In previous columns, I’ve explained why a wealth tax is a very bad idea. And I’ve also pontificated on why leftists are wrong to pursue policies of coerced equality.

So it goes without saying that I’m a big fan of a new Wall Street Journal column by John Steele Gordon.

He writes that the anti-wealth ideology animating the political elite is based on a fundamental misunderstanding of how large fortunes are generated.

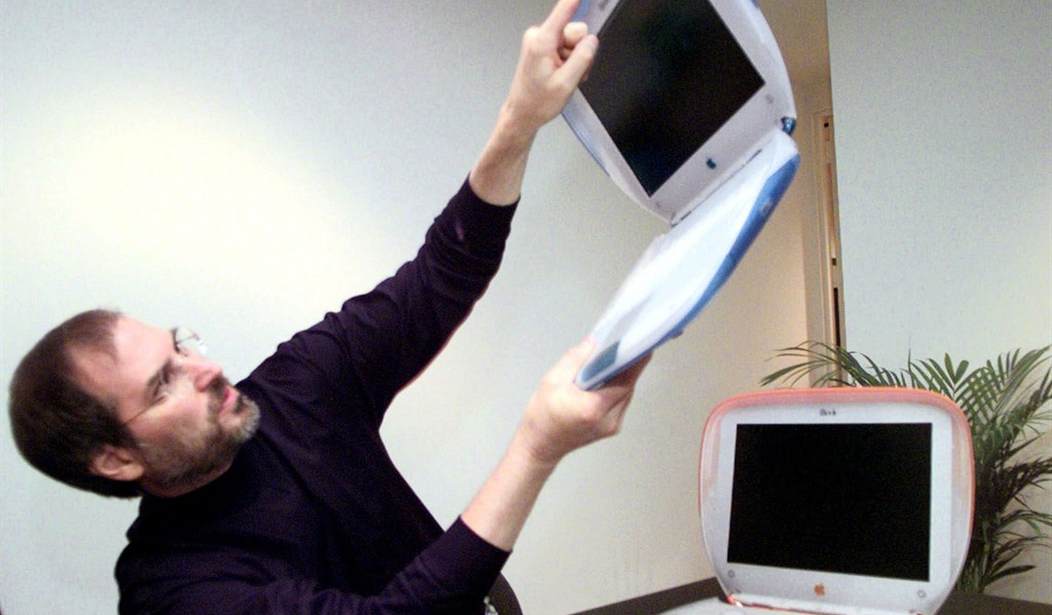

He starts by pointing out that many of today’s richest people earned their money as a result of the microprocessor, a technological development that has dramatically improved the lives of ordinary people.

The French economist Thomas Piketty, in his new book “Capital in the 21st Century,” calls for an 80% tax on incomes over $250,000 and a 2% annual tax on net worth in order to prevent an excessive concentration of wealth. That is a monumentally bad idea. The great growth of fortunes in recent decades is not a sinister development. Instead it is simply the inevitable result of an extraordinary technological innovation, the microprocessor… Seven of the 10 largest fortunes in America today were built on this technology, as have been countless smaller ones. …no one is poorer because Bill Gates, Larry Ellison, et al., are so much richer. These new fortunes came into existence only because the public wanted the products and services—and lower prices—that the microprocessor made possible.

He then points out that this is actually a consistent pattern through history.

New technologies make us better off, and also create riches for those who most effectively bring those new developments to consumers.

