Reuters reports that the markets fell below their 50-day moving averages this week on news that housing is softer than expected and there's a slump in factory output.

Hewlett Packard disappointed too and that's hurting tech stocks.

"HP, the world's largest technology company, cut its financial forecasts because of problems stemming from Japan's earthquake," says Reuters, "soft PC sales and lowered expectations for its service business. HP's stock was down 6.5 percent at $37.21."

The lesson is that the stock market is all about earnings. Forget Japan, Libya, et al.

More from Reuters: "This shows that we are kind of losing momentum ... and it is certainly disturbing considering that we are nearing the end of QE2," said Jack Ablin, chief investment officer at Harris Private Bank in Chicago, referring to the U.S. monetary stimulus program known as QE2.

With talk like that can QE3 be far behind?

The market has done well during earnings season generally.

It's gone from a low of 1294 on the S&P to 1370 before starting this latest round of consolidation.

Much of the movement was based on strong earnings. As a backward glance, earnings are great. Certainly they are indicative of what the economy has done in the past.

Going forward however, there are indications that earnings could be a bit softer.

"We have had some data that has been softening so I guess we are going to experience a bit of a slowdown," said Frank Lesh, an analyst and broker at FuturePath Trading in Chicago according to Reuters.

Manufacturing data hit a five-month low in the recent NY survey. Europe and China have raised interest rates to combat inflation, which would imply a slowdown. Unemployment continues to be persistent. And the end of QE2 will dry up a source of liquidity that markets have counted on.

Recommended

Our friend Mike Shedlock continues to think that China is headed for a bust. And so do I.

On the plus side, the end of QE2 should take pressure off of commodity markets. If commodity prices come down in reponse to slowing global growth, and a tigher monetary policy, it could help create conditions for the mythical "soft-landing" the Fed is supposed to manufacture.

Of course a "soft landing" scenario should apply only to a recovery, which we haven't had.

How we got to the end of the business cycle where we are combating inflation without going through the middle of the business cycle- you know the part that creates wealth and jobs?- is the story of the O-pocalypse.

To be fair to Obama, the trend started before he was president. But his policies have certainly accelerated the process. Again, we've gone through a whole boom-and-bust business cycle (almost) without the nastiness of, um, jobs and wealth creation.

If he wants to tax the rich, he better do so while we have a few rich left.

(Source: Barry Ritholtz)

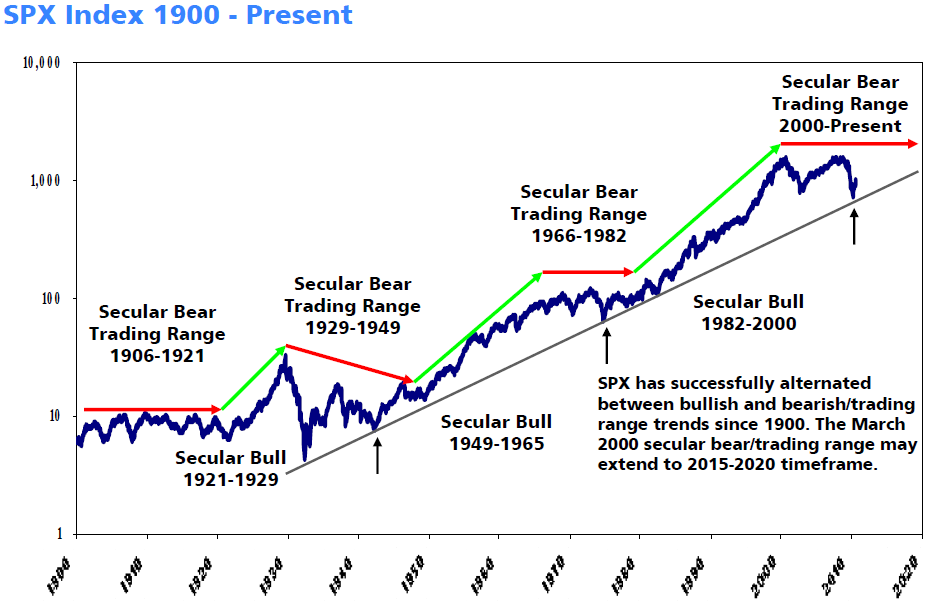

The trendline on the S&P would suggest that the market is in a period not unlike that from 1971 to 1973 when the market attempted to break above the trend, but instead traded sideways for the next 9 years.

Interestingly, even after the market enjoyed an historic bull run in the 1980s, the S&P didn't break well above the trend until 1994.

The chart above puts in perspective the long-range nature of how markets react to events. Rather than being drivers of events, the markets are just reflections of things that are going on in society at large.

The period from 1966 to 1982 is a good exmaple of that. It looks like the economy was on drugs during that period, until the recovery began when it just said "no."

The drug of choice back then, of course, was dollars and government spending.

Looking at a longer term perspective, it's a very good time to be investing in stocks if your investment horizon is 10-20 years or more.

Of course investing in stocks would give you extra incentive to give Obama the boot too.

For more on money and markets, take a look at our commentary every day at the Ticker.

Cantor: An Air of Willingness- Larry Kudlow

O-pocalypse Now- John Ransom

Investing for Idiots: Bear Markets are Good!- Morales & Karcher

A "Rich Guy" Speaks Out Against Higher Taxes (Part 2 of 2)- Cliff Ennico

Number 4? Invest More Agressively- Carrie Schwab Pomerantz

The Ostrich ECB- Mike Shedlock

Rap This: The Job Killer- Bob Beauprez

You can email John Ransom at thfinance@mail.com

You can follow him on Twitter @bamransom and on Facebook: bamransom.

Get John Ransom's daily market commentary at:

-

-

Join the conversation as a VIP Member