I like tax havens for the simple reason that we need some ways of restraining the greed of the political class.

Simply stated, if profligate politicians think that we are “captive customers,” they are much more likely to impose (even) higher tax rates (as we’ve seen in the past couple of years in Europe). But if they think that we have escape options, they’ll probably exercise some self control.

That’s why I defend nations such as Switzerland, which often are persecuted by politicians from high-tax nations.

It’s also why I defend the tax system of the United States.

Huh?!? What do I mean by that?

Well, while there are many bad things about the American tax system (including pervasive double taxation and a very uncompetitive corporate tax system), one of few redeeming features of our tax system is that we are a tax haven.

Not for Americans, of course, but it turns out we have some good rules for foreigners.

Here’s some of what was recently published by the Heartland Institute.

Some international tax experts note a big irony…in continued U.S. government pressure to compel overseas banks to give up information on Americans with bank accounts in the belief those people may be hiding money from the taxman. The irony: Much of the world considers the United States to be one of the world’s biggest tax havens. …”it’s very easy for anybody in the world today to set up, let’s say, a Delaware Corporation. You can do it online. You have to give very little information to get it up and running. And Delaware’s not alone. There are other states where you can do it as well,” said Jim Duggan, a tax, wealth and estate planning attorney with the Duggan Bertsch LLC law firm in Chicago.

Recommended

Other experts agree.

He’d get no argument from Kevin Packman, chairman of the Offshore Tax Compliance Team at the Holland & Knight international law firm. “There are a number of countries that have said the U.S. is the biggest tax haven in the world,” Packman said. “There’s something to be said for that view.” He noted there are many countries where people are rightly concerned about government moves to impose confiscatory taxes or seize assets. They view the United States as more respectful of property rights and therefore look for ways to move investments into the U.S., including by setting up Delaware or other corporations, and parking money in U.S. banks.

I’ve already noted that Delaware is one of the world’s best tax havens because of its attractive incorporation policies, but we also have very attractive federal tax rules.

Dennis Kleinfeld adds his analysis in an article for Money News.

Tax havens serve two vitally important purposes to everyone lucky enough to have private investment capital. First, they are a source by which foreign capital can be routed into the United States or other countries with tax efficiency. Second, they represent a safe haven where investors’ private capital can flee from overbearing governments of all kinds — democratic, republic, dictatorship, monarchy and just plain thugs and despots — and with a comfortable level of privacy, confidentiality and secrecy. What is the world’s largest tax haven? …the United States can lay claim to that title. …the United States would not be able to maintain its economy without large inflows of foreign capital. Foreign investors can invest in the United States virtually tax free — in structures that are legally protected from risks and, currently, with secrecy. With fairly simple planning, a foreign investor can avoid tax on interest as well as gains from sale of securities — all protected by the legal system… As for secrecy, Delaware or Nevada are quite accommodating. In these states, a foreign company or individuals can form a limited liability company and open a bank account, but if the investor does its or his business outside the United States, there is no U.S. tax or reporting.

Just as important, Dennis explains that tax havens are not only good for the American economy, but also for individuals seeking to protect themselves from rapacious government.

There are no investors — the people who actually create investment capital — who have any complaint against offshore tax-haven financial centers. …To politicians, your capital is their means to advance their political goals. Notwithstanding their propaganda of serving the American people, the needs of the people are always subservient to the voracious needs of political advancement. How can private investors protect themselves from becoming the spoils of war from the marauding armies of politicians fighting for power? For that, investors need tax havens.

By the way, leftists also agree that the United States is a tax haven for non-Americans, so that’s not in dispute.

But there is a big argument about whether it’s good for America to have these policies. I’ve argued over and over again in favor of tax havens as a general principle (I recommend my New York Times piece if you want a good short summary), but it’s also worth noting that America’s tax haven policies have helped to attract trillions of dollars to the U.S. economy.

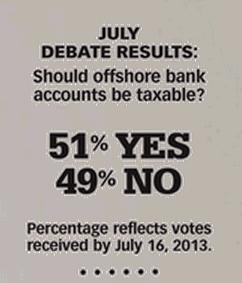

By the way, I suppose it’s time to confess that I lost my recent debate on tax havens for the

Costco Connection. Though I argued last month that the magazine phrased the question in a very misleading way, so the fact that the margin was only 51-49 could be an indication that I was actually somewhat persuasive.

Costco Connection. Though I argued last month that the magazine phrased the question in a very misleading way, so the fact that the margin was only 51-49 could be an indication that I was actually somewhat persuasive.

And maybe some late-reporting precincts could still turn the tide, so feel free to add your opinion if you still haven’t voted.

But I’m digressing. Let’s conclude by assessing where we stand. Tax experts on the right and left agree that the United States is a tax haven for foreigners who need a safe place to invest their money.

There’s also no doubt that foreigners take advantage of these policies in ways that attract huge amounts of money to the American economy – more than $25 trillion according to the Commerce Department!

P.S. You won’t be surprised to learn that hypocritical leftists love using tax havens to protect their money even though they want to deny that freedom to the rest of us.

P.P.S. I’m such an avid defender of tax havens that I almost wound up in a Mexican jail. That’s dedication

Join the conversation as a VIP Member