Thanks to inflation, the average American household is much worse-off financially in 2021 than in recent years.

In fact, according to a new report from the Penn-Wharton Budget Model, “inflation in 2021 will require the average U.S. household to spend around $3,500 more in 2021 to achieve the same level of consumption of goods and services as in recent previous years (2019 or 2020).”

In other words, due to inflation, Americans’ standard of living is rapidly plummeting.

What’s more, the report proves yet again that inflation disproportionately affects lower- and middle-income families compared to high-income households.

As the report states, “because of variation in the composition of consumption bundles, we find that higher-income households had smaller percentage increases in their total expenditure. Higher-income households spent relatively more on services, which experienced the smallest price increases. On the other hand, lower-income households spent relatively more on energy whose prices had large increases. Under the fixed 2019 bundle assumption, the bottom 90 percent saw their consumption expenditure go up by between 6.7 percent to 6.9 percent in 2021. The top 5 percent, on the other hand, saw an increase of 6 percent. Under the fixed 2020 bundle assumption, the bottom 90 percent saw increases of 6.7 percent to 6.9 percent while the top 5 percent saw a 6.1 percent increase.”

In real terms, inflation in 2021 has resulted in the bottom 20 percent of U.S. households paying an extra $309 for food, $761 for energy, $476 for shelter, $390 for other commodities, and $224 for other services.

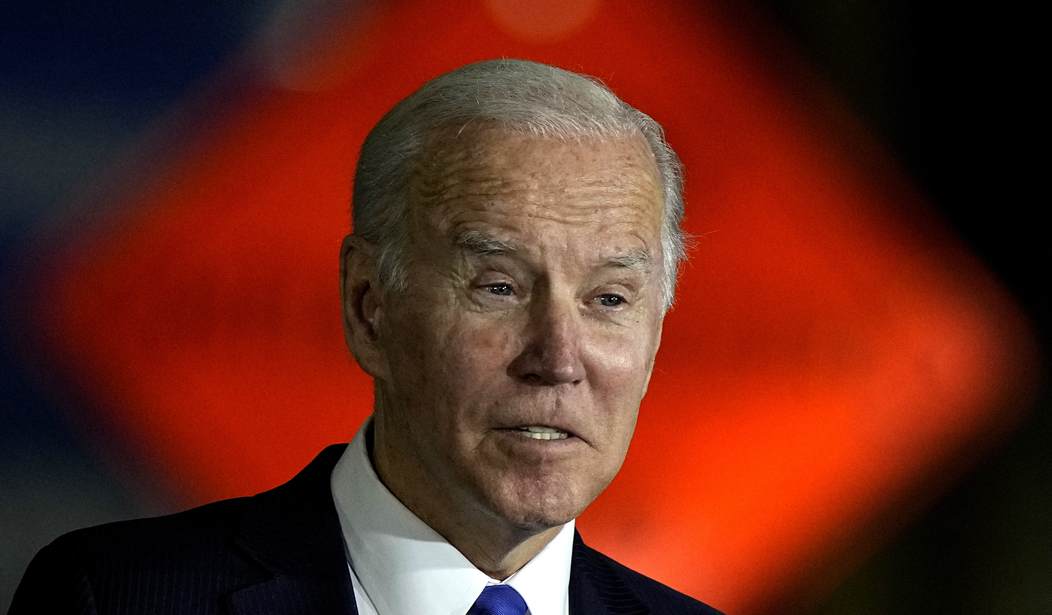

At this point, it is safe to say that the current bout of inflation is far from transitory, despite the fact that countless Biden administration officials relentlessly repeated that tired talking point for the past several months.

Indeed, based on recently released data, inflation is likely to increase for the foreseeable future.

Recommended

For instance, the producer price index, which measures final demand for goods and services and works as a canary in the coal mine of sorts in terms of future consumer inflationary pressures, released its November 2021 report, which showed an all-time record high of 9.6 percent.

Yet, this should come as no surprise to anyone who has been paying attention to fiscal and monetary policy.

On the fiscal side of the inflation equation, government spending has reached levels heretofore unseen in American history. The federal government’s unabated spending binge in response to the COVID-19 pandemic has now eclipsed the amount of spending the U.S. government undertook to win World War II and rebuild Europe under the Marshall Plan.

As Sen. Joe Manchin (D-WV) recently said in response to calls for him to rubberstamp President Biden’s Build Back Better Act, “Inflation is real, it's not transitory. It's alarming. It's going up, not down. And I think that should be something we're concerned about.”

Put another way, Manchin is saying now is not the time to spend another $5 trillion, which will increase inflation even more while adding another $3 trillion to the $29 trillion national debt.

Fortunately, due to Manchin, it seems as if Biden’s Build Back Better bill is not going anywhere anytime soon.

On the other side, monetary policy, under the bailiwick of the Federal Reserve, has been no better. Since the 2008 economic crisis, the Fed has kept interest rates near record-lows, while printing ungodly sums of money.

Over the past year alone, the money supply has increased by nearly 40 percent. No wonder Bitcoin and other cryptocurrencies are skyrocketing. They are the twenty-first century hedge against out-of-control inflation.

Make no mistake, inflation is caused by more dollars chasing fewer goods and services. Since taking office less than one year ago, the Biden administration’s war on fossil fuels, misguided policies of ever-more government spending, vaccine mandates, amplified regulations, increased taxes, and bigger welfare benefits have all contributed to the onslaught of inflation that is making the lives of average Americans worse, not better.

While campaigning for president, Biden portrayed himself as “Scranton Joe,” claiming his administration would address the economic needs and concerns of everyday Americans. It sure seems as if Biden’s agenda is making things worse, not better, for all Americans, especially those struggling to get by, living paycheck to paycheck.

Join the conversation as a VIP Member