Welcome to Ransom's Stocks in the News where the headlines meets the trendlines:

Ransom's Stocks in the News is produced by John Ransom in conjunction with Ransom Notes Radio.

Stock Number One: AT&T (SYMBOL: T)

And the headline says: U-Verse live TV streaming comes to iPhone – Engadget

“AT&T is ahead of schedule in bringing live U-Verse TV streaming to mobile devices,” writes Engadget “it just updated the service's iPhone app several days earlier than promised. As on the iPad, U-Verse subscribers with iPhones can now watch up to 108 live channels while at home, and as many as 25 when they're away.”

AT&T stock has preformed kind of unevenly during this bull run. That’s primarily because earnings year-over-year have shrunk by about 2%. This market is willing to give companies a premium on price earnings but not for companies like AT&T that are underperforming.

The forward PE is about 13 times earnings, with analysts expecting that earnings will go up by about eight and half percent next year with a five-year average about 6 1/2% going forward.

The trend is not your friend however on telephone.

Our Ransom Note Trendline says: Avoid AT&T

Stock number two: National Bank of Greece SA (SYMBOL: NBG)

And the headline says: Whether They Know it or not, Hedge Funds Love Greece ETF – ETF Trends

Recommended

“John Paulson’s Paulson & Co. and other U.S. hedge funds are gobbling up shares of Greek banks on expectations that one of Europe’s most beaten-up banking sectors has seen its darkest days,” writes ETF Trends. “Paulson, who made winning bets on the sub-mortgage crisis and subsequent rebound in U.S. bank stocks, said his fund had substantial stakes in Piraeus Bank and Alpha Bank, according to the Financial Times.”

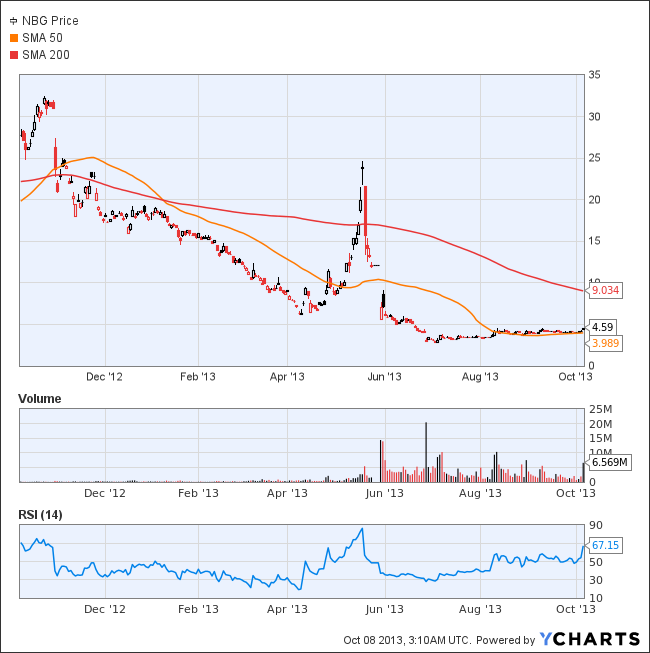

After showing signs of life in May national Bank of Greece essay flatlined over the summer, like a patient in cardiac arrest.

The stock has virtually no momentum and unless you’re willing to assume the same type of risk that hedge funds are willing to assume, US banks might be a better play for you.The bank generated negative cash flow of $9.50 billion in the last year.

Greece is still in talks with the EU about restructuring their debt, and the bailouts for the tiny Mediterranean country may not yet be over.

Our Ransom Note Trendline says: Sell National Bank of Greece

Stock Number Three: GW Pharmaceuticals (SYMBOL: GWPH)

And the headline says: GW Pharmaceuticals soars after analyst nearly triples price target - Fly on the Wall

“Shares of Britain's GW Pharmaceuticals (GWPH) are jumping after a Lazard Capital analyst wrote that the company has one of the most compelling opportunities he's ever seen,” writes Fly on the Wall, “and nearly tripled his price target on the stock. WHAT'S NEW: GW's CBD, a drug derived from the cannabis plant, has significantly helped some epilepsy patients to whom it has been administered, Lazard Capital analyst Joshua Schimmer wrote in a note to investors earlier today.”

This biotech stock traded near $32.50 today was up over $8 with a print near $32.79.

The company just released data on a drug already approved in 22 countries to treat multiple sclerosis’s called SATIVEX.

It’s also filed for phase 3 investigation of Sativex for use in controlling pain.

Our Ransom Note Trendline says: Hold GW Pharmaceuticals

Join the conversation as a VIP Member