What a spectacular way to power up to a fresh all-time high! Yesterday, the S&P 500 and other major indices held up all morning long and came out of the gate with gusto, only to stumble when the infamous war hawk Senator Lindsey Graham published a threatening tweet about inflicting pain to counter “thuggish” actions by Iran.

It’s clear very few folks in the United States are eager to go to war, particularly in another theater in the Middle East.

President Trump appeared calm and even suggested that the downing of a U.S. Navy drone could have been the result of a “loose and stupid” mistake. This level of calmness caught a lot of folks off guard, including the market, which figured Trump would take the counsel of Graham and come out swinging. Instead, there was a degree of level-headedness that didn’t match the media’s portrayal of a president spoiling for war.

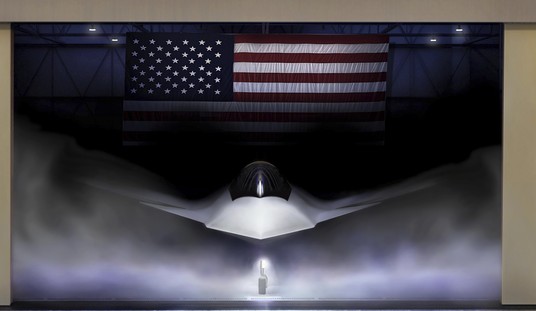

America will strike back for sure, but it will be measured to avoid human life and still send a clear message.

Do You Hear Me Now?

The reaction after the conclusion of the Federal Open Market Committee (FOMC) gathering is always critical. Investors had an evening to digest Powell’s press conference, and they came to the realization he was sending a clear message. Of course, it’s the same message he and many of his colleagues have sent for some time. However, too many people are watching the Fed through an old lens and hearing what they want.

On Wednesday, Powell stepped up to the lectern and spoke into the microphone and said:

My colleagues and I have one overarching goal: to sustain the economic expansion, with a strong job market and stable prices, for the benefit of the American people.

Recommended

What he didn’t say directly but alluded to on numerous occasions is that this goal will be reached by any means necessary. Investors are believers now. This could change how the Street roots for upcoming economic releases. I’m rooting for good news because stocks aren’t excessively expensive, and many have room for prodigious rallies from here.

June Boom

- S&P 500: +17.8%

- Nasdaq Composite: +21.3%

- Dow Jones Industrial Average: +14.7%

- Russell 2000: +15.9%

If you went away in May, you avoided a lot of pain. If you stayed on the sidelines, you’ve missed the June Boom that’s heading for a place in the record book for the best rally. Therein lies the problem with market timing, especially for folks that want to be investors but react to the first hint of worry as a trader.

Cup & Handle

Because the market was off sharply over a six-week period, there are a lot of charts that have one of my favorite formations: Cup & Handle.

Already this week, several big winners have broken out of this formation, and many more are right on the cusp.

The challenge is finding this formation in a company with strong earnings beats and improving earnings-per-share estimates.

By the same token, many stocks were so beaten down that there are great short-term trading opportunities.

Improving Breadth

Blue-chip names on the NYSE continue to attack big money, as the overall market breadth reflects increased confidence.

NYSE

- Advancers: 2,141

- Decliners: 810

- New Highs: 323

- New Lows: 27

- Up Volume 2.96 billion

- Dow Volume 831.0 million

Today, we’ll get a look at Existing Home Sales, and perhaps a chance to see how many investors are willing to ride this wave versus how many will be tempted to take some off the table going into the weekend.

Portfolio Approach

Communication Services | Consumer Discretionary | Consumer Staples |

1 | 4 | 1 |

Energy | Financials | Healthcare |

1 | 2 | 1 |

Industrial | Materials | Real Estate |

2 | 3 | 1 |

Technology | Utilities | Cash |

3 | 0 | 1 |

Join the conversation as a VIP Member