Advertisement

According to the AP:

“When the administration unveiled the small business tax credit earlier this week, officials touted its "broad eligibility" for companies with fewer than 25 workers and average annual wages under $50,000 that provide health coverage. Lost in the fine print: The credit drops off sharply once a company gets above 10 workers and $25,000 average annual wages.

“It's an example of how the early provisions of the health care law can create winners and losers among groups lawmakers intended to help—people with health problems, families with young adult children and small businesses. Because of the law's complexity, not everyone in a broadly similar situation will benefit.

“’On paper, the credit seems to be available to companies with fewer than 25 workers and average wages of $50,000. But in practice, a complicated formula that combines the two numbers works against companies that have more than 10 workers and $25,000 in average wages… You can get zero even if you are not hitting the max on both pieces,’ (Linda) Blumberg said.”

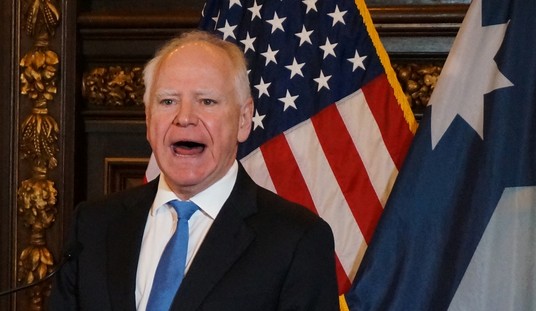

Unfortunately, this bill will only discourage small businesses from raising wages and/or hiring more employees. The business owners and employers in Minnesota I’ve met with all have said one thing: the uncertainty of the newly passed Health Care bill is keeping them from hiring and expanding.

Recommended

Advertisement

The AP story concluded with the thoughts from a small business owner, Trevor Hoffman, who was shocked to discover he didn’t qualify for the tax credit, and determined that in order to qualify, he would need to go from 24 to 10 employees and everyone would need to take a pay cut. “That seems like a strange outcome, given we've got 10 percent unemployment,” Hoffman said.

I think that’s pretty strange too. Instead of punishing businesses, we need to repeal this bill and replace it with reforms that help businesses grow.

Join the conversation as a VIP Member