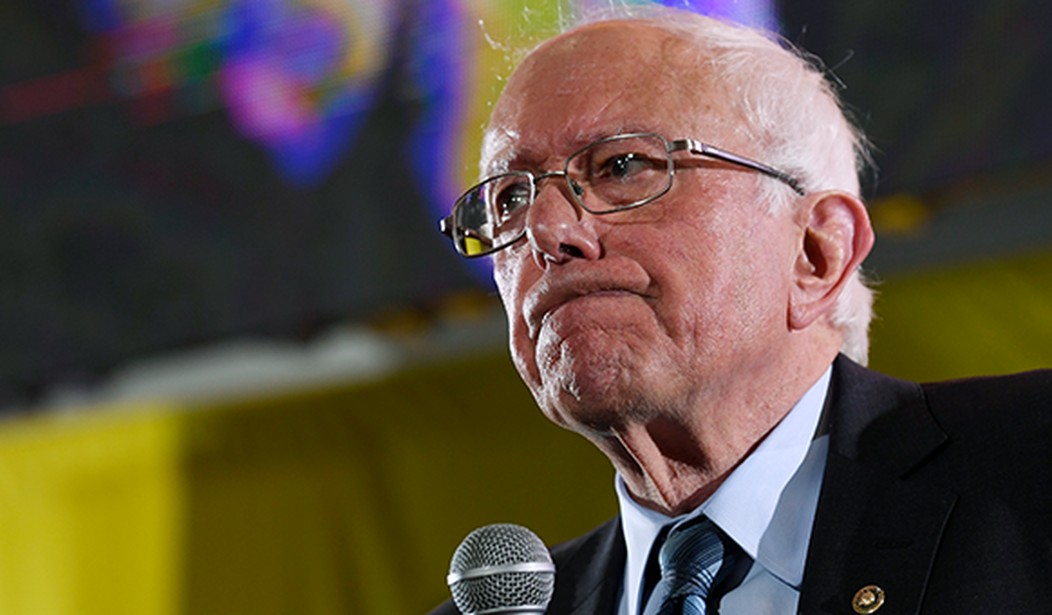

An opinion piece in the Wall Street Journal recently about Medicare-for-All, or BernieCare, got me thinking that driving institutions into bankruptcy based upon wishful thinking and a failure to grasp basic economics may just be a Sanders household trait.

The column by the Journal’s editorial board, titled “Bernie’s Medicare-for-All Bailout”, gets to the heart of the fiscal irresponsibility of Senator Bernie Sanders’s plan to force us all onto a government run healthcare plan, which would cause 150 million Americans to lose their private health insurance. The opening paragraph of the piece sets it up well:

“Usually politicians pass a bailout to clean up a mess they’ve created in the past, but Bernie Sanders is now promising cash up front. Witness the democratic socialist’s opening offer to the hospitals he’d bankrupt with his Medicare-for-All bill.”

The column explains that Medicare and Medicaid pay hospitals 87 to 90 percent of actual cost of care, and sometimes even less in high-cost areas like New York City. In economics, the difference between what Medicare/Medicaid reimburse hospitals and their actual cost is called an “operating loss.” Those of us who have run even the most rudimentary of businesses understand that one cannot operate at a loss for very long. Making a profit is necessary to pay yourself and your employees and to keep your business, whatever it is, viable - a going concern.

But no worries. Bernie has a plan. Bernie has proposed creating a $20 billion bail-out fund for struggling hospitals. What the struggling hospitals are supposed to do after they have exhausted that $20 billion is anybody’s guess. And if Bernie has his way and foists Medicare-for-All on all the nation’s hospitals, that $20 billion would be gone lickety-split.

Recommended

Where Bernie came up with his $20 billion figure for that bail-out fund is also anybody’s guess. I suspect he pulled it out of his nether regions, as Democrats are wont to do with numbers, like the magical $15 per hour that they have conjured up as the ideal national “minimum wage.” (Why not $50 per hour? Heck, why not $500 per hour? Go big or go home, I always say. In the land of unicorns and pixie dust that Democrats inhabit, The Rich will pay for it all anyway.)

