Ever get the feeling that Washington sees every issue as a hockey puck in a rink with no nets? There's just a constant back-and-forth between two teams with big elbows and pointed fingers -- but no real resolution.

That's how a battle over federal student loans played out in Congress last week -- lots of news conferences but no legislation.

The two parties faced off after Congress failed to act before a July 1 deadline. Rates for subsidized Stafford loans doubled, from 3.4 percent to 6.8 percent.

"Most people would see that rate, especially for borrowing with no collateral, and think that's awfully, awfully good," critic Neal McCluskey of the libertarian-leaning Cato Institute observed.

But in a town in fierce competition to win the student-parent vote, neither party wanted to be seen as doubling the price of student borrowing, even if the program is unsustainable. The Congressional Budget Office expects student loans to cost taxpayers $95 billion over the next decade.

Those loans, many voters have come to realize, do not make college affordable as politicians suggested they would. To the contrary, McCluskey argues, federal aid has fueled tuition hikes and encouraged students to borrow more than they will be able to pay back.

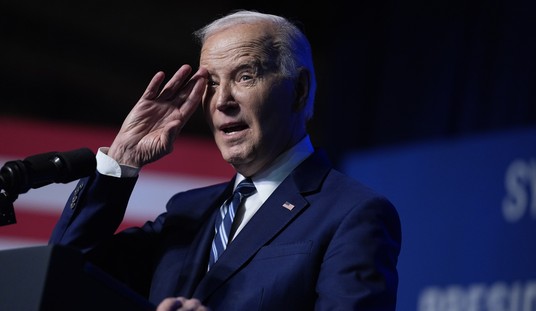

Last year, when the subsidized Stafford rate was scheduled to rise, President Barack Obama launched a "#DontDoubleMyRate" Twitter campaign. Young voters swooned. In the heat of the 2012 election season, Congress voted to delay the slated rate increase for a year.

Call it spendthrift gridlock. When both parties cannot agree on anything, they can always agree to dump all reform and keep on spending.

Recommended

This year, there was every reason to expect a repeat. Then, to his credit and Washington's surprise, President Obama proposed tying federal student loans to the 10-year Treasury yield. With interest rates expected to rise, it was a smart and bold move.

"When he did that," McCluskey told me, "it really signaled to Republicans you can do something that is more responsible, and you have political cover for it."

House Republicans passed a measure The New York Times described as "similar enough to the White House proposal to give Republicans solid political cover against Democratic attacks."

Alas, neither the White House nor Senate Majority Leader Harry Reid wanted to give House Republicans a win. The president and Reid vigorously opposed the House measure.

For their part, House Repubs seemed all too pleased with an opportunity to needle Obama for failing to lead and the Senate for not passing their measure and allowing subsidized Stafford rates to double. (The House bill would limit this year's increase to below 5 percent and cap rates at 8.5 percent if interest rates rise.) House Speaker John Boehner gamely proclaimed, "The White House and Senate Democrats have let these students down."

On Wednesday, Reid tried to ram through a bill to prevent the rate increase for yet another year. Even as he hectored Boehner for blocking the passage of bipartisan measures on such issues as immigration, Reid would not allow a Senate floor vote on a bipartisan measure by Sen. Joe Manchin, D-W.Va., Angus King, an independent from Maine who caucuses with Democrats, and Richard Burr, R-N.C. It took guts for these three senators to oppose Reid and Washington's usual game of pandering and deficit spending -- and never fixing a problem.

After Manchin and King joined a GOP filibuster Wednesday, Reid's pet bill failed.

The rate for new loans is 6.8 percent. That's not a bad thing, but there was a better way to solve the problem. Obama suggested it himself. Tie interest rates to the market; let the increase be more gradual. Because House Republicans, Senate Democrats and the White House cared more about blaming the other guys for doubling loans, it didn't happen.

To Washington's elected class, taxpayers and students are just two hockey pucks in an endless, netless game of gotcha.

Join the conversation as a VIP Member