Recommended

Whenever a new technology comes along that greatly reduces the cost of a fundamental input to the economy, or makes possible what had previously been impossible, there has always been a flowering of great new fortunes—often far larger than those that came before. …The full-rigged ship that Europeans developed in the 15th century, for instance, was capable of reaching the far corners of the globe. …The Dutch exploited the new trade so successfully that the historian Simon Schama entitled his 1987 book on this period of Dutch history “The Embarrassment of Riches.” …Before James Watt’s rotary steam engine, patented in 1781, only human and animal muscles, water mills and windmills could supply power. But with Watt’s engine it was suddenly possible to input vast amounts of very-low-cost energy into the economy. Combined with the factory system of production, the steam engine sparked the Industrial Revolution, causing growth—and thus wealth as well as job creation—to sharply accelerate. By the 1820s so many new fortunes were piling up that the English social critic John Sterling was writing, “Wealth! Wealth! Wealth! Praise to the God of the 19th century! The Golden Idol! The mighty Mammon!” In 1826 the young Benjamin Disraeli coined the word millionaire to denote the holders of these new industrial fortunes. …before the railroad, moving goods overland was extremely, and often prohibitively, expensive. The railroad made it cheap. Such fortunes as those of the railroad-owning Vanderbilts, Goulds and Harrimans became legendary for their size. …Many of the new fortunes in America’s Gilded Age in the late 19th century were based on petroleum, by then inexpensive and abundant thanks to Edwin Drake’s drilling technique. Steel, suddenly made cheap thanks to the Bessemer converter, could now have a thousand new uses. Oil and steel, taken together, made the automobile possible. That produced still more great fortunes, not only in car manufacturing, but also in rubber, glass, highway construction and such ancillary industries.

Gordon then concludes by warning against class-warfare tax policy, since it would discourage the risk-taking that necessarily accompanies big investments in new technology.

Any attempt to tax away new fortunes in the name of preventing inequality is certain to have adverse effects on further technology creation and niche exploitation by entrepreneurs—and harm job creation as a result. The reason is one of the laws of economics: Potential reward must equal the risk or the risk won’t be taken. And the risks in any new technology are very real in the highly competitive game that is capitalism. In 1903, 57 automobile companies opened for business in this country, hoping to exploit the new technology. Only the Ford Motor Co. survived the Darwinian struggle to succeed. As Henry Ford’s fortune grew to dazzling levels, some might have decried it, but they also should have rejoiced as he made the automobile affordable for everyman.

My only complaint about Gordon’s column is that he didn’t have the space to emphasize a related point.

All of the large fortunes that he discusses were not accumulated at the expense of those with less money.

In other words, the economy was not a fixed pie. Capitalism made everybody better off. Some just got richer faster than other people got richer.

P.S. I wrote the other day about the VA scandal and emphasized that the problem was not inadequate spending.

I want to revisit the issue because Professor Glenn Reynolds makes a very important point about greed in a column for USA Today.

People sometimes think that government or “nonprofit” operations will be run more honestly than for-profit businesses because the businesses operate on the basis of “greed.” But, in fact, greed is a human characteristic that is present in any organization made up of humans. It’s all about incentives. And, ironically, a for-profit medical system might actually offer employees less room for greed than a government system. That’s because VA patients were stuck with the VA. If wait times were long, they just had to wait, or do without care. In a free-market system, a provider whose wait times were too long would lose business, and even if the employees faked up the wait-time numbers, that loss of business would show up on the bottom line. That would lead top managers to act, or lose their jobs. In the VA system, however, the losses didn’t show up on the bottom line because, well, there isn’t one. Instead, the losses were diffused among the many patients who went without care — visible to them, but not to the people who ran the agency, who relied on the cooked-books numbers from their bonus-seeking underlings. …that’s the problem with socialism. The absence of a bottom line doesn’t reduce greed and self-dealing — it removes a constraint on greed and self-dealing.

Amen.

Greed is always with us. The question is whether greed is channeled in productive ways. In a free market, greedy people can only become rich by providing the rest of us with valuable goods and services.

In statist systems, by contrast, greedy people manipulate coercive government policies in order to obtain unearned wealth.

And that choice has big consequences for the rest of us, as illustrated by this satirical image.

P.S. Here’s a cartoon from Robert Ariail that sums up how Washington will probably deal with the mess at the Veterans Administration.

Sort of reminds me of this Gary Varvel cartoon.

Join the conversation as a VIP Member