The other day I blogged about my “Put Your Money Where Your Mouth Is” Act. I received an overwhelming response from groups like Citizens against Government Waste, Americans for Prosperity, the National Taxpayer’s Union, and Americans for Tax Reform.

This morning the “Put Your Money Where Your Mouth is Act” was featured in the Wall Street Journal. For your reading pleasure I’ve included the text below:

The Tax Me More Act

April 11, 2008

Wall Street Journal, Page A16

We recently suggested that if Bill and Hillary Clinton are eager to pay more taxes, they should write a personal check to the U.S. Treasury to compensate for the lower tax rates they so frequently decry. And lo, here comes legislation to make it easier for the former first lady and other pseudo-populists to do just that.

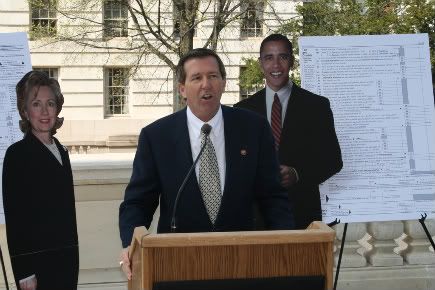

California Republican John Campbell yesterday introduced in the House his "Put Your Money Where Your Mouth Is Act," which would amend the tax code to allow individuals to make voluntary donations to the federal government above their normal tax liability. The bill would place a new line on IRS tax forms to make this easy.

Mr. Campbell says he has heard the "cries" of those wealthy Americans – Mrs. Clinton, Warren Buffett, Barbra Streisand – who reject the lower tax rates passed in 2001 and 2003 and complain that they and their fellow rich don't pay enough. "It's a great injustice that citizens wishing to fulfill their dream of paying more taxes cannot simply check a box on their 1040 form to make a donation," he says. His bill would give liberals a chance to salve their consciences without having to raise taxes on millions of Americans who already feel overtaxed as it is.

Recommended

Still, don't expect many to take Mr. Campbell up on his offer. The Treasury already accepts voluntary donations to decrease the nation's debt; last year it received all of $2.6 million. Apparently even most liberals would rather keep their money, or bequeath their estates to charity rather than to the IRS.

Join the conversation as a VIP Member