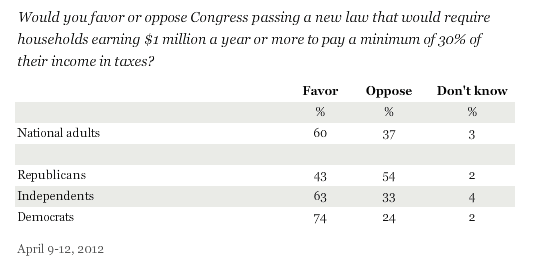

For weeks President Obama has traveled the country delivering speech after speech asserting that if implemented, the so-called “Buffett Rule” would “stabilize” our national debt over the next ten years. In reality, however, it would do almost nothing to solve our lingering budget woes or pay off our national debt. Nevertheless, his unrelenting tax-the-rich mantra seems to be resonating with voters. According to the latest Gallup poll, 6 in 10 Americans support the Buffett rule – named for billionaire investor Warren Buffett – a policy that would impose a 30 percent minimum tax rate on households that earn more than $1 million a year.

In point of fact, the Buffett rule would raise about $31 billion over the next 11 years. These tax hikes, in other words, wouldn’t even come close to paying off the government’s projected federal budget deficits during that period, let alone the national debt. (The graph in this post, incidentally, underscores just how serious the president is about reducing the deficit). To make matters worse, as Kate pointed out earlier today, this is the first year since 2006 that the Obama family didn’t earn more than $1 million. And so, while the president believes millionaires and billionaires should pay their “fair share,” he wouldn’t even qualify for the tax hikes he himself is advocating! How convenient.

So why, then, do a majority of Americans support such a seemingly flawed and unsound policy? According to the findings, Gallup suggests that Americans in general believe that the distribution of money and wealth in the United States is unfair, and that the president’s relentless campaign to raise taxes on the wealthy is influencing voters. What’s worth mentioning, though, is that less than 1 percent of Americans believe income inequality is the most salient issue in 2012. As expected, most people care about the deficit, job creation and economic opportunity.

Recommended

Still, at the end of the day, taxing upper income earners seems to be a popular position to take in this country, even if it does little or nothing to solve our long term fiscal problems.

Join the conversation as a VIP Member