MADISON – It’s amazing what a little competition will do to a monopolized health insurance marketplace.

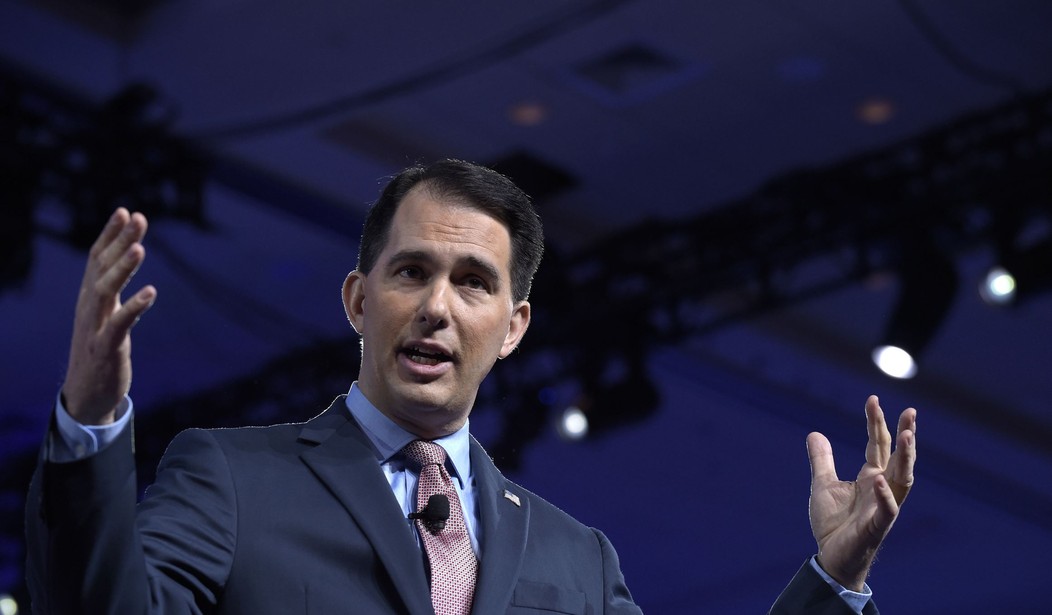

In Wisconsin, the free-market forces unleashed by Gov. Scott Walker’s signature Act 10 law have saved taxpayers some $3.2 billion in benefits costs alone, mostly thanks to reduced health insurance costs, according to 2017-18 data from the state Department of Administration.

The 2011 measure, a sweeping reform of the Badger State’s public sector collective bargaining law, holds negotiations over wage increases to the rate of inflation and requires government employees to contribute to their generous public benefits packages.

As the MacIver Institute reported in 2016, Act 10 had saved taxpayers more than $5 billion just five years after its implementation.

What wasn’t as widely known or appreciated - until now - is how much money taxpayers in Wisconsin’s 422 public school districts have saved through a key Act 10 provision that opened up bidding to new insurers for the first time in years.

Once effectively locked in to no-competition contracts, districts have largely moved to more taxpayer-friendly health plans, ultimately freeing up more money for education.

For years, WEA Trust, the nonprofit insurer created by the state’s teachers union, dominated the public school health insurance marketplace. In the 2010-2011 school year, a year prior to Act 10, about two-thirds of Wisconsin’s public school districts purchased their insurance from WEA Trust, the Milwaukee Journal Sentinel reported in May 2012. The percentage had been higher in previous years.

About 7,000 health plan subscribers left WEA Trust in the first 12 months after Act 10’s rollout, according to multiple news reports. By September 2013, WEA Trust had seen 24 percent of its insurance members depart.

Recommended

Under Act 10, public sector unions could no longer negotiate health insurance and other benefits as part of contracts. That ended WEA Trust’s preferred status with teacher unions that so often demanded the higher-cost insurer. School districts across the state left WEA Trust in droves for lower-cost plans. And with more players competing, WEA Trust was forced to adapt to market forces in hopes of luring back members.

Act 10 also changed expectations. No longer would the entire burden of ever-escalating premiums be placed solely on the backs of taxpayers.

Before Act 10, 43 percent of all school districts in the state paid their employees’ entire premium on single plans. That number has dropped to 6.4 percent, according to the latest data.

Public employees are now required to contribute at least 12 percent of wages to their health care costs. That provision has delivered huge cost savings to taxpayers.

Not every district has abided by the 12 percent mandate. Twenty-three local public school systems do not require employees to contribute anything to monthly premiums in either their single or their family plans, the latest data show.

Across all districts, employee contributions toward premiums average 11.61 percent for single plans and 11.75 percent for family plans, according to the DOA database.

When Walker introduced Act 10 in February 2011, opponents predicted nothing but gloom and doom. Tens of thousands of protesters, led by public sector unions, crowded the state capitol to fight against the reforms. Despite threats of political recalls and worse, Walker and the Republican-controlled Legislature stayed the course. Taxpayers have been the beneficiaries of that persistence.

In all, had health insurance spending continued along its trend prior to Act 10, taxpayers could be paying billions more for public sector health insurance and other benefits that far outpace private sector compensation. In fact, if the prior trend had continued, school districts benefits costs would be 60 percent higher than they are now.

Act 10 ultimately was drafted to lighten the load put on taxpayers. Seven years after going into effect, Walker’s watershed reform has done precisely that. It’s truly the gift that keeps on giving.

Join the conversation as a VIP Member