On the December 23, 2023, Wall Street Journal Editorial Report with Paul Gigot, Karl Rove noted, "since President Biden became president, prices have gone up about 18% while median household income has dropped 3%.” Rove went on to state there’s a 21% delta or 21% decline in the average American’s purchasing power under President Biden.

Rove was pointing out why most Americans are finding it very difficult to survive and get ahead in today's economy. Most problems with our economy today stem from inflation fueled by excessive government spending and dramatic increases in government and personal debt. Our U.S. national debt has gone from $0 in 1776 to $13 trillion in 2010 to a staggering total of nearly $34 trillion today. It took us just under 240 years as a nation to run up a $13 trillion-dollar debt and just 13 years to almost triple it!

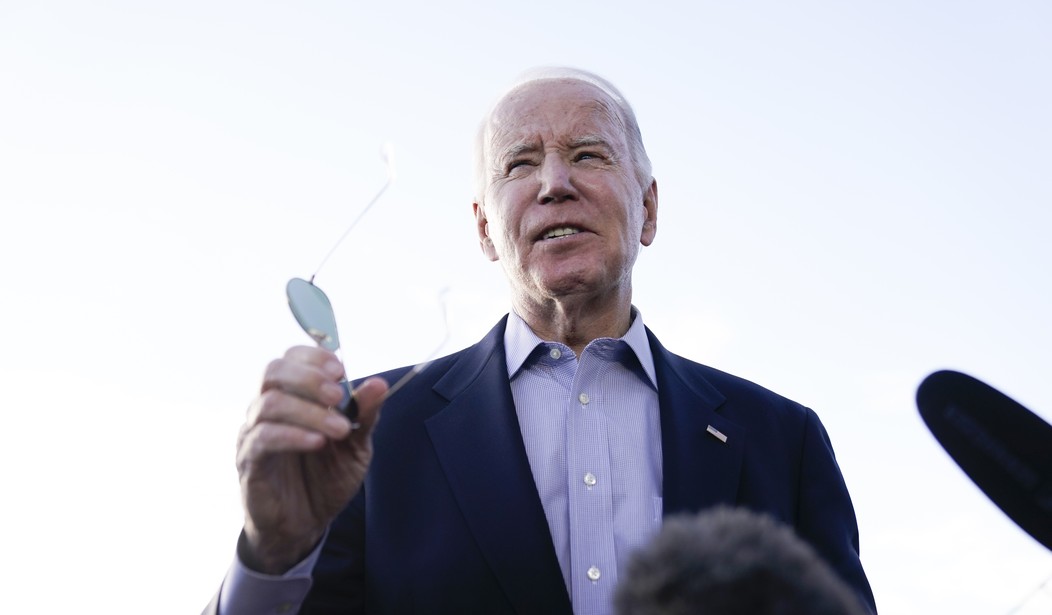

While the wealth effect from the stock market has been quite positive and jobs are abundant, American consumers have found it very difficult to get ahead over the last three years. As a result, President Biden’s approval rating has nosedived from 57% when he took office to 39%, according to a December 2023 Gallup Poll – the lowest in modern presidential history.

We believe that James Carville got it right in the Bush versus Clinton election of 1992 when he boldly stated, “it’s the economy, stupid”.

The following data addresses eight key reasons affecting consumer confidence in 2023.

1. Inflation

Federal Reserve interest rate hikes helped reduce inflation growth from 2022 as measured by the Consumer Price Index (CPI). According to the U.S. Bureau of Labor Statistics in January 2023, the U.S. inflation rate was 5.6% and hasdecreased to 3.1% as of the end of November; the lowest since 2021. Despite this decrease, 3.1% inflation on top of a 2022 high of 9.1% continues to harm the U.S. economy by reducing consumer purchasing power.

Recommended

2. Food Prices

Inflation has forced consumers to spend more on food. For example, the U.S. Bureau of Labor Statistics reported that food prices are up 2.9% this year, as of the end of November. This year’s increase is on top of last year’s 10% rise, meaning American consumers willspend hundreds of dollars more purchasing the same food items they did in 2022.

