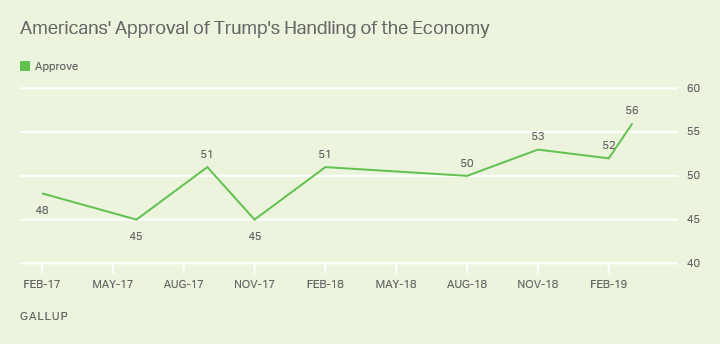

Last week, we highlighted the Trump administration's accomplishment of achieving better than three percent GDP growth over a year-long period, between Q4 and Q4. That victory came in spite of a global slowdown, as well as the president's various anti-growth trade policies -- with deregulation and the GOP tax reform law playing quantifiably pro-growth roles. After seeing his numbers sag noticeably during the partial government shutdown, Trump has rebounded, hitting 46 percent approval in the latest NBC/WSJ national survey. His average job approval is hovering around 44 percent, underwater by roughly nine points. Specifically on the economy, however, he's in significantly better shape. Gallup's new poll measures much higher marks on this key measure:

He's at 56 percent approval on the economy, 54 percent on unemployment, and 50 percent on national defense. Much can change in 20 months, obviously (as we discussed a bit here), but those are formidable numbers -- even if his top line approval is weaker. Remember, this is a man who won the presidency among a hostile electorate: Fully 60 percent of 2016 voters held a negative view of him. And he won. There's no doubt that sky-high ratings from Republican voters are helping the outcome depicted above, but he's also winning independents on this issue set; majorities of non-affiliated voters give Trump the thumbs-up on economic performance, even as only 35 percent of this group say they approve of his broader job as president. He needs to improve that number. Allahpundit examines how the president's economy-related strength could impact his re-election efforts, with the enormous caveat about changing events and conditions:

No incumbent president pulling 55 percent on the economy and unemployment can be counted out for reelection, however anemic his overall job approval might be...In fact, this poll is a reminder of how solid Trump’s 2020 prospects would look if he was a bit less … Trumpy, for lack of a better word...Maybe this is the first stirrings of the 2020 dynamic in action. Trump benefited enormously in 2016 from facing an opponent who was widely disliked and distrusted herself. For the first two years of his presidency he lacked that contrast; his job approval was a pure referendum on him. Now, with the Democratic presidential field starting to fill out, his job approval may not be entirely a reflection of his own performance but also partly a measure of how voters think he compares to the top tier of the other party.

Recommended

Incidentally, since we mentioned the tax cuts (opposed by every Democrat in Congress) as growth-fostering economic fuel, this little contretemps is worth mentioning: A recent Daily Mail article quoted Alexandria Ocasio-Cortez's mother, who moved to Florida in the last few years, describing the Sunshine State's tax climate as far more favorable and less stressful than than New York's. To that point, the Empire State's Governor recently griped that Florida was "stealing" his residents. When conservatives noted the irony of AOC's mother preferring lower taxes, a New York Times reporter tried to put an anti-tax reform spin on the anecdote:

So she’s one of the people who recognizes that New York got soaked in the federal tax bill that potus championed? https://t.co/qi2gOeMqPq

— Maggie Haberman (@maggieNYT) March 4, 2019

In fact, fewer than ten percent of New York taxpayers saw a net tax increase under the new law (mostly wealthy itemizers), while the vast majority received a tax cut. And AOC's mother purchased her home in Florida before Trump became president, moving south prior to the tax law being passed or signed. Oops. I'll leave you with a reminder of why Kamala Harris' dumb attack over tax refund statistics, parroted my many in the press, was both premature and totally irrelevant:

Three weeks ago I cautioned as to why Democrats shouldn't latch onto weekly data for IRS refunds.

— Andrew Clark (@AndrewHClark) March 1, 2019

Why? The latest data shows a 19% increase from last week; and refunds *overall* are now 1.3% *bigger* than last year.

So, yeah. https://t.co/BDd0F5K3KJ

Those who deployed this criticism were doing so based off of an extremely limited amount of data, and now the narrative is shifting. And once again, with feeling: The size of one's tax refund has nothing to do with whether one's taxes went up or down over the course of the year. Under the Republican-passed law, a massive, lopsided majority of Americans' taxes went down in 2018. This is an empirical fact, despite an enormous propaganda effort to convince people otherwise.

Join the conversation as a VIP Member