Factoid of the day: President Barack Obama's economic recovery program saved 935 jobs at the Southwest Georgia Community Action Council, an impressive success story for the stimulus plan. Trouble is, only 508 people work there.

– Quote from an Associated Press Report on overstating of stimulus job creation by the White House.

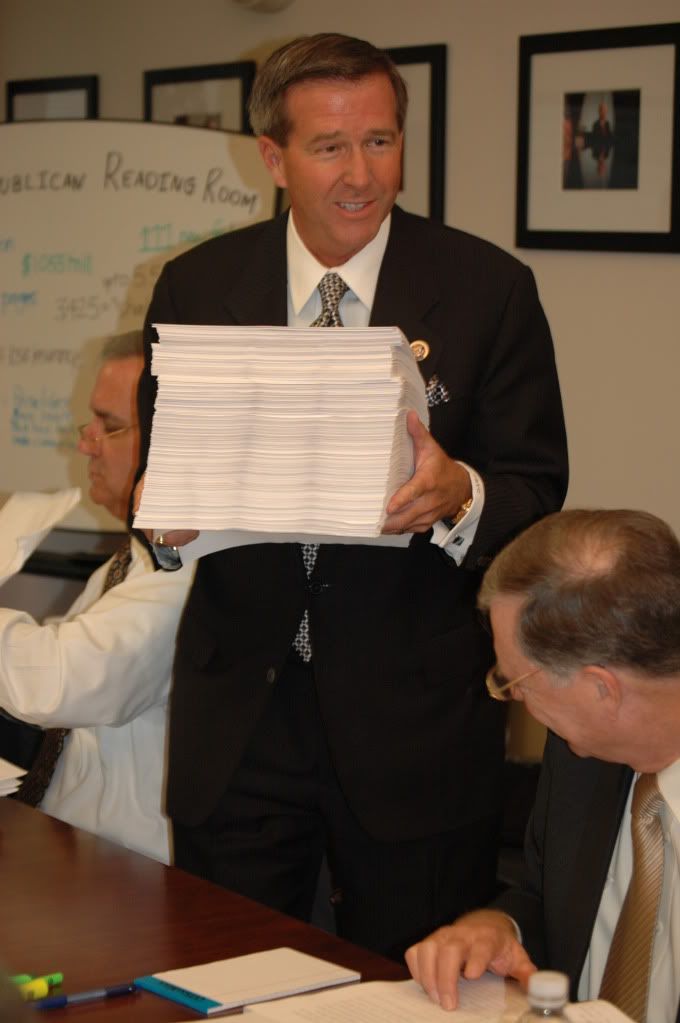

Pelosi Health Care Update: Last night at 10:07 PM Eastern time, Speaker Pelosi released the latest version of her health care plan. This version added 42 pages to make the total bill now a whopping 2,032 pages. Majority Leader Steny Hoyer (D-MD) had pledged to have the final bill in print for 72 hours before it is voted upon. That means that the soonest the bill could be brought to a vote on the House floor is 10:07 PM on Friday night.

But by all accounts, they have not yet cajoled the necessary 218 votes to ensure the bill’s passage. It also appears clear that they may make more changes to the bill in order to secure more votes before Friday night or Saturday. But they have also been clear that they will not wait until 72 hours after any further changes.

Yesterday, I spent some time in a “bill reading room” set up by Republicans to read the bill. In between floor speeches and committee votes, I randomly picked 3 sections of the bill to read. Each one was instructive. Here’s what I learned that I had not before known about the bill in just a short reading:

Recommended

1. The bill contains a section called “Individual responsibility.” It is less than 20 words long. It merely refers to a section in the Internal Revenue Code of 1986. But immediately following, is a section called “employer responsibility.” It goes on for many sections and pages. We will never control health care costs as long as people are disconnected from the choice, cost, and quality of the services they receive. This bill moves people farther away.

2. In another section of the bill, I only went a few pages before encountering an entirely new “private right of action.” A “private right of action” is an opportunity to file a lawsuit on the basis of federal law. This particular new lawsuit opportunity would be for employees to sue employers if they don’t like their health care choices. There are many more such new litigation opportunities in this bill. It is universally (except of course for Pelosi and her minions) acknowledged that lawsuit abuse is driving up health care costs through direct costs as well as “defensive medicine” by tens of billions of dollars annually. However this bill not only contains no lawsuit reform, it actually will make the problem far, far worse. The trial lawyer lobby, however, must be very happy.

3. There is a 5.4% surtax on incomes over $500,000. This is just a “soak the rich” tax to partially pay for socialized medicine. But interestingly, the tax applies to adjusted gross income, not to taxable income. That means if you make $500,000 and give it all to charity, you will still pay a surtax of $27,000 even though you have no net income. I am not aware of any other provision of the tax code that applies the tax on gross income, rather than taxable income.

It just gets worse and worse and worse. We will keep up the fight. I hope you will too.

Join the conversation as a VIP Member