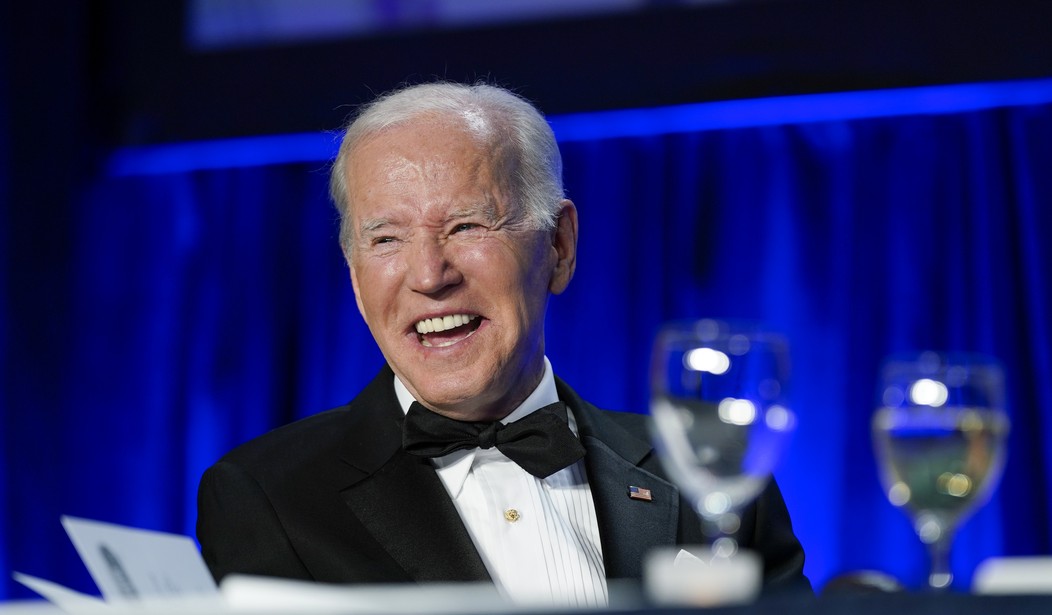

President Joe Biden and his administration continue to claim the economy is in good shape. During Monday's press briefing at the White House, Economic Advisor Jared Bernstein claimed the economy is set for growth expansion.

Biden Economic Adviser Jared Bernstein:

— Townhall.com (@townhallcom) July 18, 2022

"If you look at the strength of the current economy...you would conclude that where we are right now remains solidly within expansion." pic.twitter.com/dHBGWCaRrL

But new numbers published Tuesday morning by the Federal Reserve Bank of Atlanta paint a different picture. Previously published numbers show the U.S. economy shrank for two consecutive quarters -- the definition of a recession.

"The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.6 percent on July 19, down from -1.5 percent on July 15. After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth decreased from -8.8 percent to -10.1 percent," the bank stated.

Another update on GDP numbers is expected on July 27.

In the meantime, housing estimates are also taking a dive.

JPMORGAN morning trading note: "Today, we have

— James Pethokoukis (@JimPethokoukis) July 19, 2022

another batch of housing data where continued weakness is expected; we have not seen

prices see negative growth but that feels inevitable."

And now, nearly a quarter of working Americans are being forced to delay retirement as a result of inflation. Small businesses are also getting slammed. From the New York Post:

Recommended

Rampant inflation will result in a delayed retirement for a large swathe of Americans who are concerned about dwindling savings accounts and tight budgets, according to the results of a new survey published this week.

With the costs of daily necessities such as food and fuel hitting record highs, 25% of Americans will need to delay their retirement to account for the reduced savings, according to the quarterly BMO Real Financial Progress Index.

“Prices across the board – from cars and gasoline to groceries and other everyday essentials – are rising at the fastest pace since the 1980s,” said Paul Dilda, the head of consumer strategy for BMO Harris Bank. “Consumers must think differently about their finances in this inflationary environment.”

"ECONOMIC DOWNTURN": A new survey finds 93% of small businesses fear a recession, while 89% say they are feeling the impacts of Bidenflation pic.twitter.com/wUJnzNcGzC

— RNC Research (@RNCResearch) July 19, 2022

Join the conversation as a VIP Member