Stocks in the News is produced by Ransom Notes Radio and Goodfellow, LLC. Crista Huff manages Goodfellow LLC, a website that recommends outperforming stocks using fundamental and technical analysis.

Stock number one is:

Adobe Systems Inc., (SYMBOL: ADBE) and the headline says:

Adobe Profit Tops Estimates on Cloud Subscriber Growth -- Bloomberg

Software company Adobe Systems beat quarterly profit expectations on surprising momentum with its new Creative Cloud product. The company is sacrificing short-term revenue and earnings from traditional up-front software purchases, and implementing a monthly subscription model for its popular graphic-design products.

Earning were previously expected to grow 22% per year for the next two years. Investors can now expect a rash of upward earnings revisions.

The stock chart is bullish, currently trading between $42 and $47.

Our Ransom Note trendline says: BUY ADOBE SYSTEMS.

Stock number two is:

FedEx Corp., (SYMBOL: FDX) and the headline says:

FedEx Sees 2014 Profit Gain Up to 13% Amid Cutting Costs -- Bloomberg

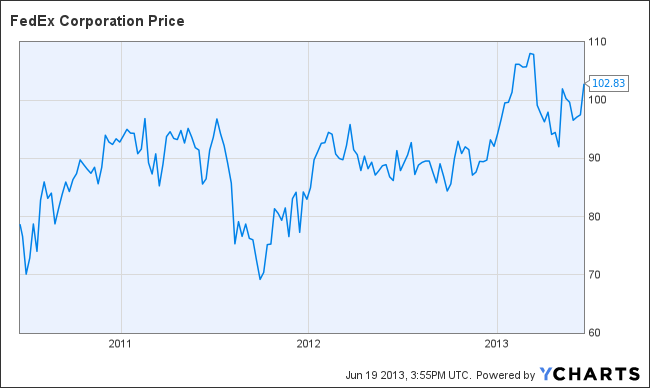

FedEx stock is up after reporting fourth quarter earnings & operating margins which handily beat estimates. The company announced plans to buy out 3600 employees, park older planes and engines, and cut capacity to Asia as part of a $1.7 billion dollar cost-cutting program.

Revised 2014 & ’15 earnings growth is expected at 13 and 23%.

The stock broke out of a long-term trading range this year, and is trading between $90 and $110. On June 4, we said to accumulate FedEx shares below $98. That opportunity came and went, but investors may still be able to buy under $100 near-term.

Recommended

Our Ransom Note trendline says: ACCUMULATE FEDEX CORP.

Stock number three is:

News Corp., (SYMBOL: NWSA) and the headline says:

Prepping for the Split: A Closer Look at Valuation – Citi Research

Rupert Murdoch’s News Corp. will begin trading as two separate stocks on July 1. Citi Research has doubled its estimate on the new News Corp’s trading value to $4.80 per share, and expects Fox Group shares to be valued around $31. Therefore, Citi has raised its price target on current News Corp. shares to $36.

Combined earnings are expected to grow 16-19% per year for the next three years.

We repeatedly recommended that investors buy News Corp. this year, based on strong earnings growth, a bullish chart, and the upcoming Fox Group spin-off.

Our Ransom Note trendline says: BUY NEWS CORP.

Join the conversation as a VIP Member