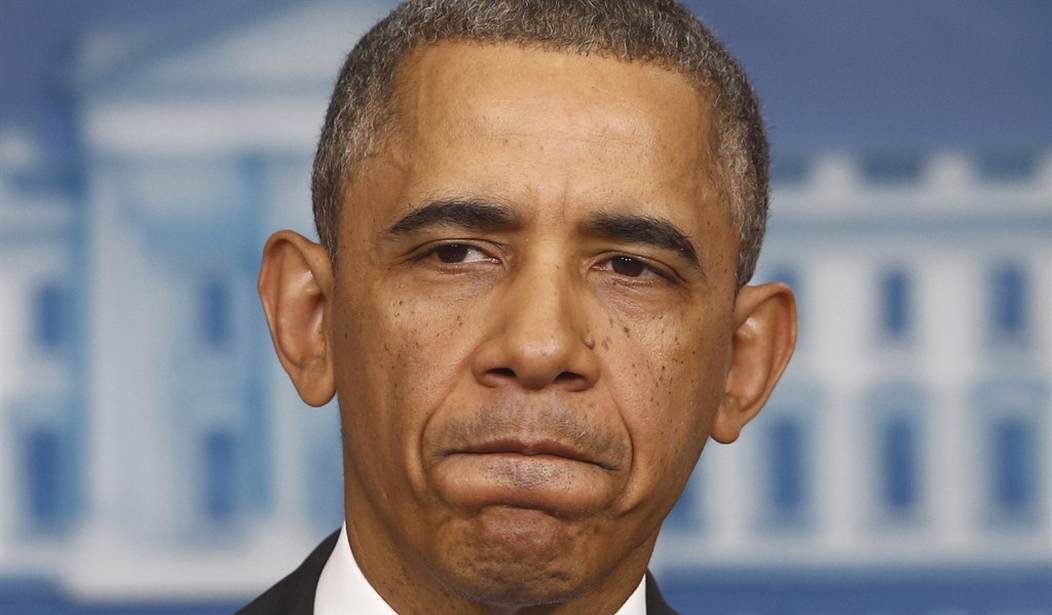

When the Supreme Court ruled in June 2012 that Obamacare is a tax, they weren't kidding. Obamacare taxes and fees set to kick in this year are sure to put a dent in your wallet and in the economy.

Advertisement

The folks over at the Heritage Foundation have put together a list of what's to come in 2014 to show you how you'll be directly paying for President Obama's signature legislation.

1. Individual Mandate Tax. The individual mandate is designed to strong-arm individuals into purchasing government-approved health insurance or facing a tax penalty. In 2014, the penalty for not purchasing insurance will be either $95 or 1 percent of annual income (whichever is greater). Very few, if any, people will end up paying just $95, because individuals with an annual income of only $9,500 or less would likely qualify for Medicaid or a hardship exemption from the mandate. The mandate increases drastically in coming years, rising to $325 or 2 percent of income in 2015, and $695 or 2.5 percent of income in 2016—whichever is greater.

2. Health Insurer Tax. One of the largest tax increases in the law is an annual fee imposed on health insurers based on their share of the market. It is estimated to raise $8 billion in 2014 alone. The tax will more than likely be passed on to consumers through premium increases. An actuarial analysis by the consulting firm Oliver Wyman projects that in 2014, this tax will increase premiums by 1.9 percent to 2.3 percent. And the impact will be greater in later years as the tax increases.

3. Reinsurance Fee. This fee isn’t included in the list of 18 tax hikes, but it’s another one that will impact the cost of insurance. Health insurers will have to pay the temporary fee on group health plans to help spread the cost of the covering those in the individual market, inside and outside Obamacare’s exchanges. The fee begins in 2014, costing $63 per covered person and decreasing in 2015 and 2016. Like most taxes and fees, the result will likely be higher insurance premiums.

Sneak Peek at 2015: Employer Mandate. By law, the employer mandate was supposed to begin in 2014, but the Obama Administration delayed enforcing it until 2015. The employer mandate forces employers with 50 or more full-time employees (defined as those working 30 hours per week) to offer government-approved health coverage or pay a penalty. The penalty varies—either $2,000 per employee after the first 30 workers, or $3,000 per employee receiving subsidized coverage in the exchange, whichever is less.

Recommended

Advertisement

Join the conversation as a VIP Member