America desperately needs genuine entitlement reform to avoid a Greek-style fiscal future.

The biggest problems are the health entitlements such as Medicare, Medicaid, and Obamacare, but Social Security also has a huge long-run fiscal shortfall.

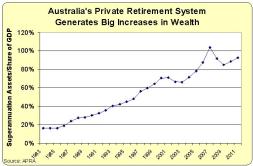

That’s why I’m a big fan of the very successful reforms in places such as Chile and Australia, where personal accounts are producing big benefits for workers.  These systems also boost national economies since they generate higher savings rather than added unfunded liabilities.

These systems also boost national economies since they generate higher savings rather than added unfunded liabilities.

And I’m very happy that we now have more than 30 nations with personal accounts, even tiny little jurisdictions such as the Faroe Islands.

But many statists object to reform, presumably because they don’t want workers to become capitalists. They apparently prefer to make people dependent on government.

Not all leftists take that narrow and cramped approach, however. Some academics at Boston College, for instance, produced some research showing some big benefits from Australia’s private Social Security system.

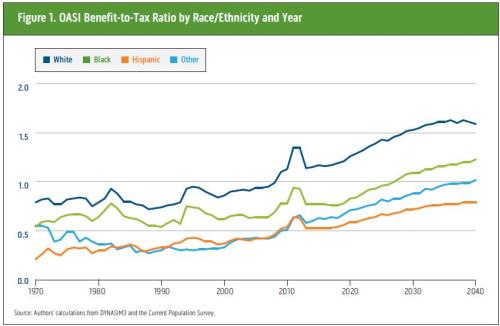

And new we have some remarkable admissions about how minorities are net losers from Social Security in a study from the left-leaning Urban Institute.

We use historical and projected data from 1970 to 2040 to measure the ratio of old age, survivors, and disability insurance (OASDI) benefits received to taxes paid by members of each race or ethnicity each year. This measure captures the transfers that occur in a given year from current workers to current beneficiaries of each group. We then examine benefit-tax ratios for each race or ethnicity into the future to determine how these redistributions will play out in the coming years. Our conclusion: When considered across many decades—historically, currently, and in the near future—Social Security redistributes from Hispanics, blacks, and other people of color to whites.

Recommended

Why does the program have this perverse form of redistribution?

On average, blacks are more likely to be low income and short lived and are less likely to marry than whites. …Given this, one would expect forced annuitization and auxiliary benefits related to marriage and divorce to redistribute from blacks to whites.

And that’s exactly what the research found.

…whites have clearly received a disproportionate share of benefits relative to the taxes that they pay in at a point in time. Their benefit-to-tax ratio has been higher than that of blacks, Hispanics, and other ethnic groups for as long as the system has existed, while projections continue that trend at least for decades to come.

Here’s a chart from the study showing how different races have fared in terms of taxes paid and benefits received.

In other words, if folks on the left really cared about minorities, they would be among the biggest advocates of genuine reform.

By the way, it’s also worth noting that Social Security is a bad deal for everyone. The Urban Institute study simply investigates who loses the most.

And the system is getting worse for every new generation.

Recent studies have also documented how different generations are treated within Social Security, with succeeding generations achieving successively lower “returns” on their contributions.

This helps explain why the evidence shows personal retirement accounts are superior – even for folks who would have retired at the peak of the recent financial crisis.

Here’s my video on why we should replace the bankrupt tax-and-transfer Social Security system with personal retirement accounts.

P.S. You can enjoy some Social Security cartoons here, here, and here. And we also have a Social Security joke, though it’s not overly funny when you realize it’s a depiction of reality.

P.P.S. Thanks to Social Security, I made a $16 trillion mistake in a TV debate. Fortunately, it didn’t really change the outcome since I was understating the fiscal shortfall of the current system.

Join the conversation as a VIP Member