uncompetitive. Change is needed and it is incumbent on President-elect Donald Trump to make pro-growth tax reform a priority, not add unnecessary complexity and a greater tax burden to our archaic code. Thirty years has been too long to wait for reform, we cannot afford to wait any longer.

Join the conversation as a VIP Member