3. Insurance Costs

Americans have also suffered substantial insurance rate spikes in 2023 that far surpass our rate of inflation. According to a 12-month percentage change to the Consumer Price Index report through November 2023 from the U.S. Bureau of Labor Statistics car insurance rates have seen a crushing 19.2% increase. According to a report by S&P Global Market Intelligence, homeowners were also hit hard: Through the first eight months of 2023, the national average rise in homeowners’ premium rates increased 8.8%. These insurance rate increases further reduce the financial stability of American consumers and make it difficult to purchase a wider variety of goods and services.

4. Mortgage Interest Rates

The key driver of wide fluctuations in any interest rate is the inflationary risk premium. Inflation continued to negatively impact home buyers in 2023. In January of 2023, the bank rate 30-year fixed mortgage interest rate was 5.3%. As of December 26th, the rate was 7.12%. Consumers who purchased a new home in 2023 on credit were generally paying substantially more in mortgage interest leaving less to spend elsewhere in the economy.

5. Automobile Loans

According to Statista, the average interest rate for a 60-month new car loan began 2023 at 6.13%. By the end of November, the average interest rate for a 60-month new car loan was 7.74%. Historically, used car finance rates are usually 3-4 percentage points higher than the new car rate. A consumer purchasing a new car in 2023 saw a substantial increase in the purchase and financing cost of a new automobile, making it more difficult to buy a new or used automobile. Higher automobile prices and financing costs mean less purchasing of other goods and services.

6. National Credit Card Debt and Interest Rates

In addition to the above costs, credit card interest rates have also increased 1.1% percent since Q1 2023. At the beginning of the year, the average credit card rate was 20.09% and has increased to 21.19% as per the latest numbers from the Federal Reserve Board. This increase is particularly destructive becauseof the level of credit card debt. The latest numbers from the Board also reveal that U.S. credit card debt just surpassed $1.07 trillion in early December - an increase of almost $100 billion from the beginning of this year. The $1.07 trillion carried by credit holders averages to $6,500 per credit holder – an increase of $600 dollars per credit holder from the start of the year. The amount of debt consumers carry, coupled with the rate increases,further reinforces how strapped the average American consumer is.

7. Gasoline and Electricity Prices

According to AAA, the average national price of a gallon of gasoline was $3.10 in the last week of 2022 and $3.126 at the close of 2023. The price of West

Texas Intermediate Crude closed 2022 at $73.89; in late December it was $75.26; up almost 2% for the year. The average American paid 15.47 cents a kilowatt hour for electricity at the end of January 2023 according to Quick Electricity and 16.8 cents by the end of November, an increase of 8.5%. It is of additional concern the U.S. Strategic Petroleum Reserve (SPR) is down to roughly seventeen days.

8. Personal Consumption Expenditures

The Bureau of Economic Analysis (BEA) reported that personal consumption expenditures in November of 2023 increased 1.8% from January. This increase can be linked to high consumer confidence generated by low unemployment rates. American consumers are very concerned about the economy in which we live, yet with many it seems like A Tale of Two Cities. Americans are showing increased consumer confidence as measured by the University of Michigan’s Consumer Confidence Index, and perhaps fueled by a low unemployment rate of 3.7% and the wealth effect of two years of a recovering stock market. However, they are making it difficult to add to the growth of the U.S. economy in 2024 where the consumer will hopefully continue to represent 67% of U.S. GDP. Of concern to us is 49% of Americans dipped into their savings in 2023 with 51% reporting they would run out of money within one month if they lost their job, according to an October Clever Real Estate survey.

How can the American consumer continue spending if mortgage interest rates and automobile interest rates stay the same or increase in 2024? How can the average American consumer continue to dip into savings in 2024 the way they did in 2023 to get by and make purchases? How will record average personal debt and a need to reduce spending by consumers along with the federal governments need to do the same in 2024 reflect on U.S. economic growth in 2024?

We have our doubts an ever-burdened American consumer can continue to fuel economic growth in 2024 as it did in 2023.

About the Authors

Dr. Timothy G. Nash is Director of the McNair Center at Northwood University, Anthony Storer is a McNair Scholar and a freshman finance major at Northwood University, and Dr. Tom Rastin is a retired business leader from Ohio.

Join the conversation as a VIP Member