I’ve explained before that “high-speed rail” is a boondoggle, and I’ve also posted a thorough presentation on the topic from the folks at Reason about this issue.

But some politicians can’t resist throwing good money after bad on these money-losing schemes. The latest example is from the People’s Republic of California, where Governor Jerry Brown is acting as if he wants the state to become a basket case.

Here are some passages from the Wall Street Journal’s editorial on the topic.

The good news in this debacle is that the state’s fiscal woes will make it nearly impossible to complete Governor Jerry Brown’s runaway high-speed rail train. The bad news is that the Governor is going to try anyway. Transportation experts warn that the 500-mile bullet train from San Francisco to Los Angeles could cost more than $100 billion, though the Governor pegs the price at a mere $68 billion. The state has $12.3 billion in pocket, $9 billion from the state and $3.3 billion from the feds, but Mr. Brown hasn’t a clue where he’ll get the rest. …In 2008 voters approved $9 billion in bonds for construction under the pretense that the train would cost only $33 billion and be financed primarily by the federal government and private enterprise. Investors, however, won’t put up any money because the rail authority’s business plans are too risky. Rail companies have refused to operate the train without a revenue guarantee, which the ballot initiative prohibits. Even contractors are declining to bid on the project because they’re worried they won’t get paid. Mr. Brown is hoping that Washington will pony up more than $50 billion, but the feds have committed only $3.3 billion so far—and Republicans intend to claw it back if they take the Senate and White House this fall. If that happens, the state won’t have enough money to complete its first 130-mile segment in the lightly populated Central Valley, which in any event wouldn’t be operable since the state can’t afford to electrify the tracks. …Mr. Brown and the White House are betting that the state will be in far too deep when the money runs out to abandon this mission on Camino Unreal. The Governor also figures that the $100 billion bill will seem smaller spread out over 30 years. What’s an extra $3 billion a year when the state’s already $16 billion in the hole?

Recommended

The uncharitable part of me is thinking “Good, these morons are getting exactly what they deserve since voters were foolish enough to approve the 2008 referendum.”

But even though I think there is a value in having bad examples (whether cities or countries), it is tragic to see a beautiful state destroyed by reckless politicians and their big-government schemes.

I wrote that year that the last job creator to leave California should make sure to turn off the lights. I doubt that will be necessary since the electrical system probably will have failed by that time.

American Politicians Should Learn Some Policy Lessons from Hong Kong and Singapore

Singapore has been in the news because one of the Facebook billionaires has decided to re-domicile to that low-tax jurisdictions.

Some American politicians reacted by blaming the victim and are urging tax policies that are disturbingly similar to those adopted by totalitarian regimes such as the Soviet Union and Nazi Germany.

Maybe they should go on one of their fancy junkets instead and take a visit to Hong Kong and Singapore. Even with first-class airfare and 5-star hotels, taxpayers might wind up benefiting if lawmakers actually paid attention to the policies that enable these jurisdictions to grow so fast.

They would learn (hopefully!) some of what was just reported in the Wall Street Journal.

Facebook co-founder Eduardo Saverin’s recent decision to give up his U.S. citizenship in favor of long-term residence in Singapore has drawn fresh attention to the appeal of residing and investing in the wealthy city-state and other parts of Asia, where tax burdens are significantly lighter than in many Western countries. …Some 100 Americans opted out of U.S. citizenship in Singapore last year, almost double the 58 that did so in 2009, according to data from the U.S. Embassy in Singapore. …The increase of Americans choosing to renounce their citizenship comes amid heated tax debates in the U.S. Many businesses and high-income individuals are worried…[about]…tax increases in future years.

It’s not just that America is moving in the wrong direction. That’s important, but it’s also noteworthy that some jurisdictions have good policy, and Hong Kong and Singapore are always at the top of those lists.

The Asian financial hubs of Singapore and Hong Kong, on the other hand, have kept personal and corporate taxes among the lowest in the world to attract more foreign investment. Top individual income-tax rates are 20% in Singapore and 17% in Hong Kong, compared with 35% at the federal level in the U.S., according to an Ernst & Young report. The two Asian financial centers have also been praised by experts for having simpler taxation systems than the U.S. and other countries. …The tax codes are also more transparent so that many people don’t require a consultant or adviser.

Keep in mind that Hong Kong and Singapore also avoid double taxation, so there’s nothing remotely close to the punitive tax laws that America has for interest, dividends, capital gains, and inheritances.

One reason they have good tax policy is that the burden of government spending is relatively modest, usually less than 20 percent of economic output (maybe their politicians have heard of the Rahn Curve!).

No wonder some Americans are shifting economic activity to these pro-growth jurisdictions.

“The U.S. used to be a moderate tax jurisdiction compared with other countries and it used to be at the forefront of development,” said Lora Wilkinson, senior tax consultant at U.S. Tax Advisory International, a Singapore-based tax services firm that specializes in U.S. taxation laws. Now “it seems to be lagging behind countries like Singapore in creating policies to attract business.” She said she gets at least one query per week from Americans who are interested in renouncing their citizenship in favor of becoming Singaporeans. …Asian countries offer a business climate and lifestyle that many find attractive: “America is no longer the Holy Grail.”

That last quote really irks me. I have a knee-jerk patriotic strain, so I want America to be special for reasons above and beyond my support for good economic policy.

But the laws of economics do not share my sentimentality. So long as Hong Kong and Singapore have better policy, they will grow faster.

To get an idea of what this means, let’s look at some historical data from 1950-2008 on per-capita GDP from Angus Maddison’s database. As you can see, Hong Kong and Singapore used to be quite poor compared to the United States. But free markets, small government, and low taxes have paid dividends and both jurisdictions erased the gap.

Wow, America used to be 4 times richer, and that huge gap disappeared in just 60 years. But now let’s look at the most recent data from the World Bank, showing Gross National Income for 2010.

It’s not the same data source, so the numbers aren’t directly comparable, but the 2010 data shows that the United States has now fallen behind both Hong Kong and Singapore.

These charts should worry us. Not because it’s bad for Hong Kong and Singapore to become rich. That’s very good news.

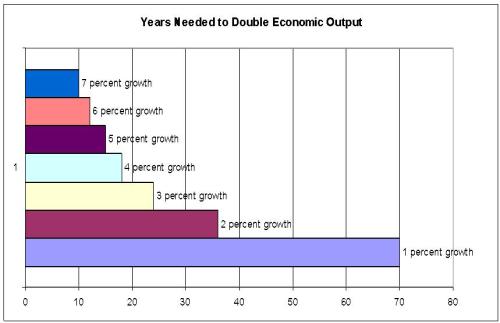

Instead, these charts are worrisome because trend lines are important. Here’s one final chart showing how long it takes for a nation to double economic output at varying growth rates.

As you can see, it’s much better to be like Hong Kong and Singapore, which have been growing, on average, by more than 5 percent annually.

Unfortunately, the United States has not been growing as fast as Hong Kong and Singapore. Indeed, last year I shared some data from a Nobel Prize winner, which showed that America may have suffered a permanent loss in economic output because of the statist policies of Bush and Obama.

What makes this so frustrating is that we know the policies that are needed to boost growth. But those reforms would mean less power for the political class, so we face an uphill battle.

Join the conversation as a VIP Member