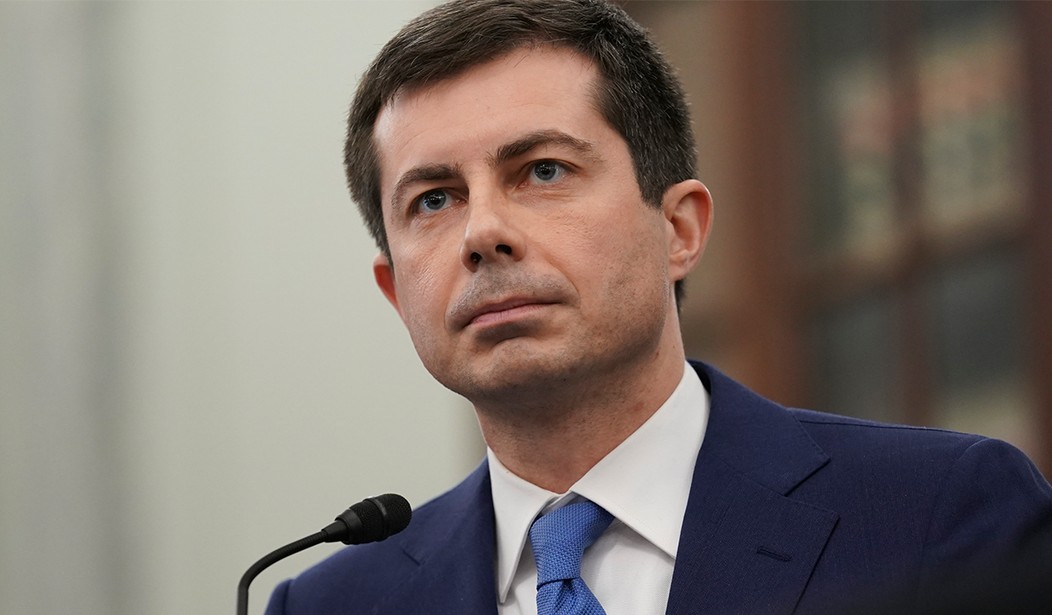

The Biden administration is trying to find creative ways to pay for President Joe Biden's upcoming $2-$3 trillion infrastructure plan and Transportation Secretary Pete Buttigieg, who had a hard time fixing potholes as the mayor of South Bend, Indiana, has a new idea.

"If we believe in that so-called user pays principle, the idea that part of how we pay for roads is you pay based on how much you drive, the gas tax used to be the obvious way to do it, it's not anymore, so a so-called vehicle miles traveled tax or mileage tax, whatever you want to call it, could be a way to do it," Buttigieg said in response to a question about taxing people by the miles they drive.

NEW: Transportation Sec. Pete Buttigieg says that the Biden administration is considering taxing drivers by the mile to fund infrastructure pic.twitter.com/pCcCvms4bi

— Breaking911 (@Breaking911) March 26, 2021

A tax on drivers by the mile would negatively impact the poor and middle class the most. Not to mention, the price of gas has increased by 25 percent since Biden took office in January.

Buttigieg's bright idea comes as the White House lowers the threshold for massive tax increases on Americans. On the campaign trail, Biden said nobody making less than $400,000 per year would see a tax increase. That has changed in more ways than one.

White House press secretary Jen Psaki clarified on Wednesday that Biden's proposed $400,000 threshold for tax increases applies to families, rather than individuals, meaning the hike could hit individuals who earn $200,000 a year if they are married to someone who makes the same amount.

Psaki did not specify a threshold for individual earners.

Biden is eyeing the next big-ticket economic bill as a vehicle for one of the major tax hikes in close to 30 years.

The planned changes include: raising the corporate tax rate to 28% from 21%, raising the income tax rate on individuals earning more than $400,000, expanding the estate tax, creating a higher capital-gains tax rate for individuals earning at least $1 million annually and paring back tax preferences for so-called pass-through businesses.

Join the conversation as a VIP Member