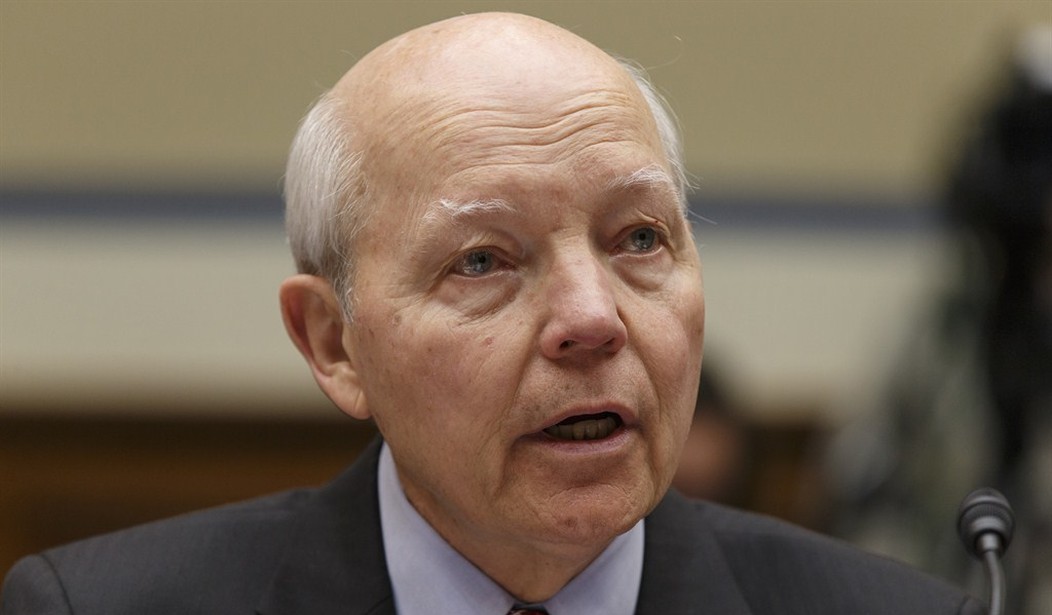

IRS Commissioner John Koskinen, infamous for his defiant congressional testimony about the inappropriate targeting of conservative tea party groups, is warning that budget cuts to the agency will cause delayed refunds, more identity theft, long wait times for help and a possible shut down of the agency. More from Forbes:

With a week to go before tax season opens, taxpayers were already bracing for a potentially “miserable” filing season. It turns out that it could live up to the hype.

Internal Revenue Service (IRS) Commissioner Koskinen has advised employees that the budget cuts will result in reduced services to taxpayers. In an email to employees sent earlier today, Commissioner Koskinen advised that “realistically we have no choice but to do less with less.”

Notice how Koskinen doesn't mention the extra hell Obamacare rules are putting tax filers through this year...

Maybe Koskinen should ask IRS employees who owe back taxes to pay up in order to help fill the gap. Or how about avoiding handing out bonuses worth millions to employees who owe back taxes to the federal government?

Commissioner John Koskinen announced the bonuses in an email to employees on Monday, saying they were a way to reward long-suffering staffers who have put up with budget and workforce cuts and are still keeping the agency humming.

But the payout, worth millions of dollars in taxpayers’ money, isn’t sitting well with congressional critics, who said it sends the wrong message at a time when the agency is reeling from several scandals, and when even staffers who are delinquent on their taxes can collect bonuses.

“It’s no wonder the American people find it hard to believe the IRS needs more money when the agency fails to collect back taxes from their own employees and instead rewards them with bonuses,” said Sen. Orrin G. Hatch, the Utah Republican who is poised to become chairman of the Senate Committee on Finance next year. “American families have been doing more with less for far too long now, and it is time the IRS [does] the same.”

Recommended

Oh, and then there's the $3.3. billion federal government employees owe in back taxes.

Federal employees owe a total of $3.3 billion in back taxes to the federal government, according to Internal Revenue Service data released Thursday.

In all, 318,462 federal employees owed back taxes as of last Sept. 30 — an increase of 2.6% from the previous year. That puts the average tax bill at $10,391, according to IRS data obtained by USA TODAY under the Freedom of Information Act.

Further, the IRS budget has increased over past years.

Before Koskinen whines about Americans getting a break through less funding of the IRS, he should demand employees within his agency are held to the same standards as the rest of us. For some context, Americans spend 6.1 billion hours per year preparing their tax returns at an average cost of $168 billion. If they don't, they get fined and threatened with prison.

Long-term tax reform is the only real solution to IRS budget problems, but imagine Koskinen's outrage over that proposal.

Join the conversation as a VIP Member