As the Journal points out, in the June Democratic primary debate, Rep. John Delaney told Bernie a very simple truth. If you were to survey hospital administrators and ask them, “How would it have been for you last year if every one of your bills were paid at the Medicare rate?” every administrator would tell you they would close. And Mr. Delaney knows whereof he speaks. He was a successful entrepreneur before entering Congress and had launched a business that made loans to smaller-sized health care service providers. His company was so successful that it went public and was acquired six years after it began by Heller Financial, providing Mr. Delaney a net worth north of $200 million.

That is in stark contrast to Senator Sanders, who’s never run so much as a hotdog stand. In fact, Sanders didn’t earn his first paycheck until he was nearly 40, and then it was a government paycheck, as mayor of Burlington, Vermont. He lived in a maple sugar shack with a dirt floor during his first marriage, until his wife walked out on him. Then he went on unemployment, tried carpentry, and failed at that. His friends said he was “always poor” and his “electricity was turned off a lot.”

But he thinks he can transform one-sixth of the US economy by fiat.

What the opinion piece called to mind, though, was work I had done several years ago looking into Bernie’s wife, Jane Sanders, and her abysmal management of Burlington College when she served as its president from 2004 through 2011. Bernie’s seeming willingness to bankrupt American hospitals and airy talk about bailing them out with government largesse wasn’t an option when Jane bankrupted that private Vermont school.

Desperate to bolster the student population at Burlington College, Jane had the brilliant idea of expanding the campus with more land and additional buildings at a cost for the cash-strapped university of $10 million, on the theory, “Build it and they will come.” But the best laid plans of mice and college presidents being what they are, Burlington College’s fortunes did not improve with the acquisition. In fact, Jane was removed from her position in 2011 due to this debacle. She claimed she was leaving because she and the school’s board had “different visions.” It probably also had something to do with her saddling the college with a “crushing weight of debt,” in the words of the school’s dean of operations, forcing it to declare bankruptcy in 2016.

In a story I did several years ago for Judicial Watch, I noted that Jane tried to kick disabled people out of a building she had acquired in her ill-starred acquisition of the properties for Burlington College. She wrote to the disabled residents’ lawyer: “It is simply not fair to expect the College to continue to carry the burden of the expenses associated with housing both your population and ours until February 2012.”

Ah, nothing says compassion like a liberal college president yelling at disabled folks to get off her lawn - or out of their group home.

Jane would subsequently be investigated for bank fraud, when it was learned that she acquired the loans for the Burlington College real estate purchase based upon alleged misrepresentations she made in the loan applications as to the true amount of pledged donations made to the school by its benefactors. That’s another element of Democratic schemes - the necessity to misrepresent. Who can forget Barack Obama’s pitch for ObamaCare: “If you like your plan, you can keep it.” Obama’s speechwriter, Jon Favreau, is probably still guffawing over that one.

Remarkably, Jane received a $200,000 severance package plus two years of continued salary payments as “President Emeritus” for destroying Burlington College. And Bernie became mayor of Burlington, and then a congressman, US Senator, and finally presidential candidate, without ever having held a real job in his life. Bernie now owns three homes and has a reported net worth of $2.5 million, according to Forbes, having never produced anything of value for our society. The couple demonstrate a real penchant for failing upward.

If Bernie pulls off a miracle in 2020 and becomes President Sanders, it’s a safe bet that bankruptcy lawyering will become a booming industry in Bernie’s America.

William F. Marshall has been an intelligence analyst and investigator in the government, private, and non-profit sectors for more than 30 years. He is a senior investigator for Judicial Watch, Inc. (The views expressed are the author’s alone, and not necessarily those of Judicial Watch.)

Join the conversation as a VIP Member